Yo, ready to talk about investing in REITs? Let’s break it down in a way that’s easy to understand and totally lit. From what REITs are to the risks and rewards, we’ve got you covered.

So, buckle up and get ready to learn all about how to make bank with REITs.

What are REITs?

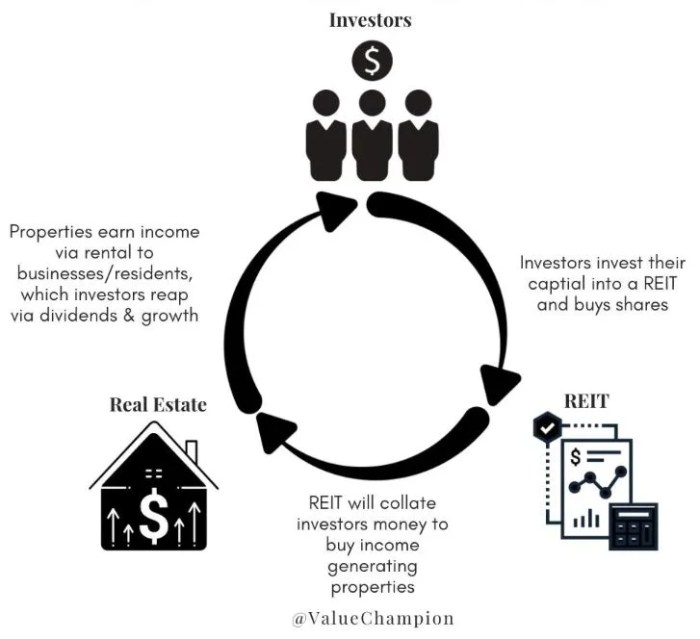

REITs, or Real Estate Investment Trusts, are companies that own, operate, or finance income-producing real estate across a range of property sectors. They provide a way for individuals to invest in real estate without having to buy, manage, or finance any properties themselves.

Types of REITs

- Equity REITs: These own and operate income-producing real estate. They earn revenue mainly through leasing properties and collecting rent.

- Mortgage REITs: These provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities.

- Hybrid REITs: These combine the characteristics of both equity REITs and mortgage REITs, owning properties and providing financing.

Benefits of Investing in REITs

- Diversification: Investing in REITs allows investors to diversify their portfolios without directly owning physical properties.

- Liquidity: REITs are traded on major stock exchanges, providing investors with liquidity compared to traditional real estate investments.

- High Dividend Yields: REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, making them attractive for income-seeking investors.

- Potential for Capital Appreciation: In addition to dividends, REITs can also offer potential capital appreciation through property value increases over time.

How to Invest in REITs?

Investing in REITs can be a smart move for those looking to diversify their portfolio and earn passive income. Here’s a step-by-step guide on how to start investing in REITs:

Choose Your Investment Goal

Before diving into REITs, it’s essential to determine your investment goals. Are you looking for regular income or long-term capital appreciation? Understanding your objectives will help you make informed decisions.

Educate Yourself About REITs

Take the time to research and learn more about REITs. Understand how they work, their potential risks, and the types of REITs available in the market. Knowledge is key to making sound investment choices.

Open a Brokerage Account

To invest in REITs, you’ll need to open a brokerage account. Choose a reputable brokerage firm that offers access to a wide range of REITs and other investment options.

Consider Your Risk Tolerance

Evaluate your risk tolerance before investing in REITs. While REITs can offer attractive returns, they also come with risks. Assess how much risk you are willing to take on based on your financial situation and investment goals.

Choose Your REITs

Once you’re ready to invest, select the REITs that align with your investment strategy. Consider factors such as the property types the REIT invests in, its historical performance, and the expertise of the management team.

Monitor Your Investments

After investing in REITs, it’s crucial to monitor your investments regularly. Stay updated on market trends, economic conditions, and any news that could impact your REITs. Make adjustments to your portfolio as needed.

Investing in REITs can be a rewarding venture, but it’s essential to do your due diligence and make informed decisions based on your financial goals and risk tolerance.

Risks and Rewards of Investing in REITs

When it comes to investing in Real Estate Investment Trusts (REITs), there are both risks and rewards that investors should consider. Let’s delve into the potential upsides and downsides of investing in REITs.

Risks of Investing in REITs

- Market Volatility: REITs can be sensitive to market fluctuations, impacting their stock prices.

- Interest Rate Risks: Changes in interest rates can affect the financing costs for REITs, impacting their profitability.

- Property Market Risks: The performance of REITs is tied to the real estate market, which can be influenced by various factors like supply and demand dynamics.

- Liquidity Risks: Some REITs may have limited liquidity, making it challenging to buy or sell shares quickly.

Rewards of Investing in REITs

- Dividend Income: REITs are required to distribute a significant portion of their income to shareholders in the form of dividends.

- Diversification: Investing in REITs can provide diversification to a portfolio by adding exposure to real estate assets.

- Potential for Capital Appreciation: As real estate values increase, the value of REIT shares can also appreciate over time.

- Tax Benefits: REITs are pass-through entities, meaning they are not taxed at the corporate level, potentially resulting in higher distributions to shareholders.

Economic Factors Impacting REIT Investments

- Interest Rates: Changes in interest rates can impact borrowing costs for REITs, affecting their profitability.

- Economic Growth: Strong economic growth can lead to increased demand for real estate, benefiting REITs.

- Inflation: Inflation can drive up property values and rental income, potentially benefiting REITs as well.

- Regulatory Environment: Changes in regulations related to real estate can impact the operations and profitability of REITs.

Tax Implications of Investing in REITs

When it comes to investing in Real Estate Investment Trusts (REITs), it’s important to understand the tax implications that come along with it. Let’s dive into the tax advantages and disadvantages of investing in REITs and how to minimize tax liabilities.

Tax Advantages and Disadvantages

- One major advantage of investing in REITs is that they are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This means that investors can enjoy high dividend yields, often higher than traditional stocks.

- On the flip side, REIT dividends are taxed at ordinary income tax rates, which can be higher than the preferential tax rates applied to qualified dividends from other investments like stocks.

Taxation of REIT Dividends

- REIT dividends are taxed as ordinary income, regardless of how long you’ve held the shares. This means that if you fall into a higher tax bracket, you could end up paying more in taxes on your REIT dividends compared to other investments.

- It’s important to keep in mind that REITs do not qualify for the qualified dividend tax rate, which is generally lower than ordinary income tax rates.

Strategies for Minimizing Tax Liabilities

- One strategy to minimize tax liabilities when investing in REITs is to hold them in tax-advantaged accounts like IRAs or 401(k)s. This way, you can defer taxes on the dividends until you start withdrawing funds in retirement.

- Another strategy is to balance your REIT investments with other tax-efficient investments like index funds or ETFs that generate capital gains rather than ordinary income.