Alright, buckle up and get ready to dive into the world of refinancing auto loans. We’re about to break it down for you in a way that’s easy to understand and totally rad.

So, imagine you’re cruising down the highway in your sweet ride, but you’re looking for ways to save some cash. That’s where refinancing your auto loan comes in.

Introduction to Refinancing Auto Loans

Refinancing auto loans is like giving your car loan a makeover. It involves taking out a new loan to pay off your existing car loan, usually with better terms.

When you refinance your auto loan, you may be able to lower your monthly payments, reduce your interest rate, or even shorten the length of your loan.

Benefits of Refinancing Auto Loans

- Lower Monthly Payments: Refinancing can help you secure a lower monthly payment, giving you more breathing room in your budget.

- Reduced Interest Rates: By refinancing at a lower interest rate, you can save money over the life of the loan.

- Shorter Loan Term: Refinancing to a shorter loan term can help you pay off your car faster and save on interest.

- Improved Credit Score: Making timely payments on your refinanced loan can help boost your credit score over time.

Reasons to Consider Refinancing Auto Loans

- Interest Rates Have Dropped: If interest rates have decreased since you first took out your car loan, refinancing could save you money.

- Improved Credit Score: If your credit score has improved since getting your original loan, you may qualify for a better interest rate when refinancing.

- Change in Financial Situation: If your financial situation has improved, you may be able to qualify for better loan terms when refinancing.

- Need to Lower Payments: If you’re struggling to make your current car payments, refinancing could help lower your monthly expenses.

How Refinancing Auto Loans Works

When it comes to refinancing auto loans, the process involves taking out a new loan to pay off your existing auto loan. This new loan usually comes with better terms such as a lower interest rate or lower monthly payments. It can help you save money in the long run and even improve your credit score if managed properly.

Refinancing Process

- Apply for a new loan: Start by applying for a new loan with a better interest rate.

- Pay off existing loan: Once approved, use the new loan to pay off your existing auto loan.

- Enjoy better terms: With the new loan in place, you can benefit from lower interest rates and potentially lower monthly payments.

Key Factors to Consider

- Credit score: A higher credit score can help you qualify for better interest rates when refinancing.

- Loan term: Consider the length of the new loan term and how it will impact your monthly payments.

- Fees and penalties: Be aware of any fees or penalties associated with refinancing your auto loan.

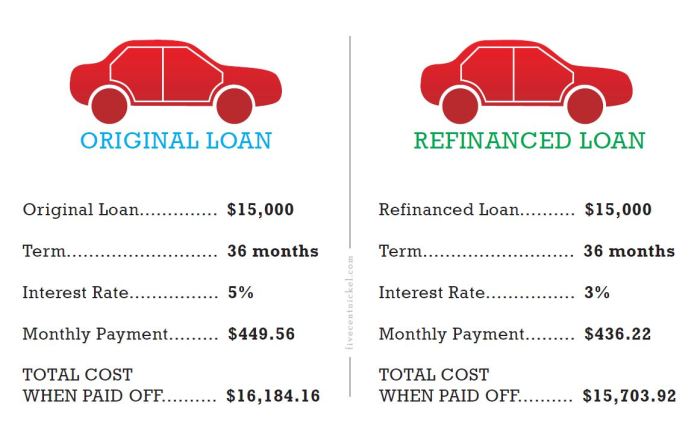

Interest Rate Comparison

Before refinancing, it’s important to compare the interest rates offered by different lenders. Look for a lower interest rate than what you currently have to ensure that refinancing will actually save you money in the long run.

Pros and Cons of Refinancing Auto Loans

When considering refinancing auto loans, there are several advantages and disadvantages to keep in mind. Let’s take a closer look at the pros and cons.

Advantages of Refinancing Auto Loans

- Lower Interest Rates: Refinancing can help you secure a lower interest rate, which can save you money over the life of the loan.

