Yo, financial markets basics is where it’s at! Get ready to dive into the world of investing with this lit overview that’ll have you hooked from the get-go.

So, you wanna know about stocks, bonds, and all that jazz? Well, buckle up because we’re about to break it down for you in a way that’s totally rad.

Importance of Financial Markets Basics

Understanding financial markets basics is crucial for investors as it provides them with the necessary knowledge to make informed investment decisions and navigate the complexities of the financial world. Without a solid grasp of these basics, investors may be at risk of making poor choices that could negatively impact their financial well-being.

Knowledge is Power

- Knowledge of financial markets basics can help investors understand the different types of investment options available, such as stocks, bonds, and mutual funds.

- By knowing how these markets operate, investors can assess the risks and potential returns associated with each investment, allowing them to make decisions that align with their financial goals.

- Understanding financial markets basics also enables investors to interpret market trends and economic indicators, which can inform their investment strategies and help them capitalize on opportunities for growth.

Impact on the Economy

- Financial markets play a crucial role in the overall economy by facilitating the flow of capital between investors and businesses.

- Changes in financial markets, such as fluctuations in stock prices or interest rates, can have far-reaching effects on consumer spending, business investments, and overall economic growth.

- By understanding how financial markets work, investors can better anticipate and react to these changes, potentially mitigating risks and maximizing returns in their investment portfolios.

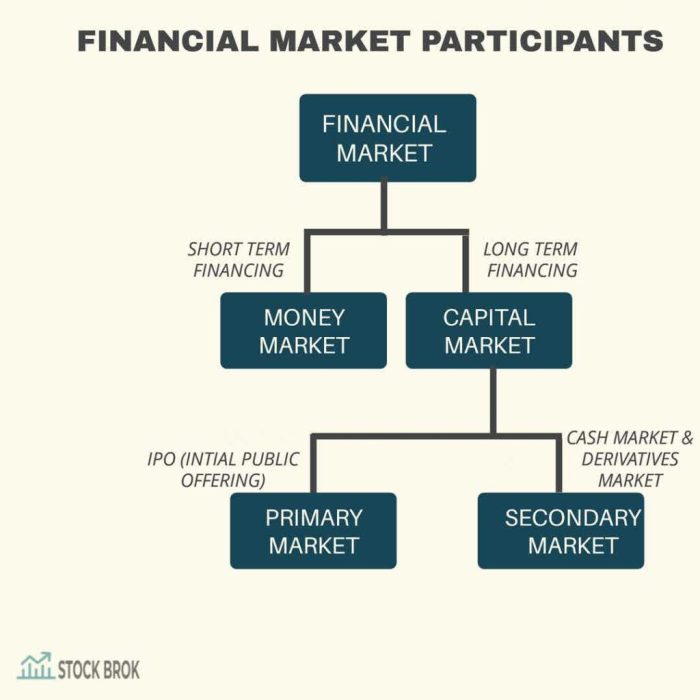

Types of Financial Markets

In the world of finance, there are different types of financial markets that serve various purposes and cater to different needs. Let’s dive into the main categories of financial markets and understand their functions.

Primary vs. Secondary Financial Markets

Primary Financial Markets:

– The primary market is where new securities are issued for the first time.

– Companies raise capital by selling stocks or bonds directly to investors.

– Examples of financial instruments traded in the primary market include initial public offerings (IPOs) and corporate bonds.

Secondary Financial Markets:

– The secondary market is where existing securities are bought and sold among investors.

– Investors trade previously issued securities without the involvement of the issuing company.

– Examples of financial instruments traded in the secondary market include stocks and bonds on stock exchanges like NYSE and NASDAQ.

Money Markets and Capital Markets

Money Markets:

– Money markets are where short-term debt securities are traded, typically with maturities of one year or less.

– These markets provide liquidity and short-term funding for governments, financial institutions, and corporations.

– Examples of financial instruments traded in money markets include Treasury bills, commercial paper, and certificates of deposit.

Capital Markets:

– Capital markets are where long-term debt and equity securities are traded, with maturities exceeding one year.

– These markets facilitate long-term investment and capital formation for businesses and governments.

– Examples of financial instruments traded in capital markets include common stocks, corporate bonds, and government securities.

Key Participants in Financial Markets

In financial markets, various key participants play crucial roles in ensuring the smooth functioning of the market and maintaining transparency and integrity.

Investors

Investors are individuals or institutions that provide capital to financial markets by purchasing securities such as stocks, bonds, or derivatives. They contribute to market liquidity and price discovery by buying and selling financial assets based on their investment objectives and risk tolerance.

