Yo, ready to dive into the world of credit repair strategies? Get ready for some juicy tips and tricks that can help you turn your credit score around and secure that bag!

Let’s break down the basics and explore DIY methods versus professional services to help you make the best decision for your financial future.

Understanding Credit Repair

Credit repair strategies are methods used to improve an individual’s credit score by addressing negative items on their credit report. This can involve disputing inaccuracies, negotiating with creditors, or implementing responsible financial habits.

Repairing credit is essential for gaining access to better interest rates on loans, credit cards, and mortgages. A higher credit score can also lead to lower insurance premiums and increased approval chances for rental applications.

Common Reasons for Credit Repair

- Missed Payments: Late or missed payments can significantly impact credit scores, making it essential to address and rectify these issues.

- High Credit Card Balances: Utilizing a high percentage of available credit can negatively affect credit scores, so reducing balances can help improve credit health.

- Identity Theft: Victims of identity theft may find fraudulent accounts on their credit reports, requiring immediate action to repair the damage.

Impact of Credit Repair on Financial Well-being

- Improved Loan Approval Odds: A better credit score increases the likelihood of loan approval and better terms, saving money in the long run.

- Lower Interest Rates: With a higher credit score, individuals can qualify for lower interest rates, reducing the overall cost of borrowing money.

- Enhanced Financial Opportunities: A healthy credit score opens doors to better financial opportunities, such as higher credit limits and premium credit cards.

- Dispute any errors or inaccuracies with the credit bureaus.

- Set up payment reminders to ensure you pay your bills on time.

- Reduce your credit card balances to below 30% of your credit limit.

- Avoid opening new credit accounts unnecessarily.

- Regularly checking your credit report for errors and disputing them.

- Paying down debt and keeping credit card balances low.

- Making all payments on time to avoid late fees and negative marks on your credit report.

- Avoiding opening too many new credit accounts at once.

- Empowerment – You take control of your credit repair process.

- Cost-effective – You can save money by not hiring a credit repair company.

- Time-consuming – It can take time and effort to see results.

- Complexity – Understanding credit repair laws and processes can be challenging.

- Professional Services:

- Expertise: Credit repair companies have knowledge and experience in dealing with credit bureaus and creditors.

- Time-saving: They handle the process for you, saving you time and effort.

- Legal knowledge: They understand consumer rights and can navigate complex credit laws.

- DIY Approaches:

- Cost-effective: Doing it yourself can save you money on service fees.

- Personal control: You have more control over the process and can monitor progress closely.

- Educational: Learning about credit repair can empower you to manage your finances better in the long run.

- Expertise: Professionals know the ins and outs of credit repair and can navigate the process effectively.

- Time-saving: They handle all the paperwork and negotiations on your behalf, saving you time and hassle.

- Legal protection: They understand consumer rights and can ensure that your credit repair is done within legal boundaries.

- Upfront fees: Beware of companies that require payment before any services are rendered.

- Guarantees: Be cautious of companies that promise a specific outcome or timeline for credit repair.

- Lack of transparency: Ensure that the company provides clear information about their services and pricing.

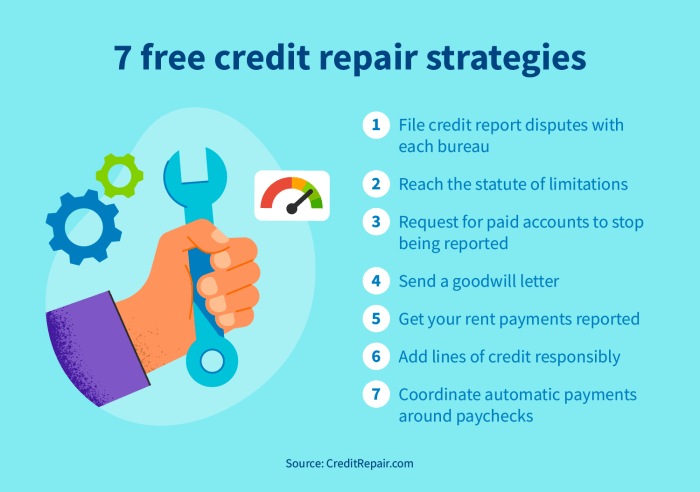

DIY Credit Repair Strategies

To improve your credit score on your own, you need a solid plan and some know-how. DIY credit repair strategies can be effective if done correctly, but they also come with their own set of challenges. Here, we’ll break down the steps for creating a personalized credit repair plan and discuss common methods to boost your credit score.

Creating a Personalized Credit Repair Plan

When creating a personalized credit repair plan, it’s essential to start by getting a copy of your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion. Review each report carefully to identify any errors or inaccuracies that could be dragging down your score. From there, you can take the following steps:

Common DIY Methods for Improving Credit Scores

There are several common methods you can use to improve your credit score on your own. These include:

Pros and Cons of Using DIY Credit Repair Strategies

Using DIY credit repair strategies has its advantages and disadvantages. Some pros include:

However, there are also cons to consider, such as:

Professional Credit Repair Services

When it comes to fixing your credit, you might be torn between going the DIY route or hiring a professional credit repair service. Let’s break down the pros and cons of each to help you make an informed decision.

Comparing Professional Services with DIY Approaches

Benefits of Hiring a Professional Credit Repair Company

Red Flags to Watch Out for When Choosing a Credit Repair Service

Effective Credit Repair Techniques

To improve your credit score and repair your credit history, several techniques can be utilized. These techniques include debt validation, goodwill letters, and credit monitoring. By understanding and implementing these strategies effectively, individuals can work towards achieving a better credit profile.

Debt Validation

Debt validation is a process where individuals request verification of a debt from the creditor. This technique can help identify any inaccuracies or errors in the debt information, which can potentially lead to the removal of negative items from the credit report. Successful debt validation stories have shown significant improvements in credit scores as a result of correcting erroneous debt information.

Goodwill Letters

Goodwill letters are written to creditors or collection agencies to request the removal of negative items from a credit report as a gesture of goodwill. These letters can be effective in situations where the negative information is accurate but the individual has a valid reason for requesting its removal. Successful goodwill letter stories showcase how a sincere and well-crafted letter can lead to positive outcomes in credit repair.

Credit Monitoring

Credit monitoring involves keeping a close eye on one’s credit report and score to identify any changes or discrepancies. By regularly monitoring their credit, individuals can quickly address any issues that may arise and take proactive steps to improve their credit health. This technique is crucial in maintaining a good credit standing and preventing potential credit problems in the future.