Yo, brace yourself for the ultimate showdown between growth and value stocks! Get ready to dive into the world of investing with a twist of excitement and a dash of thrill.

Let’s break down the key differences, characteristics, and factors that make growth and value stocks stand out in the market.

Growth vs Value Stocks Overview

In the world of stocks, there are two main categories that investors often look at: growth stocks and value stocks. Let’s break it down for you, dude.

Growth stocks are those of companies that are expected to grow at an above-average rate compared to other companies in the market. These companies typically reinvest their earnings into expanding their business, rather than paying dividends to shareholders. Think of companies like Amazon or Tesla – always innovating and expanding.

On the flip side, value stocks are those that are considered undervalued by the market. These companies are often more established and stable, paying out dividends to their shareholders. Examples of value stocks include companies like Coca-Cola or Johnson & Johnson.

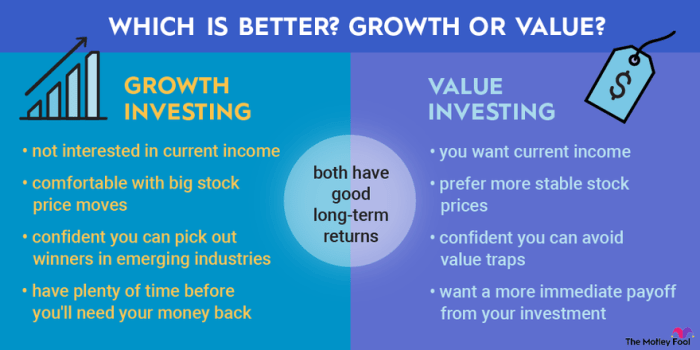

The main difference between growth and value stocks lies in their investment strategies. Growth stocks are all about capitalizing on potential future growth, while value stocks focus on finding bargains in the market.

Historical Performance of Growth vs Value Stocks

When looking at the historical performance of growth vs value stocks, we can see some interesting trends. Over the long term, growth stocks have tended to outperform value stocks, especially during bull markets. However, value stocks have shown resilience during market downturns, providing a more stable investment option.

In recent years, growth stocks have been on a winning streak, fueled by technological advances and changing consumer behaviors. On the other hand, value stocks have struggled to keep up, but that doesn’t mean they’re out of the game.

Remember, investing in stocks always carries risks, so it’s essential to diversify your portfolio and do your research before making any investment decisions.

Characteristics of Growth Stocks

Growth stocks are a type of stock in a company that is expected to grow at a rate significantly above average compared to other firms in the market. These stocks typically do not pay dividends and reinvest their earnings to fuel further growth. Investors are attracted to growth stocks because of the potential for substantial capital appreciation over time.

High Earnings Growth

- Growth stocks are characterized by high earnings growth rates, which can outpace the broader market.

- Companies experiencing rapid revenue and profit growth are often considered growth stocks.

- Investors look for companies with strong growth potential and competitive advantages in their respective industries.

Innovative Industries

- Growth stocks are commonly found in innovative industries such as technology, biotechnology, and e-commerce.

- These industries are known for their disruptive nature and potential for exponential growth.

- Investors seek out growth stocks in these sectors for the possibility of substantial returns on their investments.

Characteristics of Value Stocks

Value stocks are a type of investment that typically have the following characteristics:

Low Price-to-Earnings (P/E) Ratio

Value stocks often have a lower P/E ratio compared to growth stocks. This indicates that the stock is undervalued by the market, making it an attractive investment opportunity.

Strong Dividend Yield

Value stocks tend to offer higher dividend yields compared to growth stocks. This can provide investors with a steady income stream, even during market downturns.

Stable and Established Companies

Value stocks are usually found in well-established companies with stable earnings and a long history of profitability. These companies are less volatile compared to growth stocks, making them a safer investment option.

Market Overreaction

Value stocks are often the result of market overreaction to negative news or temporary setbacks. This creates an opportunity for investors to buy these stocks at a discounted price before their true value is recognized by the market.

Attractiveness to Value-Oriented Investors

Investors are attracted to value stocks because of their potential for capital appreciation as the market corrects the undervaluation. Additionally, the higher dividend yield provides a source of passive income for investors.

Industries with Common Value Stocks

Value stocks can be commonly found in industries such as banking, utilities, and consumer staples. These sectors typically have stable earnings and are less susceptible to economic downturns, making them attractive for value investors.

Factors Influencing Growth vs Value Stocks

When it comes to growth vs value stocks, there are several factors that can influence their performance in the market. These economic and market conditions play a crucial role in determining which type of stock may be more favorable at a given time.

Economic Factors Impacting Growth vs Value Stocks

- Interest Rates: Changes in interest rates can have a significant impact on growth vs value stocks. Typically, growth stocks are more sensitive to interest rate changes as they rely on borrowing to fuel their expansion. On the other hand, value stocks may be less affected by interest rate fluctuations.

- Inflation: Inflation can also affect growth and value stocks differently. High inflation rates may erode the real value of future cash flows, making growth stocks less appealing. Value stocks, with their focus on stable and established companies, may be more resilient during inflationary periods.

Market Conditions Favoring Growth vs Value Stocks

- Bull Market: During a bull market, where stock prices are rising, growth stocks tend to outperform value stocks. This is because investors are more willing to take on risk and bet on high-growth companies in a bullish market environment.

- Recession: In contrast, during a recession or economic downturn, value stocks may perform better than growth stocks. Investors tend to seek out stable, dividend-paying companies with solid fundamentals during uncertain times.

Global Events and Performance of Growth vs Value Stocks

- Trade Wars: Global events like trade wars can impact growth and value stocks differently. Companies that rely heavily on international trade may be more vulnerable to the effects of trade disputes, affecting growth stocks disproportionately.

- Political Instability: Political instability in key markets can also impact growth and value stocks. Uncertainty stemming from political events can lead investors to favor value stocks with more stable earnings and lower volatility.

Risk and Return Profiles of Growth vs Value Stocks

Investing in growth and value stocks comes with its own set of risks and potential returns. Let’s take a closer look at how these two types of stocks differ in terms of risk and return profiles.

Risk and Return Comparison

When it comes to growth stocks, they usually offer higher potential returns but also come with higher volatility. This means that while you have the chance to earn more, you also face a greater risk of losing money due to the price fluctuations. On the other hand, value stocks tend to be more stable with lower volatility, offering modest returns over time.

- Growth stocks: These stocks have historically outperformed value stocks in terms of returns, but they are also more susceptible to market fluctuations. Investors looking for higher growth potential should consider including growth stocks in their portfolio, but be prepared for a bumpy ride.

- Value stocks: Value stocks are known for their stability and consistent performance over time. While they may not offer the same high returns as growth stocks, they can provide a reliable source of income and a buffer against market downturns.

Historical Data Analysis

Analyzing historical data on returns and risks associated with growth vs value stocks reveals interesting trends. Over the long term, growth stocks have shown higher returns but also higher volatility compared to value stocks. However, during periods of economic uncertainty or market downturns, value stocks have demonstrated resilience and maintained their value better than growth stocks.

It’s important for investors to strike a balance between growth and value stocks in their portfolio to mitigate risk and optimize returns.

Recommendations for Portfolio Balancing

To achieve optimal risk-return outcomes, it is advisable to diversify your portfolio with a mix of growth and value stocks. This approach helps spread out risk and capitalize on the strengths of each type of stock. By carefully balancing your investment strategy, you can create a well-rounded portfolio that can weather various market conditions and potentially deliver solid returns over time.