Yo, peeps! So, you’re diving into the world of finances and wanna know all about calculating debt-to-income ratio, right? Well, buckle up ‘cause we’re about to break it down in a way that’ll make your head spin with excitement!

Now, let’s get into the nitty-gritty details of what this whole debt-to-income ratio thing is all about.

Understanding Debt-to-Income Ratio

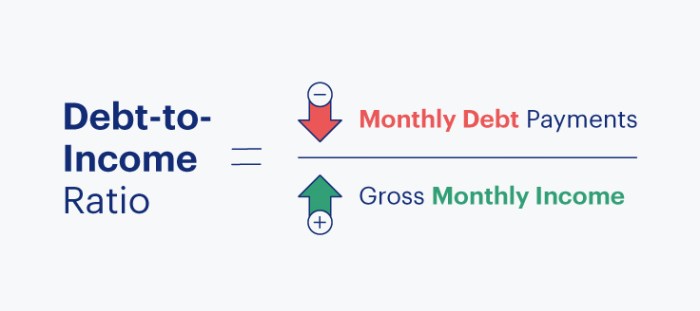

Debt-to-Income Ratio, or DTI, is a financial metric used by lenders to determine an individual’s ability to manage monthly payments and repay debts. It is calculated by dividing total monthly debt payments by gross monthly income, expressed as a percentage.

When applying for a loan, lenders use DTI to assess a borrower’s financial health and risk level. A lower DTI indicates that a borrower has more disposable income available to cover debt payments, making them less risky to lend to. On the other hand, a higher DTI suggests that a borrower may struggle to make payments, increasing the risk for the lender.

Calculating Debt-to-Income Ratio

To calculate DTI, add up all monthly debt payments, including mortgage/rent, car loans, student loans, credit card minimum payments, and other debts. Then, divide this total by gross monthly income and multiply by 100 to get the percentage.

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

For example, if someone has total monthly debt payments of $1,500 and a gross monthly income of $5,000, their DTI would be calculated as follows:

DTI = ($1,500 / $5,000) x 100 = 30%

Significance of Low vs. High DTI

A low DTI, typically below 36%, is considered favorable as it shows that a borrower has more financial flexibility and is less likely to default on payments. This can lead to better loan terms, lower interest rates, and higher chances of loan approval.

Conversely, a high DTI, above 43-50%, indicates that a significant portion of income is already committed to debt payments. This may result in higher interest rates, stricter loan terms, or even loan denial due to the perceived risk of default.

Maintaining a healthy DTI is crucial for financial stability and the ability to access credit when needed.

Calculating Debt-to-Income Ratio

To calculate your debt-to-income ratio, you need to divide your total monthly debt payments by your gross monthly income. This ratio is crucial for lenders to determine your ability to manage additional debt responsibly.

The Formula for Calculating Debt-to-Income Ratio

The formula to calculate your debt-to-income ratio is:

Debt-to-Income Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100

Step-by-Step Guide to Calculate Debt-to-Income Ratio

Here’s how you can calculate your debt-to-income ratio using actual figures:

- List all your monthly debt payments (such as credit card bills, student loans, car loans, and mortgage payments).

- Sum up all these monthly debt payments to get your total monthly debt.

- Calculate your gross monthly income (before taxes and deductions).

- Divide your total monthly debt by your gross monthly income.

- Multiply the result by 100 to get your debt-to-income ratio as a percentage.

Scenario: Calculate Debt-to-Income Ratio

Let’s say you have the following financial details:

- Total Monthly Debt Payments: $1,500

- Gross Monthly Income: $5,000

Using the formula, your debt-to-income ratio would be:

(1500 / 5000) x 100 = 30%

So, in this scenario, your debt-to-income ratio is 30%, which indicates that 30% of your gross monthly income goes towards debt payments.

Interpreting Debt-to-Income Ratio Results

When it comes to interpreting your debt-to-income ratio, different ranges can signify varying levels of financial health. Let’s break it down:

Significance of Different Debt-to-Income Ratio Ranges

- Below 20%: A debt-to-income ratio below 20% is considered excellent. It indicates that you have a good balance between your debt and income, showing that you have more income available to cover your debts.

- 20-35%: Falling within the 20-35% range is generally considered manageable. While it’s not ideal, it suggests that you are still able to handle your debt payments without too much strain on your finances.

- Over 35%: A debt-to-income ratio exceeding 35% is a red flag for lenders. It shows that a significant portion of your income is already allocated to debt payments, raising concerns about your ability to take on additional debt responsibly.

Lender’s Perspective on Debt-to-Income Ratios

Lenders view varying debt-to-income ratios as a key factor in the loan approval process. They prefer to see lower ratios as it indicates a lower risk of default on the loan. A high debt-to-income ratio may result in higher interest rates or even lead to loan denial.

Tips to Improve a High Debt-to-Income Ratio

- Increase Income: Consider taking on a part-time job or freelancing to boost your income and help lower your ratio.

- Reduce Debt: Focus on paying off high-interest debts first or consolidating your debts to make them more manageable.

- Create a Budget: Track your expenses and prioritize paying off debts to ensure you’re not accumulating more debt than you can handle.

- Avoid Taking on New Debt: Limit new credit card applications or loans to prevent further increasing your debt-to-income ratio.

Importance of Debt-to-Income Ratio in Financial Planning

Maintaining a healthy debt-to-income ratio is crucial in financial planning as it directly impacts major decisions like buying a house or car. Let’s dive into how this ratio plays a significant role in budgeting and managing personal finances.

Impact on Buying a House or Car

Your debt-to-income ratio is a key factor that lenders consider when you apply for a mortgage or car loan. If your ratio is too high, it may signal to lenders that you are already carrying too much debt and could struggle to make additional payments. On the other hand, a lower ratio demonstrates your ability to manage your debt responsibly, making you a more attractive borrower.

Role in Budgeting and Managing Personal Finances

Understanding your debt-to-income ratio can help you create a realistic budget and avoid taking on more debt than you can afford. By keeping this ratio in check, you can ensure that you have enough income to cover your existing debts while still saving for the future. It serves as a guide to help you make informed decisions about your financial health and long-term goals.

Real-life Examples of Financial Stability

For example, let’s consider two individuals with different debt-to-income ratios. Person A has a ratio of 25%, while Person B has a ratio of 40%. Person A is more likely to qualify for lower interest rates and better loan terms, enabling them to save money in the long run. On the other hand, Person B may struggle to secure favorable financing or may end up paying more in interest over time. By maintaining a healthy debt-to-income ratio, you can set yourself up for financial stability and success.