Yo, so loan interest calculation is like a puzzle waiting to be solved, right? It’s all about diving into the world of numbers and seeing how they dance together to determine how much you gotta pay back. Get ready to unravel this financial enigma with me!

Now, let’s break it down piece by piece to understand the ins and outs of loan interest calculation.

Loan Interest Calculation Methods

When it comes to calculating loan interest, there are various methods that lenders use to determine how much interest you’ll pay over the life of the loan. Let’s dive into some of the most common methods and see how they work.

Simple Interest Method

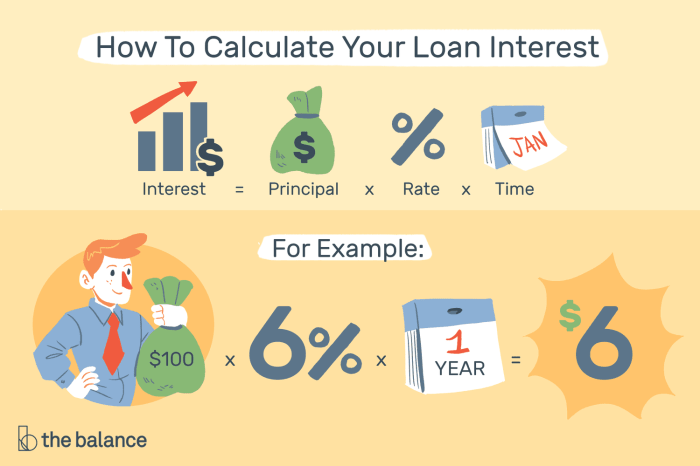

The simple interest method is the most straightforward way to calculate interest on a loan. The formula for simple interest is:

Simple Interest = Principal x Rate x Time

For example, if you borrow $1,000 at an interest rate of 5% for one year, the calculation would be:

Simple Interest = $1,000 x 0.05 x 1 = $50

This means you would pay $50 in interest for that year.

Compound Interest Method

Unlike simple interest, compound interest takes into account the accumulated interest in addition to the principal amount. The formula for compound interest is:

Compound Interest = P(1 + r/n)^(nt) – P

Where:

P = Principal amount

r = Annual interest rate

n = Number of times interest is compounded per year

t = Number of years

For example, if you borrow $1,000 at an interest rate of 5% compounded annually for one year, the calculation would be:

Compound Interest = $1,000(1 + 0.05/1)^(1*1) – $1,000 = $50

This means you would pay $50 in interest for that year, similar to the simple interest calculation.

Amortization Method

The amortization method involves calculating a fixed payment amount that includes both principal and interest. With each payment, a portion goes towards reducing the principal balance and the rest goes towards paying interest. Over time, the proportion of each changes as the principal balance decreases. This method is commonly used for mortgages and car loans.

Comparison of Methods

– The simple interest method is easy to understand and calculate, but it may not be the most accurate for longer-term loans.

– The compound interest method takes into account the effect of compounding on the overall interest paid, making it more precise for longer-term loans.

– The amortization method ensures that both principal and interest are paid off over a fixed period, making it ideal for installment loans like mortgages.

Factors Affecting Loan Interest

When it comes to calculating loan interest, there are several key factors that can influence the final amount you’ll have to pay. Understanding these factors is essential in managing your finances effectively and making informed decisions.

Credit Score

Your credit score plays a significant role in determining the interest rate you’ll be charged on a loan. A higher credit score typically translates to a lower interest rate, as it indicates to lenders that you are a low-risk borrower. On the other hand, a lower credit score may result in a higher interest rate, as lenders see you as a higher risk. For example, someone with an excellent credit score of 800 may qualify for a 3% interest rate on a loan, while someone with a fair credit score of 650 may be offered a 6% interest rate for the same loan amount.

Loan Term

The length of your loan term can also impact the amount of interest you’ll pay over time. Shorter loan terms typically come with lower interest rates but higher monthly payments, while longer loan terms may have higher interest rates but lower monthly payments. Let’s say you’re taking out a $10,000 loan with a 5% interest rate. A 3-year term may result in total interest payments of $1,322, while a 5-year term could lead to total interest payments of $2,202.

Type of Loan

The type of loan you choose can also affect the interest rate you’ll be charged. For example, secured loans, like mortgages or car loans, often have lower interest rates compared to unsecured loans, like personal loans or credit cards. This is because secured loans are backed by collateral, reducing the risk for lenders. In contrast, unsecured loans don’t require collateral, making them riskier for lenders and leading to higher interest rates.

Economic Conditions

Economic conditions, such as inflation rates and the overall state of the economy, can impact interest rates as well. During times of high inflation, interest rates tend to rise to combat the decrease in purchasing power of the currency. On the other hand, during economic downturns, central banks may lower interest rates to stimulate borrowing and spending. These fluctuations in interest rates can directly affect the cost of borrowing for consumers.

Understanding Compound Interest

Compound interest is like when you stack interest on top of interest, so you end up paying interest on the interest you already owe. It’s like interest-ception, dude.

When it comes to loans, compound interest can really mess with your total amount repaid. The more frequently interest is compounded, the more you end up owing in the long run. It’s like a snowball effect, bro.

How Compound Interest Works

Compound interest is a sneaky little thing that can really add up over time. Here’s a breakdown of how it works when applied to loans:

- When you take out a loan, the initial amount you borrow is called the principal.

- Interest is calculated on the principal amount, but with compound interest, it’s also calculated on any interest that has already been added to the principal.

- As time goes on, the amount of interest you owe grows because it’s being added to the principal and then more interest is calculated on that new total.

- So, the longer you take to pay off the loan, the more compound interest keeps piling up, making your total repayment amount higher than you originally borrowed.

Importance of Loan Terms

When taking out a loan, the terms of the loan play a crucial role in determining the total amount of interest you will pay. The loan term refers to the length of time you have to repay the loan along with interest. Understanding the impact of loan terms on interest calculation is essential for making informed financial decisions.

Impact of Loan Term Length

- Shorter Loan Term: A shorter loan term typically means higher monthly payments, but lower total interest paid over the life of the loan. This is because you are paying off the principal balance faster, reducing the amount of time that interest can accrue.

- Longer Loan Term: On the other hand, a longer loan term results in lower monthly payments but higher total interest paid. This is due to the extended period over which interest can accumulate on the outstanding balance.

Understanding how loan terms impact interest payments can help borrowers choose the most suitable repayment schedule based on their financial situation.