Ready to dive into the world of investing in healthcare stocks? Get ready for a rollercoaster ride of stability, growth potential, and economic resilience that only the healthcare sector can offer.

From pharmaceutical giants to cutting-edge biotech startups, the healthcare industry is a treasure trove of opportunities for savvy investors looking to make their mark.

Importance of Healthcare Sector Stocks

Investing in healthcare stocks is like having a solid backup plan in your financial portfolio. Here’s why it’s a smart move:

Stability in Healthcare Stocks

When the economy takes a hit, people still need healthcare services. This demand provides a level of stability to healthcare stocks that other industries might not enjoy.

Potential for Growth in the Healthcare Sector

With advancements in medical technology and an aging population, the healthcare sector is primed for significant growth. Investing in healthcare stocks can potentially lead to higher returns compared to other industries.

Hedge Against Economic Downturns

Healthcare stocks tend to perform well during economic downturns since people prioritize their health regardless of the financial situation. This resilience can help balance out losses in other sectors.

Key Factors Influencing Healthcare Stocks

Factors like regulatory changes, drug approvals, demographic trends, and healthcare spending can greatly impact the performance of healthcare stocks. Keeping an eye on these key factors can help investors make informed decisions in the healthcare sector.

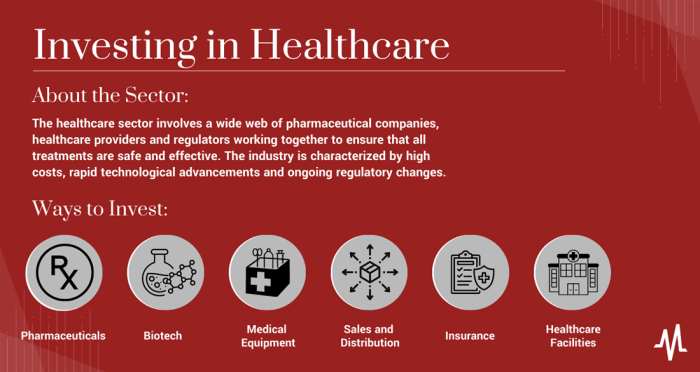

Types of Healthcare Stocks to Consider

When it comes to investing in healthcare stocks, there are several types to consider, each with its own unique characteristics and potential for growth. These include pharmaceutical companies, biotechnology firms, medical device manufacturers, healthcare REITs, and healthcare services providers.

Pharmaceutical Companies

Pharmaceutical companies develop, produce, and market drugs and medications. They often have a diverse portfolio of products targeting various medical conditions. Investing in pharmaceutical stocks can be lucrative, especially if the company has a strong pipeline of new drugs and a history of successful product launches.

Biotechnology Firms

Biotechnology companies focus on developing new treatments and therapies using biological processes. These stocks can be more volatile compared to pharmaceutical stocks due to the high-risk nature of drug development. Investing in biotech firms requires a high tolerance for risk but can also offer substantial returns if a breakthrough drug is successfully brought to market.

Medical Device Manufacturers

Medical device companies produce a wide range of products, from surgical instruments to diagnostic equipment. These stocks are often considered more stable than pharmaceutical or biotech stocks since they are less dependent on regulatory approvals for individual products. Investing in medical device manufacturers can provide steady returns over time.

Healthcare REITs

Real Estate Investment Trusts (REITs) focused on healthcare properties can be a great way to invest in the healthcare sector without directly owning healthcare stocks. Healthcare REITs own and operate medical facilities, hospitals, and senior living communities, providing a steady stream of rental income to investors.

Healthcare Services Providers

Healthcare services providers include companies that offer a wide range of services, such as hospitals, clinics, and outpatient care centers. These stocks are influenced by factors such as patient volume, reimbursement rates, and regulatory changes. Investing in healthcare services providers can be a way to diversify your healthcare portfolio and capitalize on the growing demand for healthcare services.

Factors to Consider Before Investing in Healthcare Stocks

When it comes to investing in healthcare stocks, there are several important factors to consider to make informed decisions and maximize your chances of success. From conducting thorough research to understanding how geopolitical events can impact stock prices, here are some key considerations to keep in mind:

Thorough Research is Key

Before diving into the world of healthcare stock investments, it’s crucial to conduct thorough research. This includes analyzing the company’s financial health, growth potential, market trends, and competitive landscape. By taking the time to research and understand the healthcare sector, you can make more informed investment decisions.

The Role of Diversification

Diversification is a crucial strategy when it comes to building a healthcare stock portfolio. By spreading your investments across different healthcare companies, sectors, and geographies, you can reduce the overall risk in your portfolio. This way, if one sector or company underperforms, your other investments can help offset potential losses.

Geopolitical Events and Healthcare Policies

Geopolitical events and healthcare policies can have a significant impact on healthcare stocks. Changes in regulations, government policies, or global events can influence stock prices and market dynamics. It’s important to stay informed about these factors and how they may affect the healthcare sector to make informed decisions.

Analyzing Financial Health and Growth Potential

When evaluating healthcare companies for investment, it’s essential to analyze their financial health and growth potential. Look at key financial metrics such as revenue growth, profit margins, debt levels, and cash flow. Additionally, consider the company’s pipeline of products, research and development initiatives, and market positioning to gauge their growth potential in the future.

Risks Associated with Investing in Healthcare Stocks

Investing in healthcare stocks can be lucrative, but it also comes with its own set of risks. Understanding these risks is crucial for making informed investment decisions in the healthcare sector.

Common Risks in Healthcare Sector

- Regulatory Changes: Healthcare regulations can significantly impact stock prices. Any alterations in policies related to drug approvals, reimbursement rates, or healthcare reform can cause volatility in healthcare stocks.

- Patent Expirations: Pharmaceutical companies often face the risk of losing exclusivity on their patented drugs, leading to generic competition and a decline in revenue.

- Clinical Trial Failures: Healthcare stocks, especially biotech companies, are highly sensitive to clinical trial results. A failed trial can lead to significant stock price drops.

Impact of Healthcare Regulations on Stock Prices

Changes in healthcare regulations can have a direct impact on the profitability and growth prospects of healthcare companies. For example, stricter regulations may increase compliance costs, affecting the bottom line.

Volatility of Healthcare Stocks

- Healthcare stocks are known for their volatility due to the unpredictable nature of drug approvals, clinical trial outcomes, and regulatory changes. This volatility can lead to rapid price fluctuations.

- Compared to other sectors, healthcare stocks tend to react more strongly to news and events, making them riskier but potentially more rewarding for investors.

Strategies to Mitigate Risks

- Diversification: Investing in a variety of healthcare stocks across different subsectors can help spread risk and minimize the impact of any single company’s performance.

- Research and Due Diligence: Conduct thorough research on healthcare companies, including their financial health, pipeline of drugs, and competitive position, before making investment decisions.

- Stay Informed: Keep abreast of the latest developments in the healthcare industry, including regulatory changes, clinical trial results, and market trends, to make informed investment choices.