Yo, check it out! Loan consolidation strategies are the real deal when it comes to getting your finances on point. We’re diving into the world of combining loans to make your life easier and your wallet happier. Get ready for some solid tips and tricks, peeps!

Now, let’s break it down – what’s loan consolidation all about and why should you care?

Overview of Loan Consolidation Strategies

Loan consolidation is the process of combining multiple loans into a single loan with one monthly payment. This can help simplify your finances and potentially save you money in the long run.

Benefits of Consolidating Loans

Consolidating loans can offer several benefits, including:

- Lower interest rates: By consolidating high-interest loans into one with a lower rate, you could save money on interest payments over time.

- Simplified payments: Instead of juggling multiple due dates and amounts, consolidating loans allows you to make one monthly payment, making it easier to manage your finances.

- Potential for lower monthly payments: Depending on the terms of the new consolidated loan, you may be able to reduce your monthly payment amount, providing some relief to your budget.

Common Types of Loans that Can be Consolidated

- Student loans: Consolidating federal student loans or private student loans can help simplify repayment and potentially lower interest rates.

- Credit card debt: Rolling high-interest credit card debt into a consolidation loan with a lower interest rate can save you money and streamline your payments.

- Personal loans: If you have multiple personal loans with varying interest rates, consolidating them into one loan can make repayment more manageable.

Factors to Consider Before Consolidating Loans

When looking to consolidate loans, there are several important factors to take into consideration to ensure you make the best decision for your financial situation.

Interest Rates:

Interest rates play a crucial role in loan consolidation as they determine how much you will ultimately pay back. It’s essential to compare the interest rates of your current loans with the rate offered for consolidation. If the consolidation loan has a higher interest rate, it may not be the best option for you in the long run.

Repayment Terms to Consider

- Standard Repayment: This option offers fixed monthly payments over a set period of time, usually around 10 years. It’s a good choice if you want to pay off your loan quickly and can afford higher monthly payments.

- Extended Repayment: With this plan, you can extend the repayment period up to 25 years, resulting in lower monthly payments but higher overall interest costs.

- Income-Driven Repayment: This option bases your monthly payments on your income, making it easier to manage your payments if you have a variable income.

Credit Score Impact

Your credit score plays a significant role in determining the loan consolidation options available to you. A higher credit score can help you qualify for better interest rates and terms, potentially saving you money in the long term. On the other hand, a lower credit score may limit your options and result in higher interest rates.

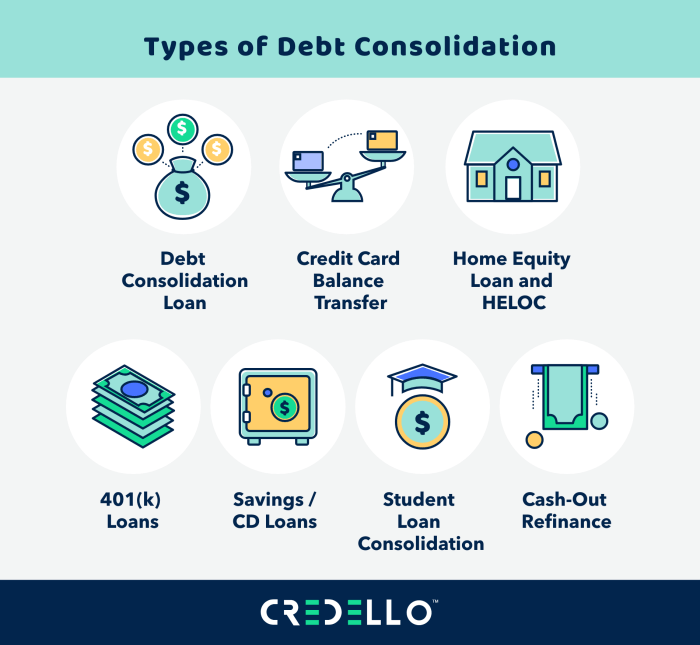

Methods of Loan Consolidation

When it comes to consolidating your loans, there are several methods you can consider to help manage your debt more effectively.

Consolidating Federal Student Loans

Consolidating federal student loans involves combining multiple federal student loans into one new loan with a fixed interest rate. This can simplify repayment by combining all loans into one monthly payment, potentially lowering the monthly amount due. However, it’s important to note that the interest rate on the new loan may be a weighted average of the existing loans, so it’s crucial to evaluate whether consolidation will save you money in the long run.

Debt Consolidation Loans vs. Balance Transfer Credit Cards

Debt consolidation loans involve taking out a new loan to pay off existing debts, consolidating them into one monthly payment with a potentially lower interest rate. On the other hand, balance transfer credit cards allow you to transfer high-interest credit card debt to a new card with a lower introductory interest rate. While both methods can help simplify payments and potentially save you money on interest, it’s important to compare the terms and fees associated with each option to determine which one is more suitable for your financial situation.

Using Home Equity Loans for Debt Consolidation

Home equity loans involve borrowing against the equity in your home to consolidate debt. This method allows you to access a large sum of money at a lower interest rate than many other forms of credit. However, using a home equity loan puts your home at risk if you’re unable to make the payments, so it’s crucial to weigh the pros and cons before considering this option.

Strategies to Optimize Loan Consolidation

When looking to optimize your loan consolidation process, there are a few key strategies to keep in mind. By negotiating better terms, understanding the impact on your credit score, and implementing effective budgeting techniques, you can make the most out of consolidating your loans. Let’s dive into these strategies below:

Negotiating Better Terms

When consolidating your loans, it’s important to negotiate for better terms such as lower interest rates, longer repayment periods, or reduced monthly payments. By presenting a strong case for why you deserve these improved terms, you may be able to save significant amounts of money in the long run.

Impact on Credit Score

Consolidating your loans can have both positive and negative effects on your credit score. On one hand, it can simplify your repayment process and potentially improve your credit utilization ratio. On the other hand, it may result in a temporary dip in your score due to the new credit inquiry and changes in credit mix. It’s essential to monitor your credit score closely during and after the consolidation process.

Budgeting Techniques for Effective Management

To effectively manage your consolidated loans, consider creating a detailed budget that Artikels your income, expenses, and debt obligations. Allocate a specific portion of your budget towards loan repayments and prioritize paying off high-interest debts first. Additionally, consider automating your payments to avoid missing deadlines and incurring late fees.