Yo, listen up! Financial asset classes are like the cool kids of the investment world, bringing some serious flavor to your portfolio. Get ready to dive into this topic with a mix of swag and knowledge that’ll leave you feeling like a boss.

Now, let’s break it down and explore the ins and outs of financial asset classes – from stocks to real estate, we’ve got you covered.

Overview of Financial Asset Classes

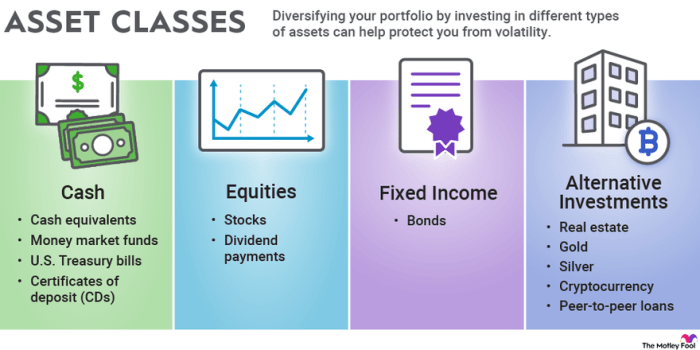

Financial asset classes play a crucial role in investment portfolios as they offer diversification and the potential for returns. These classes represent different types of investments that investors can choose from based on their risk tolerance, investment goals, and time horizon.

Types of Financial Asset Classes

- Stocks: Stocks represent ownership in a company and offer the potential for capital appreciation through price increases and dividends.

- Bonds: Bonds are debt securities issued by governments, municipalities, or corporations, offering fixed interest payments over a specified period.

- Real Estate: Real estate investments involve purchasing properties to generate rental income and potential appreciation in property value.

- Commodities: Commodities include physical goods like gold, oil, and agricultural products, offering a hedge against inflation and market volatility.

- Cash Equivalents: Cash equivalents are short-term, low-risk investments such as Treasury bills and certificates of deposit that provide liquidity and capital preservation.

Characteristics of Financial Asset Classes

When it comes to financial asset classes, each one comes with its own set of characteristics that define it and set it apart from the others. Understanding these key traits is crucial for investors looking to build a diversified portfolio that can help manage risk and maximize returns.

Equities

Equities, or stocks, represent ownership in a company and typically offer the potential for high returns but also come with higher risks. These assets are traded on stock exchanges and can provide investors with capital gains and dividends.

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. They are considered lower risk compared to equities and provide a fixed income in the form of periodic interest payments. Bonds are often used as a way to generate steady income and preserve capital.

Real Estate

Real estate investments involve purchasing properties such as residential homes, commercial buildings, or land. This asset class offers the potential for rental income, capital appreciation, and diversification. Real estate investments can provide a hedge against inflation and offer long-term growth potential.

Commodities

Commodities include physical goods such as gold, silver, oil, and agricultural products. These assets can serve as a hedge against inflation and currency fluctuations. Commodities are known for their volatility and can be influenced by factors such as supply and demand dynamics, geopolitical events, and weather conditions.

Alternative Investments

Alternative investments encompass a wide range of assets such as hedge funds, private equity, and venture capital. These investments often have low correlation to traditional asset classes and can provide diversification benefits. Alternative investments can offer unique risk-return profiles and access to niche markets not available through traditional investments.

Diversification

Diversification across asset classes involves spreading investments across different types of assets to reduce overall portfolio risk. By investing in assets with low correlation to each other, investors can potentially offset losses in one asset class with gains in another. Diversification is a key strategy for managing risk and achieving long-term financial goals.

Types of Equity Securities

Equity securities are a type of financial asset that represents ownership in a company. They provide investors with the potential for capital appreciation as the company grows and generates profits.

Common Stock

Common stock is the most basic form of equity security that a company can issue. It represents ownership in the company and gives shareholders voting rights at shareholder meetings. Common stockholders are entitled to dividends if the company distributes profits, but their claims on assets are subordinate to creditors and preferred stockholders.

Preferred Stock

Preferred stock is another type of equity security that gives shareholders priority over common stockholders in terms of dividends and assets in the event of liquidation. Preferred stockholders do not usually have voting rights, but they receive fixed dividends that must be paid before any dividends can be distributed to common stockholders.

Differences between Common Stock and Preferred Stock

– Common stockholders have voting rights, while preferred stockholders usually do not.

– Preferred stockholders receive fixed dividends, while common stockholders may or may not receive dividends depending on the company’s profitability.

– In the event of liquidation, preferred stockholders have priority over common stockholders in terms of assets.

Ownership and Capital Appreciation

Equity securities provide investors with ownership stakes in companies, allowing them to participate in the company’s growth and success. As the company’s value increases, the value of the equity securities also appreciates, offering investors the potential for capital gains.

Categories of Fixed-Income Securities

Fixed-income securities are a type of financial asset class that represents money owed by a borrower to a lender, typically in the form of a bond. These securities pay a fixed amount of interest at regular intervals, hence the term “fixed-income.”

Government Bonds

Government bonds are issued by the government to fund public projects or manage debt. They are considered low-risk because they are backed by the government’s ability to tax its citizens to repay the debt. These bonds offer fixed interest payments and are considered a safe investment option.

Corporate Bonds

Corporate bonds are issued by corporations to raise capital for various business activities. They offer higher interest rates compared to government bonds but also come with higher risk. The issuer’s creditworthiness plays a crucial role in determining the risk associated with corporate bonds.

Municipal Bonds

Municipal bonds are issued by local governments or municipalities to finance public projects like building schools or infrastructure. These bonds are exempt from federal taxes and sometimes state and local taxes, making them attractive to investors in high tax brackets. Municipal bonds offer regular interest payments and are relatively safe investments.

Real Assets and Alternative Investments

Real assets and alternative investments are two unique financial asset classes that offer investors a way to diversify their portfolios beyond traditional stocks and bonds.

Real Assets

Real assets are tangible assets that have intrinsic value and can provide protection against inflation. Examples of real assets include commodities like gold and oil, real estate properties, and natural resources such as timber and farmland. Investing in real assets can help investors hedge against economic downturns and currency devaluation.

Alternative Investments

Alternative investments are investment options beyond stocks and bonds, offering higher potential returns but also higher risks. Examples of alternative investments include hedge funds, private equity, and venture capital. Hedge funds aim to generate positive returns regardless of market conditions, while private equity involves investing in private companies with the goal of growing their value. Venture capital provides funding to startups and early-stage companies in exchange for equity.