Yo, day trading strategies are where it’s at! Get ready to dive into the world of making moves in the stock market like a boss. From technical analysis to risk management, we’ve got the lowdown on how to crush it in day trading.

Introduction to Day Trading Strategies

In the world of trading, day trading refers to the act of buying and selling financial instruments within the same trading day. This fast-paced style of trading requires quick decision-making and a solid understanding of the market.

Effective day trading strategies are crucial for success in this volatile environment. Having a well-thought-out plan can help traders minimize risks and maximize profits. Without a strategy, traders may fall victim to emotional decision-making, leading to poor outcomes.

Importance of Day Trading Strategies

- Setting clear entry and exit points helps traders stay disciplined and avoid impulsive decisions.

- Using technical analysis tools like moving averages, RSI, and MACD can help identify potential entry and exit points.

- Implementing risk management strategies, such as setting stop-loss orders, can protect traders from significant losses.

- Utilizing leverage wisely can amplify profits but also increase risks, so having a plan in place is crucial.

Examples of Successful Day Trading Strategies

- Scalping: This strategy involves making multiple trades throughout the day to capitalize on small price movements.

- Momentum Trading: Traders using this strategy focus on stocks that are showing strong upward or downward momentum.

- Range Trading: This strategy involves identifying support and resistance levels and trading within that range.

- News Trading: Traders using this strategy capitalize on market-moving news events to make quick profits.

Technical Analysis Strategies

When it comes to day trading, technical analysis plays a crucial role in helping traders make informed decisions based on historical price movements and volume data. By analyzing charts and using various technical indicators, traders can identify potential entry and exit points for their trades.

Popular Technical Indicators

- Moving Averages: These indicators smooth out price data to identify trends over a specific period of time. Traders often use the crossover of different moving averages to signal potential buy or sell opportunities.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements, indicating whether a stock is overbought or oversold. Traders use this indicator to anticipate potential reversals in the market.

- Bollinger Bands: These bands consist of a simple moving average and two standard deviations above and below the average. Traders use Bollinger Bands to identify volatility and potential price breakouts.

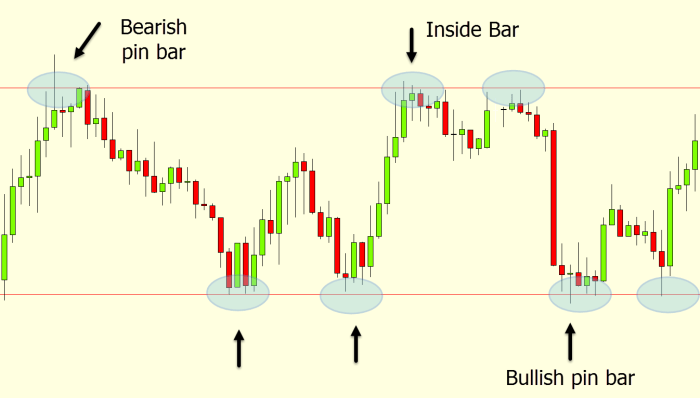

Chart Patterns

- Head and Shoulders: This pattern indicates a potential reversal from bullish to bearish or vice versa. It consists of a peak (head) followed by two lower peaks (shoulders), forming a trend reversal signal.

- Cup and Handle: This pattern signifies a bullish continuation, where the price consolidates in a rounded formation (cup) followed by a smaller consolidation (handle) before breaking out to the upside.

- Double Top and Double Bottom: These patterns indicate potential reversals in the market. A double top forms after an uptrend and signals a bearish reversal, while a double bottom forms after a downtrend and signals a bullish reversal.

Risk Management in Day Trading

When it comes to day trading, risk management is crucial to protect your capital and maximize your profits. By implementing effective risk management strategies, traders can minimize potential losses and increase their chances of success in the volatile world of day trading.

Setting Stop-Loss Orders

Setting stop-loss orders is a common risk management technique used by day traders to limit their losses. A stop-loss order is an order placed with a broker to buy or sell a security once it reaches a certain price. By setting stop-loss orders, traders can automatically exit a trade if the price moves against them, helping to prevent significant losses.

Impact of Leverage

Leverage can significantly impact day trading strategies. While leverage can amplify profits, it also increases the potential for losses. Traders should be cautious when using leverage, as it can magnify the risks involved in day trading. It is important to carefully consider the amount of leverage used and its potential impact on the overall risk profile of a trading strategy.

Fundamental Analysis for Day Trading

Fundamental analysis is a crucial component of day trading strategies as it involves evaluating the underlying factors that could influence the price movement of a security. By analyzing financial statements, economic indicators, and market trends, day traders can make informed decisions on when to buy or sell a stock.

Examples of Fundamental Factors

- Earnings reports: Positive earnings reports can signal a strong company performance, leading to an increase in stock prices.

- Interest rates: Changes in interest rates by the Federal Reserve can impact stock prices and market volatility.

- Industry trends: Understanding industry-specific factors can help traders identify opportunities for growth or decline.

Economic Indicators in Day Trading

- Gross Domestic Product (GDP): A strong GDP growth can indicate a healthy economy, boosting investor confidence.

- Unemployment rate: High unemployment rates may signal economic downturn, affecting stock prices negatively.

- Inflation rates: Rising inflation can erode purchasing power, leading to changes in consumer spending habits and stock prices.

Developing a Personalized Day Trading Plan

Creating a personalized day trading plan is crucial for success in the fast-paced world of day trading. It involves tailoring your strategies to fit your individual goals, risk tolerance, and trading style.

Setting Clear Goals

- Start by identifying your financial goals and objectives for day trading. Whether you aim to generate a full-time income or simply supplement your current earnings, clarity in your goals is key.

- Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals to track your progress and stay motivated.

- Consider factors like your risk tolerance, available capital, and time commitment when setting your goals.

Adapting to Market Conditions

- Stay flexible and be prepared to adjust your day trading strategies based on changing market conditions.

- Understand the impact of market volatility, economic events, and news releases on your trades.

- Implement risk management techniques to protect your capital during uncertain market environments.