So, you’re thinking about investing in index funds, huh? Well, buckle up because we’re about to take you on a wild ride into the world of passive investing and financial growth. Get ready to learn all about how to make your money work for you!

What are Index Funds?

Index funds are a type of mutual fund or ETF that tracks a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds aim to replicate the performance of the index they are tracking, rather than trying to outperform the market.

Examples of Popular Index Funds

- Vanguard Total Stock Market Index Fund (VTSAX)

- Schwab S&P 500 Index Fund (SWPPX)

- iShares Russell 2000 ETF (IWM)

Benefits of Investing in Index Funds

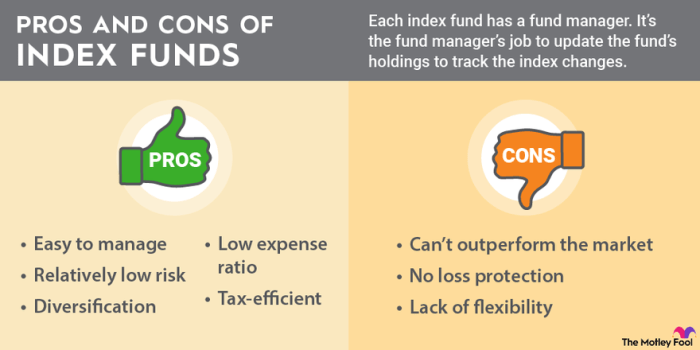

Index funds offer several advantages over investing in individual stocks:

- Diversification: By investing in an index fund, you are effectively spreading your investment across a wide range of companies, reducing the risk of losses from the poor performance of a single stock.

- Lower Costs: Index funds typically have lower expense ratios compared to actively managed funds, making them a cost-effective option for long-term investing.

- Passive Management: Index funds require minimal maintenance as they simply track the index they are based on, eliminating the need for constant monitoring and decision-making.

- Consistent Performance: Over the long term, index funds have shown to deliver competitive returns compared to actively managed funds, making them a reliable option for investors seeking steady growth.

How to Start Investing in Index Funds?

Investing in index funds is a great way to grow your money over time without the stress of picking individual stocks. Here are the steps to get started:

Opening an Investment Account

- Choose a reputable brokerage firm or financial institution to open an investment account. Make sure to consider fees, account minimums, and available investment options.

- Complete the account application and provide the necessary identification and financial information.

- Transfer funds into your investment account to have capital ready for investing in index funds.

Choosing the Right Index Funds

- Identify your investment goals, whether it’s long-term growth, income generation, or capital preservation.

- Research different index funds that align with your goals, considering factors like expense ratios, historical performance, and diversification.

- Select index funds that match your risk tolerance and time horizon, ensuring a balanced portfolio.

Importance of Diversification

Diversification is key to reducing risk in your investment portfolio. By investing in a variety of index funds across different asset classes and sectors, you can spread out your risk and potentially increase your returns. Remember the old saying, “Don’t put all your eggs in one basket!”

Risks and Considerations of Index Fund Investing

When it comes to investing in index funds, there are some risks and considerations you need to keep in mind to make smart decisions for your money. Let’s break it down for you!

Risks Associated with Investing in Index Funds

- Market Risk: Just like any investment, index funds are subject to market fluctuations. If the overall market takes a hit, your index fund will likely follow suit.

- Tracking Error: Index funds aim to mirror the performance of a specific index, but there can be slight variations. This tracking error can impact your returns.

- Costs: While index funds are known for their low fees, these costs can still eat into your returns over time. It’s important to be aware of the expense ratio of the fund you choose.

- Concentration Risk: Some index funds may be heavily weighted in a particular sector or industry, exposing you to risks associated with that specific area.

Impact of Market Fluctuations on Index Fund Performance

Market fluctuations can have a significant impact on the performance of index funds. When the market is up, your index fund will likely see gains. Conversely, during market downturns, your fund may experience losses. It’s essential to understand that index funds are not immune to market volatility.

How to Mitigate Risks through Proper Asset Allocation

Proper asset allocation is key to reducing risks in index fund investing.

By diversifying your investments across different asset classes, you can help mitigate the impact of market fluctuations on your portfolio. Consider spreading your investments across various index funds to ensure that you are not overly exposed to any single market sector. Regularly review and rebalance your portfolio to maintain your desired asset allocation and manage risks effectively.

Performance and Tracking of Index Funds

When it comes to investing in index funds, tracking their performance is crucial. It allows investors to assess how well the fund is doing compared to its benchmark index and other investment options. Understanding how to track this performance can help investors make informed decisions about their investments.

Comparing Index Funds to Actively Managed Funds

Actively managed funds are run by professional fund managers who aim to outperform the market. However, research has shown that the majority of actively managed funds fail to beat their benchmark index over the long term. On the other hand, index funds simply aim to replicate the performance of a specific index, such as the S&P 500. While they may not outperform the market, they often provide more consistent returns over time due to lower fees and expenses.

Role of Expense Ratios and Tracking Error

Expense ratios and tracking error are important factors to consider when evaluating index fund performance. Expense ratios represent the annual fees charged by the fund, which can eat into your overall returns. Lower expense ratios are generally preferred as they allow investors to keep more of their profits. Tracking error, on the other hand, measures how closely the fund’s performance aligns with its benchmark index. A lower tracking error indicates that the fund is doing a good job of replicating the index’s returns.