- Lower Monthly Payments: By extending the loan term, you may be able to reduce your monthly payments, providing more breathing room in your budget.

- Improved Credit Score: Making timely payments on a refinanced loan can positively impact your credit score, leading to better financial opportunities in the future.

- Opportunity to Change Lenders: Refinancing gives you the chance to switch to a different lender who may offer better customer service or more favorable terms.

Potential Drawbacks of Refinancing Auto Loans

- Extended Loan Term: While lower monthly payments can be appealing, extending the loan term through refinancing means you’ll pay more in interest over time.

- Fees and Closing Costs: Refinancing typically involves fees and closing costs, which can offset the savings from a lower interest rate.

- Negative Equity: If you owe more on your car than it’s worth, refinancing may not be a viable option as lenders may not approve the loan.

- Impact on Credit Score: Applying for multiple refinancing options within a short period can temporarily lower your credit score.

When Refinancing Might Not Be a Good Idea

- If You’re Close to Paying Off the Loan: Refinancing towards the end of your loan may not provide significant savings and could extend your debt unnecessarily.

- When the Current Loan Terms are Favorable: If your current loan already has a low interest rate and manageable payments, refinancing may not offer substantial benefits.

- Financial Instability: If your financial situation is unstable or you anticipate a change in income, refinancing could increase the risk of defaulting on the loan.

Tips for Refinancing Auto Loans

When it comes to refinancing your auto loan, there are a few key tips to keep in mind to ensure you get the best deal possible and make the most of your financial situation.

Getting the Best Refinancing Deal

- Shop around and compare offers from different lenders to find the most competitive rates and terms.

- Consider local credit unions or online lenders in addition to traditional banks for potentially better deals.

- Be aware of any fees associated with refinancing and factor them into your decision-making process.

- Look for lenders that offer flexible repayment options and consider your financial goals when choosing a new loan term.

Impact of Credit Scores

- Your credit score plays a significant role in determining the interest rate you qualify for when refinancing.

- Improve your credit score before applying for refinancing to secure a lower interest rate and better terms.

- Monitor your credit report for errors and work on resolving any issues that could be negatively impacting your score.

- Consider a cosigner with a strong credit history to help you secure a better refinancing deal.

Importance of Timing

- Timing is crucial when refinancing auto loans as interest rates can fluctuate frequently.

- Monitor market trends and interest rate movements to identify the best time to refinance your auto loan.

- Consider refinancing when you have improved your credit score or when you are in a better financial position to qualify for lower rates.

- Avoid refinancing too soon after taking out your original auto loan, as this could result in minimal savings or even higher costs in the long run.

Refinancing Auto Loans and Credit Score

When it comes to refinancing auto loans, your credit score plays a crucial role in determining the terms and rates you may qualify for. Here’s how refinancing can impact your credit score and some tips on how to maintain or improve it during the process.

Impact of Refinancing on Credit Score

Refinancing your auto loan can have both positive and negative effects on your credit score. When you apply for a new loan, it results in a hard inquiry on your credit report, which may cause a temporary dip in your score. However, if you make timely payments on your new loan, it can help improve your credit over time by showing responsible borrowing behavior.

Maintaining or Improving Credit Score During Refinancing

– Make sure to continue making on-time payments on your current loan until the refinancing process is complete.

– Avoid opening new lines of credit or taking on additional debt during the refinancing process.

– Monitor your credit report regularly to check for any errors or discrepancies that could negatively impact your score.

– Consider paying off any outstanding debts or credit card balances to lower your credit utilization ratio, which can positively impact your score.

Credit Score’s Impact on Refinancing Terms and Rates

Your credit score is one of the key factors that lenders consider when determining the terms and rates of your refinanced auto loan. A higher credit score typically translates to lower interest rates and better loan terms, while a lower credit score may result in higher rates or less favorable terms. It’s important to strive for a good credit score before refinancing to ensure you receive the best possible deal.