Issuers

Issuers are entities that offer securities to raise capital in the financial markets. They can be corporations, governments, or other organizations seeking funding. By issuing stocks or bonds, issuers provide investment opportunities to investors and help fund their operations or projects.

Intermediaries

Intermediaries are financial institutions like banks, brokerage firms, and investment companies that facilitate transactions between investors and issuers. They provide services such as trading, underwriting, and advisory services, helping to match buyers and sellers in the market and ensuring efficient market operations.

Regulators

Regulators are government agencies or regulatory bodies responsible for overseeing and enforcing rules and regulations in financial markets. They aim to protect investors, maintain market stability, and prevent fraudulent activities. Regulators play a crucial role in ensuring transparency, fair practices, and market integrity.

Overall, the collaboration of investors, issuers, intermediaries, and regulators is essential for the functioning of financial markets. Transparency and regulation are key factors in maintaining market integrity, investor confidence, and the overall stability of the financial system.

Basics of Stock Markets

Stock markets play a crucial role in the financial world, allowing individuals and companies to buy and sell shares of ownership in publicly traded companies. Let’s dive into the basics of stock markets.

Definition of Stocks and Shares

Stocks, also known as shares or equities, represent ownership in a corporation. When you buy a stock, you are essentially buying a small piece of that company. Shareholders have the right to vote on company decisions and may receive dividends if the company profits.

How Stock Exchanges Operate

Stock exchanges are platforms where stocks are bought and sold. Buyers and sellers come together to trade stocks, with prices determined by supply and demand. Stock exchanges provide a transparent marketplace for investors to make transactions. Some well-known stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq.

Factors Influencing Stock Prices

Several factors can influence stock prices, including:

- Company Performance: Strong financial results and growth prospects can lead to higher stock prices.

- Market Sentiment: Investor perceptions and overall market trends can impact stock prices.

- Economic Indicators: Factors like interest rates, inflation, and GDP growth can affect stock prices.

- Industry Trends: Developments in specific industries can influence the stock prices of companies within those sectors.

- Regulatory Changes: Government regulations and policies can impact stock prices in certain sectors.

Understanding Bonds

Bonds are basically IOUs issued by companies or governments to raise funds. When you buy a bond, you are lending money to the issuer in exchange for periodic interest payments and the promise to repay the principal amount at a specified date in the future.

Features of Bonds

- Bonds have a fixed maturity date when the issuer must repay the principal amount.

- They pay a fixed or variable interest rate, known as the coupon rate.

- Bonds are generally less risky than stocks but offer lower potential returns.

Relationship between Bond Prices and Interest Rates

- When interest rates rise, bond prices fall, and vice versa. This is because new bonds will offer higher interest rates, making existing bonds less attractive.

- Conversely, when interest rates fall, bond prices rise, as existing bonds with higher rates become more valuable.

Types of Bonds

- Corporate Bonds: Issued by companies to raise capital for various purposes.

- Government Bonds: Issued by governments to finance public projects and manage debt.

- Municipal Bonds: Issued by state and local governments to fund infrastructure projects.

- Zero-Coupon Bonds: Sold at a discount without periodic interest payments, with the face value paid at maturity.

Introduction to Derivatives

Derivatives are financial instruments that derive their value from an underlying asset or group of assets. They play a crucial role in financial markets by allowing investors to manage risk, speculate on price movements, and enhance investment returns.

Types of Derivative Instruments

- Futures: Futures contracts are agreements to buy or sell an asset at a specified price on a future date. They are commonly used for hedging against price fluctuations.

- Options: Options provide the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time frame. They are used for hedging and speculation.

- Swaps: Swaps involve the exchange of cash flows or assets between two parties. They are used to manage interest rate risk, currency risk, and other types of financial risks.

Derivatives are like the cool kids of the financial world – they’re versatile, edgy, and can make or break your investment game.

Role of Derivatives in Financial Markets

Derivatives are essential tools for managing risk and enhancing returns in financial markets. They allow investors to hedge against adverse price movements, speculate on future price changes, and diversify their investment portfolios.

Using Derivatives for Hedging and Speculation

- Hedging: Investors use derivatives to offset potential losses from adverse price movements in the underlying assets. For example, a farmer may use futures contracts to lock in a price for their crops before harvest to hedge against price fluctuations.

- Speculation: Speculators use derivatives to profit from anticipated price movements in the market. They take calculated risks based on their market analysis and outlook. For instance, an investor may buy call options if they expect a stock price to rise.