Yo, so you wanna know about credit score ranges explained, huh? Well, buckle up ‘cause we’re diving into this financial rollercoaster! Get ready for some eye-opening insights that’ll make you a credit score pro in no time.

Alright, let’s break it down and get into the nitty-gritty of credit scores, from what they are to how they affect your financial game.

Understanding Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness, which is essentially a measure of how likely they are to repay borrowed money. These scores are calculated based on various factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit accounts.

Importance of Credit Scores

Credit scores play a crucial role in determining a person’s financial health and well-being. A good credit score can open doors to better loan terms, lower interest rates, and higher credit limits. It can also impact one’s ability to secure a mortgage, car loan, or even rent an apartment. On the other hand, a poor credit score can lead to higher interest rates, limited access to credit, and even difficulty getting approved for certain services or products.

Factors Influencing Credit Scores

- Payment History: This is the most significant factor in determining credit scores. It reflects whether you have paid your bills on time and in full.

- Credit Utilization: This measures how much of your available credit you are using. Keeping this below 30% is generally recommended.

- Length of Credit History: The longer your credit history, the better. It shows lenders that you have a proven track record of managing credit responsibly.

- Types of Credit Used: Having a mix of credit types, such as credit cards, loans, and a mortgage, can positively impact your credit score.

- New Credit Accounts: Opening multiple new credit accounts in a short period can raise red flags for lenders, as it may indicate financial instability.

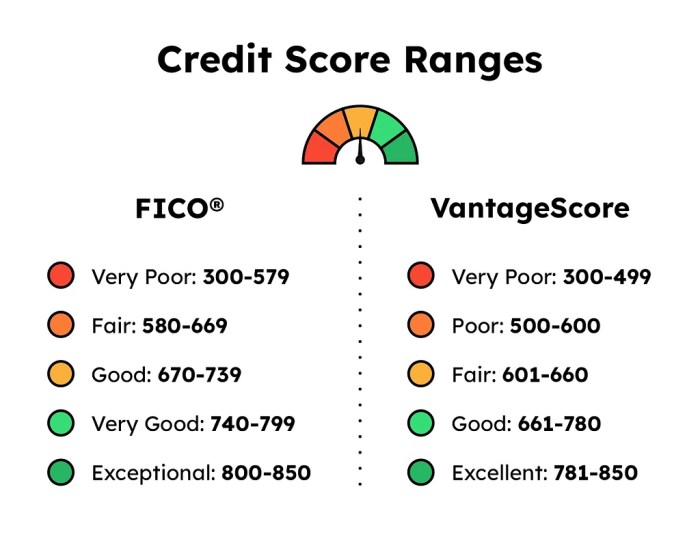

Credit Score Ranges

In the world of credit scores, there are different ranges that categorize individuals based on their creditworthiness. These categories often determine the financial opportunities available to them.

A credit score typically falls into one of the following ranges:

Poor Credit

A credit score in the poor range is usually below 580. Individuals with poor credit may have difficulty qualifying for loans, credit cards, or favorable interest rates. Lenders may see them as high-risk borrowers.

Fair Credit

Falling between 580 to 669, a fair credit score indicates some credit issues but still shows potential for improvement. Individuals in this range may qualify for loans and credit cards, but with higher interest rates.

Good Credit

A credit score of 670 to 739 is considered good. Individuals with good credit are more likely to qualify for loans and credit cards with competitive interest rates. They are viewed as less risky borrowers by lenders.

Excellent Credit

Excellent credit scores range from 740 and above. Individuals with excellent credit have access to the best financial opportunities, including low interest rates, higher credit limits, and premium credit card offers. Lenders trust them to repay debts responsibly.

Factors Affecting Credit Scores

When it comes to your credit score, there are several factors that can have a significant impact on whether it goes up or down. Understanding these factors can help you make informed decisions to improve your credit score and overall financial health.

Positive Factors for Credit Scores

- Timely Payments: Paying your bills on time shows lenders that you are responsible and can help boost your credit score.

- Low Credit Utilization: Keeping your credit card balances low compared to your credit limit can positively impact your credit score.

- Diverse Credit Mix: Having a mix of credit accounts, such as credit cards, loans, and a mortgage, can demonstrate your ability to manage different types of credit responsibly.

Negative Factors for Credit Scores

- Late Payments: Missing payments or consistently paying late can significantly lower your credit score.

- High Credit Utilization: Maxing out your credit cards or carrying high balances can negatively impact your credit score.

- Multiple Credit Applications: Applying for multiple new credit accounts within a short period can signal financial distress and lower your credit score.

Actions to Improve Credit Scores

- Check Your Credit Report Regularly: Monitoring your credit report can help you identify errors and take steps to correct them.

- Pay Down Debt: Working towards paying off your existing debt can reduce your credit utilization and improve your credit score.

- Set Up Payment Reminders: Ensuring you make payments on time by setting up reminders or automatic payments can prevent late payments from affecting your credit score.

Importance of Credit Score Ranges

Understanding credit score ranges is crucial in making informed financial decisions. Your credit score can impact your ability to secure loans, credit cards, and even rent an apartment. It provides lenders with a quick snapshot of your creditworthiness, influencing the interest rates you may receive.

Real-Life Scenarios

- When applying for a mortgage: A higher credit score can help you qualify for a lower interest rate, saving you thousands of dollars over the life of the loan.

- Getting approved for a credit card: Credit card companies often have different offers based on credit score ranges, with better rewards and perks for those with higher scores.

- Renting an apartment: Landlords may request your credit score to assess your reliability in making rent payments on time.

Effect on Loan Approvals and Interest Rates

- Excellent Credit (760-850): Borrowers in this range are likely to get approved for loans easily with the best interest rates available.

- Good Credit (700-759): While still favorable, borrowers might see slightly higher interest rates compared to those with excellent credit.

- Fair Credit (650-699): Borrowers in this range may face more scrutiny, potentially leading to higher interest rates or even loan denial.

- Poor Credit (300-649): Individuals with poor credit may struggle to get approved for loans or credit cards, and if approved, they may face very high interest rates.

Monitoring and Improving Credit Scores

Maintaining a healthy credit score is crucial for financial well-being. Here are some tips and strategies to help you monitor and improve your credit score:

Monitoring Credit Scores

- Regularly check your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion.

- Utilize free credit monitoring services like Credit Karma or Credit Sesame to keep track of changes in your credit score.

- Set up alerts for any suspicious activity or inaccuracies on your credit report.

Maintaining a Healthy Credit Score

- Pay your bills on time every month to show responsible credit behavior.

- Keep your credit card balances low and aim to use less than 30% of your available credit.

- Avoid opening multiple new credit accounts within a short period as it can lower your average account age.

Improving Credit Scores

- Focus on paying off outstanding debts and collections to reduce your overall credit utilization ratio.

- Consider becoming an authorized user on someone else’s credit card to benefit from their positive credit history.

- Be patient and consistent in your efforts to improve your credit score, as positive changes may take time to reflect.