Yo, diving into how to invest in gold, this intro is gonna give you the lowdown on all things bling-bling. From shiny bars to glittery coins, we’re gonna break it down for ya in a way that’s totally lit.

So, if you’re ready to rock and roll in the world of gold investments, buckle up and let’s ride this golden wave together.

Understanding Gold Investments

Investing in gold is when you buy gold as a way to grow your wealth over time. People choose to invest in gold for various reasons, such as its ability to act as a hedge against inflation, economic uncertainty, and currency devaluation. Gold has been valued for centuries and is considered a safe haven asset that retains its worth even during times of financial turmoil.

Historical Significance of Gold

Gold has been used as a form of currency and a store of value for thousands of years. Ancient civilizations like the Egyptians, Greeks, and Romans all valued gold for its beauty and rarity. In more recent history, gold played a crucial role in the global financial system, with many countries backing their currencies with gold reserves. Even today, central banks hold significant amounts of gold as part of their foreign exchange reserves.

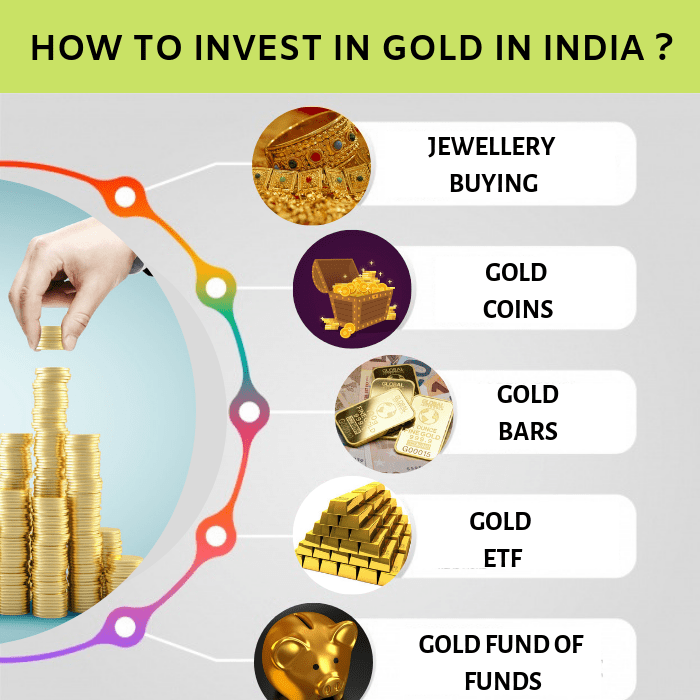

Different Ways to Invest in Gold

Investing in gold can be done through various methods, each with its own set of pros and cons. Let’s explore the different ways to invest in gold:

Physical Gold vs. Paper Gold

When it comes to investing in gold, one option is to purchase physical gold in the form of bars or coins. This allows investors to have direct ownership of the precious metal. On the other hand, paper gold options like Exchange-Traded Funds (ETFs) and futures contracts offer a more convenient way to invest in gold without the need for physical storage. While physical gold provides a sense of security, paper gold offers greater liquidity and ease of trading.

Investing in Gold Mining Stocks

Investing in gold mining stocks is another way to gain exposure to the gold market. By purchasing shares of gold mining companies, investors can benefit from the potential growth of these companies as they extract and sell gold. However, it’s important to note that investing in mining stocks can be more volatile than investing in physical gold or paper gold, as it is influenced by factors beyond just the price of gold.

Investing in Gold Jewelry and Collectibles

Some investors choose to invest in gold by purchasing jewelry and collectible items made from the precious metal. While these items can hold sentimental value and aesthetic appeal, they may not always retain their full intrinsic value when it comes to resale. Additionally, the pricing of gold jewelry includes a premium for craftsmanship and design, which may not be directly linked to the current market price of gold.

Factors to Consider Before Investing in Gold

When considering investing in gold, there are several important factors to take into account. Understanding these factors can help you make informed decisions and maximize your investment potential.

Factors that Influence the Price of Gold

- The demand and supply dynamics in the market play a crucial role in determining the price of gold. When demand outweighs supply, the price tends to increase, and vice versa.

- Economic indicators such as interest rates, currency values, and overall market conditions can also impact the price of gold. Investors often turn to gold as a safe-haven asset during times of economic uncertainty.

- The performance of other financial markets, such as stocks and bonds, can have an indirect influence on the price of gold. Investors may diversify their portfolios by including gold as a hedge against market volatility.

Geopolitical Events and Gold Value

- Geopolitical events, such as wars, political instability, or trade disputes, can significantly affect the value of gold. These events often create uncertainty in the market, leading investors to seek the safety of gold as a store of value.

