Yo, peeps! So, we’re diving into the world of debt repayment strategies – something that’s crucial for all of us to understand. Get ready for some lit info that’ll help you tackle your debts like a boss!

Now, let’s break it down and see what these strategies are all about.

Debt Repayment Strategies

To understand debt repayment strategies, it’s important to know that they are specific plans or methods used to pay off debts in a structured and efficient way. These strategies help individuals manage their debt effectively and work towards becoming debt-free.

Types of Debt Repayment Strategies

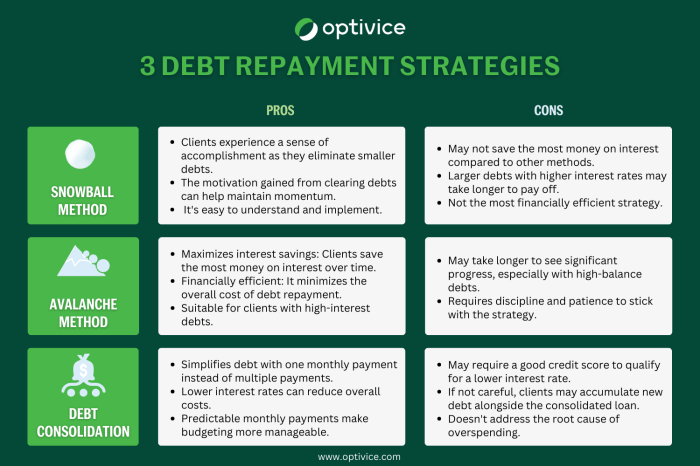

- Snowball Method: This strategy involves paying off the smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, the amount is rolled over to the next smallest debt, creating a snowball effect.

- Avalanche Method: With this strategy, you focus on paying off debts with the highest interest rates first. By tackling high-interest debts, you can save money on interest payments in the long run.

- Debt Consolidation: This strategy involves combining multiple debts into a single loan with a lower interest rate. This can simplify payments and potentially reduce overall interest costs.

Benefits of Following a Structured Debt Repayment Plan

- Clear Path to Debt Freedom: Having a structured plan helps you stay organized and motivated to pay off your debts.

- Reduced Stress: By knowing exactly how you will tackle your debts, you can alleviate stress and anxiety associated with financial obligations.

- Save Money: By choosing the right repayment strategy, you can minimize the amount of interest you pay over time, saving you money in the long term.

Snowball Method

The snowball method is a debt repayment strategy where you focus on paying off your smallest debts first while making minimum payments on all other debts. Once the smallest debt is paid off, you roll that payment into the next smallest debt, creating a snowball effect and accelerating your debt payoff.

Comparison with Other Strategies

Unlike the avalanche method where you pay off debts with the highest interest rates first, the snowball method prioritizes debts based on balance size. While the avalanche method may save you more money in the long run, the snowball method provides quick wins by eliminating smaller debts first.

Implementation Examples

- List all your debts from smallest to largest.

- Make minimum payments on all debts except the smallest one.

- Allocate any extra money towards the smallest debt until it is paid off.

- Once the smallest debt is cleared, move on to the next smallest debt, adding the previous payment amount to it.

- Repeat the process until all debts are paid off.

Psychological Impact

The snowball method can have a positive psychological impact on debtors by providing a sense of accomplishment and motivation. Seeing smaller debts disappear quickly can boost morale and keep debtors motivated to continue tackling larger debts.

Avalanche Method

The Avalanche Method is another popular strategy for paying off debt, similar to the Snowball Method but with a key difference in approach. With the Avalanche Method, you focus on paying off the debt with the highest interest rate first, then move on to the next highest, and so on. This method can potentially save you money on interest in the long run compared to the Snowball Method.

How to Use the Avalanche Method

To use the Avalanche Method for debt repayment, follow these steps:

- List out all your debts from the one with the highest interest rate to the one with the lowest interest rate.

- Make minimum payments on all debts except the one with the highest interest rate.

- Allocate any extra funds you have towards paying off the debt with the highest interest rate while still making minimum payments on the others.

- Once the debt with the highest interest rate is paid off, move on to the next highest interest rate debt and repeat the process.

- Continue this cycle until all your debts are paid off.

Real-life Success Stories

One success story comes from Sarah, who used the Avalanche Method to pay off her credit card debt. By focusing on the high-interest debt first, she was able to save money on interest and pay off her debt faster than she initially thought possible. Sarah’s dedication to the method helped her achieve financial freedom sooner than expected.

Mathematical Advantages of the Avalanche Method

The Avalanche Method can be more cost-effective in the long run compared to the Snowball Method because you tackle high-interest debt first, saving you money on interest payments over time.

By prioritizing debts based on interest rates rather than balances, the Avalanche Method can help you reduce the total amount of interest you pay, ultimately leading to faster debt repayment and greater savings in the long term.

Debt Consolidation

Debt consolidation is a strategy where you combine multiple debts into a single loan or payment, usually with a lower interest rate. This can make it easier to manage your debts and potentially save you money in the long run.

Pros and Cons of Debt Consolidation

- Pros:

- Lower interest rates: By consolidating your debts, you may qualify for a lower interest rate, saving you money over time.

- Simplified payments: Instead of juggling multiple payments, you only have to worry about one, making it easier to stay organized.

- Potential credit score boost: Paying off multiple debts with a consolidation loan can improve your credit score.

- Cons:

- Longer repayment period: Extending your repayment term may mean paying more in interest over time.

- Requires discipline: Consolidating debt does not eliminate it, so you must avoid taking on new debts to truly benefit.

- Potential fees: Some consolidation options come with fees or costs that could offset any savings.

Process of Debt Consolidation and Pitfalls to Avoid

The process typically involves taking out a new loan to pay off existing debts, then making one monthly payment towards the new loan. It’s important to avoid taking on new debts or missing payments to ensure success.

Choosing the Right Debt Consolidation Option

- Research different lenders: Compare interest rates, fees, and terms to find the best option for your financial situation.

- Consider your credit score: Some consolidation options may require a good credit score, so be sure to check your eligibility.

- Read the fine print: Understand all the terms and conditions of the consolidation loan to avoid any surprises down the road.