So, you wanna know about managing revolving credit, huh? Buckle up and get ready to dive into the world of credit limits, timely payments, and handling those credit card balances like a pro. We’re about to break it down for you in a way that’s gonna make your financial game strong.

Alright, let’s jump right in and explore the ins and outs of managing revolving credit like a boss.

Understanding Revolving Credit

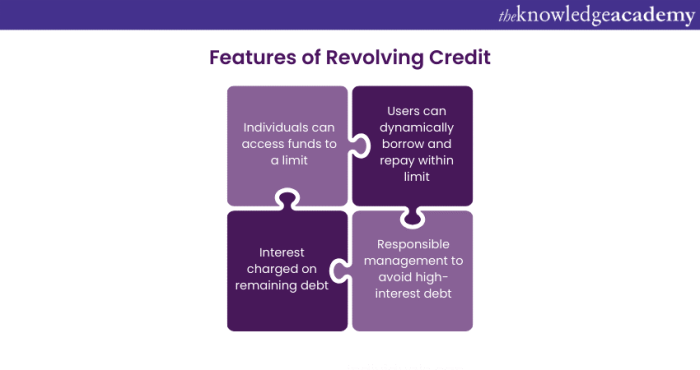

Revolving credit is a type of credit that allows you to borrow money up to a certain limit and repay it on a flexible schedule. Unlike installment loans, where you borrow a fixed amount and repay it in regular installments, revolving credit gives you the freedom to borrow, repay, and borrow again as needed.

Examples of Common Revolving Credit Accounts

- Credit cards: One of the most common forms of revolving credit, allowing you to make purchases up to your credit limit and pay off the balance over time.

- Home equity lines of credit (HELOC): A revolving line of credit that is secured by the equity in your home, giving you access to funds for various expenses.

- Personal lines of credit: Similar to credit cards, but with lower interest rates and more flexible repayment terms, providing quick access to funds when needed.

Benefits and Drawbacks of Using Revolving Credit

- Benefits:

- Flexibility: You can borrow and repay as needed, providing a safety net for unexpected expenses.

- Convenience: Access to funds when needed without applying for a new loan each time.

- Build credit: Responsible use of revolving credit can help improve your credit score over time.

- Drawbacks:

- High-interest rates: Revolving credit often comes with higher interest rates compared to other types of loans.

- Overspending: Easy access to credit may lead to overspending and accumulating debt that is difficult to repay.

- Credit score impact: Carrying a high balance on revolving credit accounts can negatively affect your credit score.

Managing Revolving Credit Limits

Understanding and managing credit limits is crucial when it comes to effectively managing revolving credit. Your credit limit is the maximum amount you can borrow from your credit card issuer, and staying within this limit is key to maintaining a healthy financial profile.

The Importance of Credit Limits

- Knowing your credit limit helps you avoid overspending and accumulating debt that you may struggle to repay.

- Staying within your credit limit demonstrates responsible financial behavior to lenders and can positively impact your credit score.

Strategies for Effective Utilization

- Regularly monitor your credit card balances to ensure you are not exceeding your credit limit.

- Consider setting up alerts or reminders to notify you when you are approaching your credit limit.

- Avoid maxing out your credit cards, as this can negatively impact your credit score and indicate financial instability to lenders.

The Impact of Credit Utilization on Credit Scores

- Credit utilization ratio is the percentage of your total credit limit that you are currently using. It is a significant factor in determining your credit score.

- Keeping your credit utilization below 30% is generally recommended to maintain a good credit score.

- High credit utilization can signal financial distress to lenders and may result in higher interest rates or credit denials.

Making Timely Payments

Making timely payments on your revolving credit accounts is crucial for maintaining a healthy financial profile and avoiding unnecessary fees and charges. When you miss a payment deadline, you not only incur late fees but also risk damaging your credit score, which can have long-term consequences.

Significance of Timely Payments

- Timely payments show lenders that you are responsible and can manage your finances effectively.

- It helps in building a positive credit history, which is essential for future loan approvals and lower interest rates.

- By making on-time payments, you avoid accumulating unnecessary interest charges and penalties, saving you money in the long run.

Tips for Ensuring On-Time Payments

- Set up automatic payments or reminders to ensure you never miss a due date.

- Create a budget and prioritize your credit card payments to make sure you have enough funds available.

- Consider setting up payment alerts on your phone or email to stay on top of your payment schedule.

Impact of Late Payments on Credit Scores

- Late payments can significantly lower your credit score, making it harder to qualify for loans or credit cards in the future.

- Repeated late payments can stay on your credit report for up to seven years, affecting your financial reputation.

- Your credit utilization ratio may increase, leading to a higher risk perception by lenders and potentially higher interest rates.

Monitoring Credit Utilization

Monitoring your credit utilization is crucial when managing revolving credit. This ratio refers to the amount of credit you are using compared to the total credit available to you. It plays a significant role in determining your creditworthiness and overall financial health.

Understanding Credit Utilization Ratio

Credit utilization ratio is calculated by dividing the total amount of credit you are currently using by the total credit limit available to you. For example, if you have a credit card with a $1,000 limit and you have a balance of $300, your credit utilization ratio would be 30%.

Methods for Monitoring and Controlling Credit Utilization

- Regularly check your credit card balances and credit limits to calculate your credit utilization ratio.

- Avoid maxing out your credit cards and try to keep your credit utilization below 30% to maintain a healthy ratio.

- Consider requesting a credit limit increase to decrease your credit utilization ratio, but be cautious not to increase your spending.

- Create a budget and track your spending to ensure you are not overspending and increasing your credit utilization ratio.

Impact of High Credit Utilization Ratio

A high credit utilization ratio can negatively impact your credit score and overall creditworthiness. Lenders may view high credit utilization as a sign of financial distress, leading to higher interest rates on loans or credit denials. It is essential to keep your credit utilization low to maintain a good credit standing.

Handling Credit Card Balances

Paying off credit card balances is crucial to avoid getting into debt and damaging your credit score. Let’s explore some strategies for managing credit card balances effectively.

Snowball and Avalanche Methods for Debt Repayment

- The snowball method involves paying off the smallest debt first while making minimum payments on larger debts. Once the smallest debt is cleared, you move on to the next smallest debt, creating momentum like a snowball rolling downhill.

- The avalanche method focuses on paying off debts with the highest interest rates first while continuing to make minimum payments on other debts. This method can save you money on interest in the long run.

- Choose the method that works best for you based on your financial situation and goals.

Managing Multiple Credit Card Balances Efficiently

- Keep track of due dates for each credit card to avoid late payments and penalties.

- Consider consolidating balances onto a single credit card with a lower interest rate or a balance transfer offer.

- Create a budget and prioritize paying off high-interest debts first to save money in the long term.

- Avoid using credit cards for unnecessary purchases to prevent accumulating more debt.