Yo, so you wanna know about financial portfolio balancing, huh? Well, buckle up ‘cause we’re diving into the world of money management in a way that’s gonna blow your mind. Get ready for some tips and tricks that’ll have you feeling like a boss in no time!

Alright, let’s break it down for you – we’re talking about why balancing your financial portfolio is key, different strategies to keep your cash flow in check, and how to make sure you’re investing like a pro. So, let’s get this party started!

Importance of Financial Portfolio Balancing

Investing in a well-balanced financial portfolio is key for any investor looking to maximize returns while minimizing risks. A balanced portfolio helps spread out investments across different asset classes, reducing the impact of market volatility on the overall performance.

Diversification Reduces Risks

- Diversification across various asset classes such as stocks, bonds, and real estate can help mitigate risks associated with a single investment.

- For example, if one sector experiences a downturn, having diversified investments can help cushion the impact on the overall portfolio.

Maximizing Returns

- A well-balanced portfolio also allows investors to capitalize on different market opportunities and optimize returns.

- By allocating investments strategically, investors can potentially benefit from the growth of multiple sectors and asset classes.

Risk Management

- Balancing a financial portfolio enables investors to manage risk effectively by setting clear investment objectives and aligning them with their risk tolerance.

- Regularly monitoring and rebalancing the portfolio ensures that it stays in line with the investor’s goals and risk preferences.

Strategies for Financial Portfolio Balancing

When it comes to balancing your financial portfolio, there are several strategies that investors can consider. These strategies can help minimize risk while maximizing returns, depending on individual financial goals and risk tolerance.

Active vs. Passive Portfolio Balancing

Active portfolio balancing involves frequent buying and selling of assets in an attempt to outperform the market. This strategy requires a lot of time, research, and expertise. On the other hand, passive portfolio balancing involves maintaining a diversified portfolio without frequent trading. This strategy is more hands-off and is often achieved through index funds or ETFs.

Role of Diversification

Diversification plays a crucial role in balancing a financial portfolio. By spreading investments across different asset classes, industries, and geographical regions, investors can reduce the overall risk of their portfolio. Diversification helps protect against significant losses in case one sector or asset class underperforms.

Asset Allocation in Portfolio Balancing

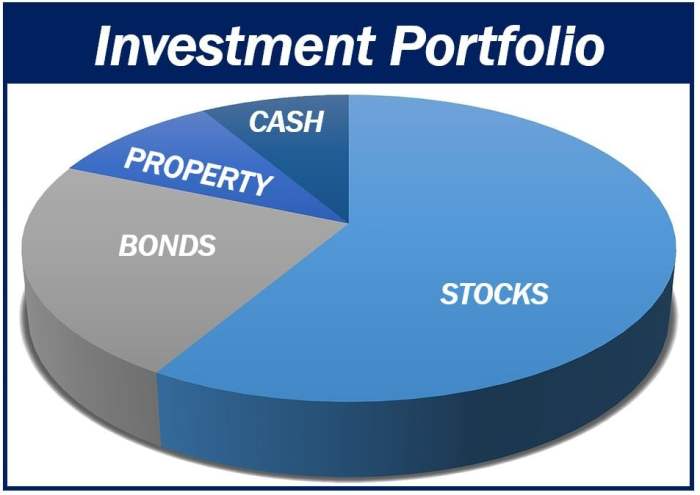

When it comes to portfolio balancing, asset allocation plays a crucial role in determining the mix of different asset classes within an investment portfolio. It involves dividing your investments among various asset classes like stocks, bonds, and cash equivalents to manage risk and achieve financial goals.

Different Asset Classes and Their Role

Asset classes can include stocks, bonds, real estate, commodities, and cash equivalents. Here are some examples of different asset classes and their roles in a balanced portfolio:

- Stocks: Represent ownership in a company and offer high growth potential but also come with higher risk.

- Bonds: Debt securities issued by governments or corporations which provide regular income and are considered less risky than stocks.

- Real Estate: Includes properties like residential or commercial real estate that can provide rental income and potential for appreciation.

- Commodities: Include physical goods like gold, oil, or agricultural products that can act as a hedge against inflation.

- Cash Equivalents: Short-term, low-risk investments like money market funds or Treasury bills that provide liquidity and stability to a portfolio.

Risk Tolerance and Asset Allocation

Risk tolerance refers to an investor’s ability to handle fluctuations in the value of their investments. It plays a significant role in determining the allocation of assets in a portfolio. For example, investors with a higher risk tolerance may allocate a larger portion of their portfolio to stocks for potential higher returns, while those with lower risk tolerance may prefer a more conservative approach with a higher allocation to bonds or cash equivalents.

Rebalancing Techniques

When it comes to rebalancing your financial portfolio, there are several techniques you can employ to ensure your investments are aligned with your goals and risk tolerance. Regularly adjusting your portfolio can help maintain your desired asset allocation and manage risk effectively.

Annual Rebalancing

- One common method for rebalancing is to do it annually, where you review your portfolio once a year and make adjustments as needed.

- By rebalancing annually, you can ensure that your portfolio stays in line with your investment strategy and long-term objectives.

Threshold Rebalancing

- Another approach is threshold rebalancing, where you set specific percentage ranges for each asset class in your portfolio.

- When an asset class deviates outside of the predetermined threshold, you rebalance your portfolio to bring it back in line with your targets.

Cash Flow Rebalancing

- For those who regularly contribute new funds to their portfolio or withdraw money for expenses, cash flow rebalancing can be an effective technique.

- By adjusting your contributions or withdrawals to rebalance your portfolio, you can maintain your desired asset allocation without needing to sell off assets.

Dynamic Rebalancing

- Dynamic rebalancing involves continuously monitoring your portfolio and making adjustments based on market conditions or changes in your financial goals.

- This method allows for more flexibility in responding to market trends and can help you capitalize on opportunities or minimize risks as they arise.

Frequency of Rebalancing

- While the frequency of rebalancing can vary based on individual circumstances, many financial advisors recommend reviewing and potentially rebalancing your portfolio at least once a year.

- However, some investors may choose to rebalance more frequently, especially during periods of high market volatility or significant changes in their financial situation.

Monitoring and Adjusting Allocations

- Regularly monitoring your portfolio’s performance and adjusting allocations as needed is crucial to achieving your financial goals.

- By staying informed about market trends, economic developments, and changes in your risk tolerance, you can make informed decisions about when and how to rebalance your portfolio.