Yo, diving into mutual funds vs ETFs, this intro will hook you up with all the deets you need to know. Get ready to explore the world of investments in a whole new way.

Now, let’s break it down and compare these two heavy hitters in the investing game.

Introduction

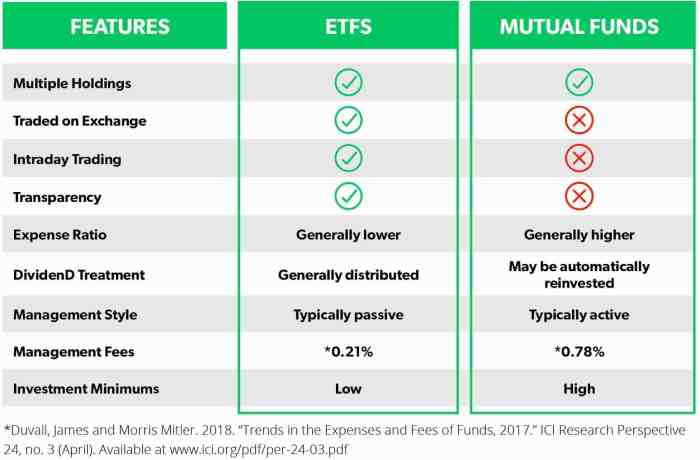

So, let’s break it down – Mutual funds and ETFs are both types of investment vehicles that allow you to pool your money with other investors to invest in a diversified portfolio of securities. The main difference between them lies in how they are bought and sold, as well as their cost structure and tax efficiency.

Basic Differences

Now, when it comes to mutual funds, they are bought and sold directly through the fund company at the end of the trading day at the net asset value (NAV). On the other hand, ETFs trade on the stock exchange throughout the day like individual stocks, and their prices fluctuate based on supply and demand.

Another key difference is the cost – mutual funds often have higher expense ratios and sales loads, while ETFs typically have lower expense ratios and are more tax-efficient due to their unique structure.

Popularity in the Investment World

When it comes to popularity, mutual funds have been around for a long time and are well-established in the investment world. They are often favored by long-term investors looking for professional management and a hands-off approach to investing.

On the other hand, ETFs have gained popularity in recent years due to their lower costs, intraday trading flexibility, and tax efficiency. They are often preferred by active traders and investors looking for more control over their investments.

Structure and Management

Mutual funds and ETFs are both investment options that pool money from multiple investors to invest in a diversified portfolio of assets. However, they have different structures and are managed differently.

Structure of Mutual Funds and ETFs

- Mutual Funds: Mutual funds are actively managed by professional fund managers who make decisions on buying and selling securities within the fund. Investors buy shares of the mutual fund at the fund’s net asset value (NAV) at the end of the trading day.

- ETFs: Exchange-traded funds (ETFs) are passively managed and typically track a specific index. They are traded on stock exchanges like individual stocks throughout the trading day, and their prices fluctuate based on supply and demand.

Management Differences

- Mutual Funds: Mutual funds are actively managed, meaning fund managers actively make decisions to buy and sell securities within the fund to achieve the fund’s investment objectives. This active management often leads to higher fees for investors.

- ETFs: ETFs are passively managed, meaning they aim to replicate the performance of a specific index. This passive management style generally results in lower management fees compared to actively managed mutual funds.

Fees Associated with Managing Mutual Funds and ETFs

- Mutual Funds: Mutual funds typically charge investors management fees, known as expense ratios, which can range from 0.5% to 2% of assets under management annually. Additionally, mutual funds may also charge sales loads or redemption fees.

- ETFs: ETFs generally have lower expense ratios compared to mutual funds, typically ranging from 0.05% to 0.75%. Since ETFs are passively managed, they tend to have fewer costs associated with active management.

Liquidity and Trading

When it comes to liquidity and trading, mutual funds and ETFs have some key differences that investors need to be aware of.

Liquidity

- Mutual funds are only traded at the end of the trading day at the net asset value (NAV) price, which is calculated after the market closes. This means that investors can only buy or sell mutual fund shares once a day.

- On the other hand, ETFs are traded throughout the trading day on the stock exchange at market price, just like individual stocks. This allows investors to buy and sell ETF shares whenever the market is open.

- Overall, ETFs tend to be more liquid than mutual funds due to their ability to be traded on the stock exchange like stocks.

Trading Process

- When trading mutual funds, investors place their orders with the fund company or through a broker. The trade is executed at the NAV price at the end of the trading day.

- For ETFs, investors can buy and sell shares through a brokerage account during market hours. The trades are executed at the prevailing market price, which may differ from the ETF’s net asset value.

- Due to the continuous trading of ETFs on the stock exchange, investors can use limit orders, stop orders, and other trading strategies commonly used for stocks.

Ease of Buying and Selling

- ETFs offer greater flexibility and ease of buying and selling due to their ability to be traded throughout the trading day. Investors can react quickly to market movements and adjust their positions as needed.

- On the other hand, mutual funds may be more suitable for long-term investors who are not concerned with intra-day price fluctuations and are comfortable with trading at the end-of-day NAV price.

