Yo, when it comes to securing that cash flow, the choice between secured vs unsecured loans can be a game-changer. Get ready to dive into the world of loans with this lit overview that’s gonna blow your mind!

In the world of finance, knowing the difference between secured and unsecured loans is key. Let’s break it down for you.

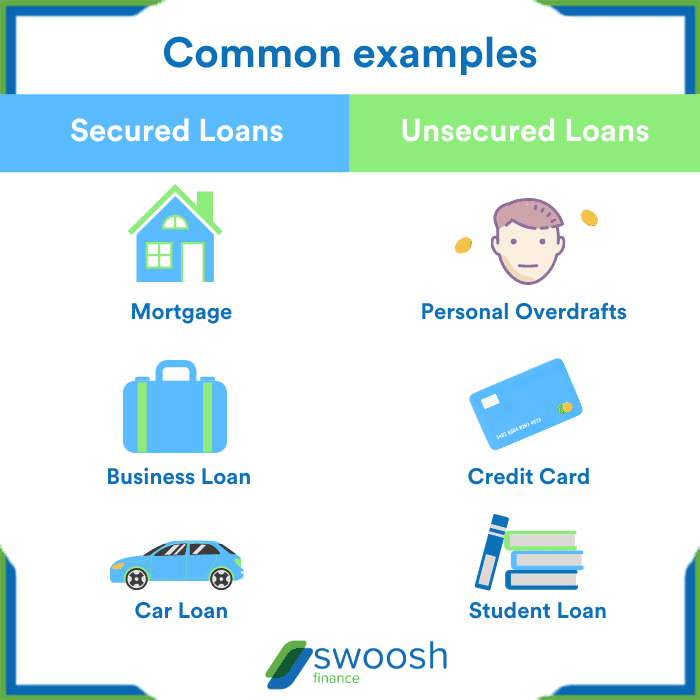

Secured Loans

Secured loans are loans that are backed by collateral, which is an asset that the borrower owns. This collateral acts as a form of security for the lender in case the borrower defaults on the loan.

Types of Collateral

- Real Estate: Properties like homes, land, or commercial buildings can be used as collateral for secured loans.

- Automobiles: Cars, trucks, or other vehicles can be used to secure a loan.

- Savings Accounts: Some lenders allow borrowers to use their savings accounts as collateral.

- Jewelry: Valuable jewelry pieces can also be used to secure a loan.

Advantages and Disadvantages

- Advantages:

- Lower interest rates compared to unsecured loans.

- Easier approval process due to the presence of collateral.

- Potential for higher loan amounts.

- Disadvantages:

- Risk of losing the collateral if unable to repay the loan.

- Longer application process due to valuation of the collateral.

- Limited flexibility in terms of loan repayment options.

Financial Institutions Offering Secured Loans

- Wells Fargo: Known for offering secured personal loans with competitive rates.

- Bank of America: Provides secured loans for various purposes with flexible repayment terms.

- Chase Bank: Offers secured loans for both personal and business needs.

Unsecured Loans

Unsecured loans are loans that are not backed by collateral, unlike secured loans which require assets like a house or car to secure the loan. This means that if a borrower defaults on an unsecured loan, the lender cannot automatically seize their assets.

When approving unsecured loans, lenders consider factors such as the borrower’s credit score, income level, employment history, and debt-to-income ratio. These criteria help lenders assess the borrower’s ability to repay the loan without the need for collateral.

Risks of Unsecured Loans

Unsecured loans pose risks for both borrowers and lenders. For borrowers, the main risk is the higher interest rates compared to secured loans due to the lack of collateral. Additionally, failure to repay an unsecured loan can negatively impact the borrower’s credit score and lead to debt collection efforts.

Lenders face the risk of not being able to recover their funds if the borrower defaults on an unsecured loan since there is no collateral to seize. This is why lenders typically have stricter approval requirements for unsecured loans compared to secured loans.

Popular Unsecured Loan Products

Some popular unsecured loan products in the market include:

- Personal Loans: Offered by banks and online lenders, personal loans can be used for various purposes such as debt consolidation, home improvements, or unexpected expenses.

- Credit Cards: A form of revolving credit that allows borrowers to make purchases up to a certain credit limit. Credit cards typically have higher interest rates compared to other unsecured loans.

- Student Loans: Designed specifically for educational expenses, student loans do not require collateral and offer flexible repayment options.

Comparison

When comparing secured and unsecured loans, it’s crucial to look at various factors such as interest rates, collateral impact, eligibility requirements, and real-life scenarios.

Interest Rates

Interest rates for secured loans are typically lower than unsecured loans because they are backed by collateral, which reduces the risk for lenders. On the other hand, unsecured loans have higher interest rates since there is no collateral involved, making them riskier for lenders.

Impact of Collateral

Collateral plays a significant role in loan terms and conditions. For secured loans, the collateral provided by the borrower can lead to lower interest rates, higher loan amounts, and longer repayment periods. In contrast, unsecured loans do not require collateral, but they often come with stricter eligibility criteria and higher interest rates.

Eligibility Requirements

Secured loans are more accessible to borrowers with lower credit scores or those with limited credit history since the collateral reduces the lender’s risk. On the other hand, unsecured loans are typically reserved for borrowers with good credit scores and a stable income to demonstrate their ability to repay the loan.

Beneficial Scenarios

In real-life scenarios, choosing a secured loan over an unsecured loan can be beneficial when a borrower needs a large loan amount at a lower interest rate. For example, a homeowner looking to renovate their house may opt for a secured home equity loan to access a significant sum of money at a favorable interest rate. On the other hand, an individual looking for a smaller loan amount for a short-term need may opt for an unsecured personal loan to avoid the hassle of providing collateral.

Considerations

When deciding between secured and unsecured loans, there are several factors to consider that can impact your financial situation. Understanding the differences between the two types of loans can help you make an informed decision that aligns with your needs and goals.

Factors to Consider

- Collateral: Secured loans require collateral, such as your home or car, to secure the loan. Unsecured loans do not require collateral but may come with higher interest rates.

- Interest Rates: Secured loans typically have lower interest rates due to the collateral provided, while unsecured loans may have higher rates to offset the risk to the lender.

- Credit Score: Your credit score plays a significant role in the approval process for both types of loans. A higher credit score can lead to better terms and lower interest rates.

- Loan Amount: Secured loans generally allow for larger loan amounts compared to unsecured loans, which may have stricter limits.

Applying for a Loan

- Secured Loan: When applying for a secured loan, you will need to provide documentation related to the collateral, such as property deeds or vehicle titles. The lender will assess the value of the collateral to determine the loan amount and terms.

- Unsecured Loan: To apply for an unsecured loan, you will need to provide proof of income, employment status, and a good credit score. The lender will evaluate your financial stability and creditworthiness to approve the loan.

Managing Repayments

- Set a Budget: Create a budget that includes your loan repayments to ensure you can afford to make timely payments each month.

- Avoid Late Payments: Missing payments can lead to penalties, additional fees, and damage to your credit score. Set up automatic payments or reminders to stay on track.

- Communicate with Lender: If you encounter financial difficulties, contact your lender to discuss alternative payment arrangements or options to avoid defaulting on the loan.

Economic Impact

- Economic conditions, such as interest rate fluctuations and market instability, can affect the availability of both secured and unsecured loans. During economic downturns, lenders may tighten lending criteria, making it harder to qualify for a loan.

- Unemployment rates and inflation can also impact loan availability and interest rates, as lenders adjust their risk assessments based on the economic environment.