- Gold is considered a reliable hedge against geopolitical risks, as it tends to retain its value even in times of global turmoil. Investors may increase their gold holdings during periods of heightened geopolitical tensions.

- Changes in government policies or international relations can also impact the value of gold. Keeping track of geopolitical developments can help investors anticipate potential price movements in the gold market.

Inflation’s Role in the Gold Market

- Inflation refers to the gradual increase in the prices of goods and services, leading to a decrease in the purchasing power of a currency. Gold is often seen as a hedge against inflation, as its value tends to rise in tandem with increasing prices.

- Investors may turn to gold as a way to preserve their wealth and purchasing power in times of high inflation. The precious metal has historically maintained its value over the long term, making it an attractive option for those seeking protection against inflation.

- The Federal Reserve’s monetary policies, including interest rate decisions and quantitative easing measures, can impact inflation rates and, consequently, the price of gold. Understanding the relationship between inflation and gold can help investors make strategic investment choices.

Risks and Benefits of Investing in Gold

When it comes to investing in gold, there are both risks and benefits that investors should consider. Gold is often seen as a safe haven asset, but it also comes with its own set of challenges.

Risks of Investing in Gold

- Price Volatility: Gold prices can be highly volatile, leading to potential losses for investors if they buy at high prices and sell at low prices.

- Liquidity Risk: Gold can be less liquid compared to other investments, making it difficult to buy or sell quickly without affecting the price.

- Storage and Insurance Costs: Physical gold requires secure storage and insurance, which can add to the overall cost of investing.

- Counterparty Risk: When investing in gold through financial instruments or companies, there is a risk of default by the counterparty.

Benefits of Adding Gold to an Investment Portfolio

- Diversification: Gold can act as a hedge against market volatility and economic uncertainty, providing a way to diversify an investment portfolio.

- Inflation Hedge: Gold has historically been considered a hedge against inflation, preserving purchasing power over time.

- Store of Value: Gold is a tangible asset that retains value, making it a reliable store of wealth in times of economic instability.

- Global Acceptance: Gold is recognized and accepted worldwide, making it a liquid asset that can be easily traded.

Gold as a Hedge Against Economic Uncertainty

Gold has long been used as a safe haven asset during times of economic uncertainty. In times of market turbulence or geopolitical instability, investors tend to flock to gold as a store of value. The precious metal has a negative correlation with other financial assets, meaning that when stock markets are down, gold prices often rise. This inverse relationship makes gold an effective hedge against economic downturns and a valuable addition to an investment portfolio.

Strategies for Investing in Gold

Investing in gold can be a smart move to diversify your portfolio and protect against economic uncertainties. Here are some key strategies to consider when investing in gold:

The Importance of Diversification

Diversification is crucial when investing in gold to spread out risk and maximize returns. By diversifying your investments across different asset classes, including stocks, bonds, and real estate, you can reduce the impact of market fluctuations on your overall portfolio.

- Allocate a portion of your investment portfolio to gold to hedge against inflation and currency devaluation.

- Consider investing in gold mining stocks or gold exchange-traded funds (ETFs) to gain exposure to the gold market without directly owning physical gold.

- Include both short-term and long-term gold investments in your portfolio to balance risk and return potential.

Tips on Timing the Market for Gold Investments

Timing the market for gold investments can be challenging, as gold prices are influenced by various factors like geopolitical tensions, interest rates, and economic data. Here are some tips to help you make informed decisions when investing in gold:

It’s essential to do thorough research and monitor market trends before buying or selling gold to capitalize on potential price movements.

- Consider dollar-cost averaging to invest a fixed amount in gold at regular intervals, regardless of market conditions, to average out the cost over time.

- Pay attention to key economic indicators, such as inflation rates and central bank policies, to anticipate potential price changes in the gold market.

- Consult with financial advisors or investment professionals to get expert insights on market timing strategies and risk management techniques.

Explaining Dollar-Cost Averaging in Gold Investments

Dollar-cost averaging is a disciplined investment strategy that involves investing a fixed amount of money in an asset at regular intervals, regardless of its price fluctuations. When applied to gold investments, dollar-cost averaging can help reduce the impact of market volatility on your overall investment returns.

By investing a fixed amount in gold regularly, you can benefit from both price dips and peaks, ultimately lowering the average cost per unit over time.

- Set up a systematic investment plan to automatically purchase a specific amount of gold at scheduled intervals, such as monthly or quarterly, to take advantage of market fluctuations.

- Stay committed to your dollar-cost averaging strategy and avoid making emotional investment decisions based on short-term market movements.

- Monitor your investment performance regularly and make adjustments to your strategy as needed to align with your financial goals and risk tolerance.