- Overall, the ease of buying and selling ETFs makes them attractive to active traders and investors looking for more control over their investment decisions.

Tax Efficiency and Dividends

When it comes to tax efficiency, ETFs generally have an edge over mutual funds. This is because of the way ETFs are structured and traded, allowing investors to potentially incur fewer capital gains taxes compared to mutual funds.

Tax Efficiency Comparison

- ETFs are more tax-efficient than mutual funds due to their unique structure. ETFs typically have lower portfolio turnover, resulting in fewer capital gains distributions, which can help reduce tax liabilities for investors.

- On the other hand, mutual funds are required to distribute capital gains to shareholders at the end of the year, even if the investor did not sell any shares. This can lead to tax consequences for mutual fund investors, regardless of their individual actions.

- Overall, ETFs are considered to be more tax-efficient vehicles for investing compared to mutual funds, especially for long-term investors looking to minimize tax implications.

Handling of Dividends

- Dividends in both mutual funds and ETFs are typically reinvested into the respective funds unless the investor chooses to receive them in cash.

- Investors can opt for dividend reinvestment plans (DRIPs) to automatically reinvest dividends back into the fund, allowing for potential compound growth over time.

- Handling of dividends in mutual funds and ETFs is generally straightforward and can be customized based on the investor’s preferences and investment goals.

Impact of Taxes on Returns

- Taxes can have a significant impact on the overall returns of mutual funds and ETFs, as they can erode gains and reduce the investor’s net return.

- Investors should consider the tax implications of investing in mutual funds and ETFs, including capital gains distributions, dividend taxes, and potential tax-efficiency strategies to optimize their after-tax returns.

- By understanding the tax implications of their investments, investors can make informed decisions to maximize their returns and minimize tax liabilities over time.

Performance and Risk

When it comes to performance and risk, both mutual funds and ETFs have their own track records and factors to consider. Let’s dive into how they stack up against each other.

Historical Performance

- Mutual funds have a longer history of performance data available, allowing investors to analyze how they have fared in various market conditions over the years.

- ETFs, on the other hand, have gained popularity for their ability to closely track specific indexes or sectors, potentially offering more transparency and predictability in performance.

- It’s important for investors to consider past performance as just one factor in their decision-making process, as it does not guarantee future results.

Risk Factors

- Mutual funds typically carry higher expense ratios and fees compared to ETFs, which can eat into overall returns over time.

- ETFs are traded on exchanges like stocks, which means they are subject to market fluctuations and may experience price volatility throughout the trading day.

- Both mutual funds and ETFs are exposed to market risk, but mutual funds may offer more diversification across different securities to help mitigate individual stock risk.

Market Volatility Impact

- During periods of market volatility, mutual funds may be more susceptible to redemptions from investors looking to cash out, potentially leading to selling pressure on underlying holdings.

- ETFs, with their ability to be traded intraday, may see more immediate price fluctuations in response to market news or events, as supply and demand dynamics play out on the exchange.

- Investors should consider their risk tolerance and investment goals when choosing between mutual funds and ETFs, as each may react differently to changing market conditions.

Investment Strategies

When it comes to investment strategies, both mutual funds and ETFs offer unique opportunities for investors to achieve their financial goals. Let’s take a closer look at how investors can use these investment vehicles in their strategies.

Using Mutual Funds in Investment Strategies

Mutual funds are a popular choice for investors looking to diversify their portfolios without having to pick individual stocks or bonds. Investors can use mutual funds to gain exposure to a wide range of assets, such as stocks, bonds, and commodities, through a single investment. This can help reduce risk and provide a more balanced approach to investing.

- Investors can use mutual funds to achieve specific investment goals, such as capital appreciation, income generation, or capital preservation.

- Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors, based on the fund’s objectives and strategy.

- Investors can choose from a variety of mutual fund types, including equity funds, bond funds, money market funds, and balanced funds, depending on their risk tolerance and investment preferences.

Different Investment Strategies with ETFs

ETFs, on the other hand, offer more flexibility in terms of investment strategies compared to mutual funds. Investors can use ETFs in various ways to achieve their investment objectives.

- Investors can use ETFs for short-term trading strategies, such as market timing or sector rotation, due to their intraday trading capability.

- ETFs can be used for tactical asset allocation by adjusting the portfolio’s exposure to different asset classes based on market conditions and economic outlook.

- Investors can also use ETFs for thematic investing, focusing on specific sectors, industries, or investment themes that align with their beliefs or interests.

Flexibility of Investment Strategies

When comparing mutual funds and ETFs in terms of flexibility of investment strategies, ETFs generally offer more options for investors due to their unique structure and trading characteristics.

- ETFs can be bought and sold throughout the trading day, allowing investors to react quickly to market events and adjust their positions as needed.

- Investors can use ETFs to implement complex trading strategies, such as hedging, arbitrage, and options trading, which may not be easily achievable with mutual funds.

- ETFs also provide transparency in terms of holdings and performance, allowing investors to make informed decisions about their investments.