So, you wanna dive into the world of credit card debt management? Buckle up because we’re about to take you on a wild ride through the dos and don’ts of handling those plastic cards. Get ready to learn the ropes and conquer your financial fears like a boss!

Let’s break it down from the basics to the nitty-gritty details of credit card debt management. Brace yourself for some eye-opening insights that will change the way you see those sneaky interest rates and minimum payments.

Importance of Credit Card Debt Management

Managing credit card debt is super important for keeping your financial game strong. If you don’t handle it right, you could end up in a major money mess. Let’s break it down so you can stay on top of your credit card game.

Consequences of Not Managing Credit Card Debt Effectively

When you don’t manage your credit card debt like a boss, things can get real ugly, real quick. You might end up drowning in high-interest rates, late fees, and a tanked credit score. It’s like a bad vibe that can mess up your financial future.

Key Strategies for Successful Credit Card Debt Management

To keep your finances in check and avoid getting into a credit card debt nightmare, you gotta be smart about it. Here are some key moves to help you slay the credit card game:

- Set a budget and stick to it like glue.

- Pay more than the minimum payment to crush that debt faster.

- Avoid using your credit card for impulse buys or things you can’t afford.

- Consider consolidating your debt to make it easier to manage.

- Negotiate with your credit card company for lower interest rates or payment plans.

Understanding Credit Card Debt

Credit card debt is the money you owe to the credit card company for purchases made using the credit card. It accumulates when you carry a balance from month to month and do not pay off the full amount owed. This leads to interest charges being applied to the remaining balance, increasing the overall debt.

Common Causes of Credit Card Debt

- Impulse Buying: Making purchases without considering if you can afford them or if they are necessary.

- Emergency Expenses: Using the credit card to cover unexpected costs when you don’t have enough savings.

- Unemployment or Reduced Income: Relying on credit cards to cover living expenses when your income decreases.

Good vs. Bad Debt with Credit Cards

- Good Debt: Using your credit card to make purchases that can improve your financial situation in the long run, such as investing in education or starting a business.

- Bad Debt: Accumulating credit card debt for non-essential items or luxuries that do not provide long-term value, leading to financial strain and high interest payments.

Tips for Managing Credit Card Debt

When it comes to managing credit card debt, there are some practical tips that can help you get back on track and pay off your balances. It’s important to create a budget, choose a repayment method, and make more than the minimum payment to effectively tackle your credit card debt.

Creating a Budget

Creating a budget is essential when it comes to managing credit card debt. Start by listing all your expenses and income to get a clear picture of your financial situation. Identify areas where you can cut back on spending to free up extra money to put towards paying off your credit card debt.

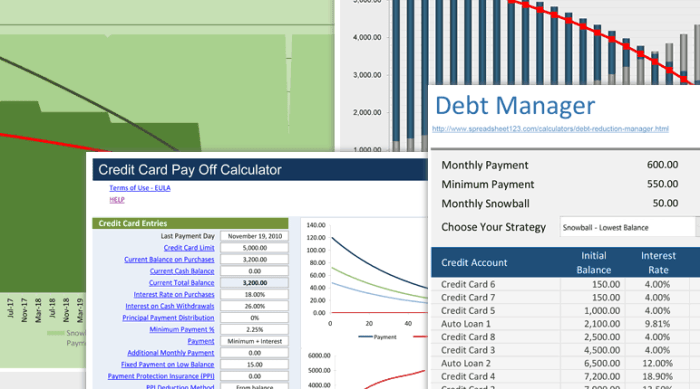

Snowball Method vs. Avalanche Method

When it comes to paying off credit card debt, there are two popular methods: the snowball method and the avalanche method.

- The snowball method involves paying off your smallest debt first while making minimum payments on larger debts. Once the smallest debt is paid off, you move on to the next smallest debt, creating momentum as you go.

- The avalanche method, on the other hand, focuses on paying off the debt with the highest interest rate first. By tackling high-interest debt first, you can save money on interest payments in the long run.

Making More than the Minimum Payment

It’s crucial to make more than the minimum payment on your credit cards if you want to make a dent in your debt. By paying more than the minimum, you can reduce the amount of interest you accrue and pay off your debt faster. Even small increases in your monthly payment can make a big difference in the long run.

Debt Consolidation and Credit Counseling

Debt consolidation and credit counseling are two popular methods for managing credit card debt effectively. Let’s dive into what they are and how they can help individuals struggling with overwhelming debt.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan or payment plan. This can make it easier to manage debt by simplifying payments and potentially lowering interest rates. However, it’s essential to consider the pros and cons before opting for debt consolidation.

- Pros of Debt Consolidation:

- Streamlines payments into one manageable amount

- Potentially reduces overall interest rates

- May offer a fixed repayment schedule

- Cons of Debt Consolidation:

- Could extend the repayment period

- May require collateral for secured loans

- Could incur additional fees or charges

Credit Counseling

Credit counseling involves working with a professional counselor to create a personalized plan for managing debt. These counselors can provide guidance on budgeting, negotiating with creditors, and developing strategies to pay off debt efficiently.

- Pros of Credit Counseling:

- Offers personalized debt management plans

- Provides financial education and tools for long-term success

- Assists in negotiating with creditors

- Cons of Credit Counseling:

- May involve fees for services

- Could impact credit score in the short term

- Requires commitment to the repayment plan