Alright, peeps! Today, we’re diving into the world of credit card debt and how to kick it to the curb like a boss. Buckle up for some major money moves and tips that’ll have you slaying that debt game in no time.

Now, let’s break down the nitty-gritty of understanding credit card debt and the killer strategies to make it disappear faster than your latest TikTok dance video goes viral.

Understanding Credit Card Debt

Credit card debt is the money you owe to credit card companies for purchases made using your credit card. This debt accumulates when you carry a balance from month to month instead of paying it off in full. High-interest rates on credit card balances can make it challenging to pay off the debt quickly, leading to a cycle of debt accumulation.

Impact of High-Interest Rates

High-interest rates on credit card balances can significantly increase the amount you owe over time. For example, if you have a $1,000 balance on a credit card with an interest rate of 20%, you could end up paying hundreds of dollars in interest charges each year, making it harder to pay off the debt.

Common Reasons for Credit Card Debt

- Unexpected Expenses: Sudden medical bills or car repairs can force people to rely on credit cards to cover the costs.

- Lack of Emergency Savings: Without a financial safety net, individuals may turn to credit cards when faced with unexpected expenses.

- Living Beyond Means: Overspending on non-essential items can lead to accumulating credit card debt.

- Job Loss or Income Reduction: A loss of income can make it difficult to keep up with credit card payments, leading to debt accumulation.

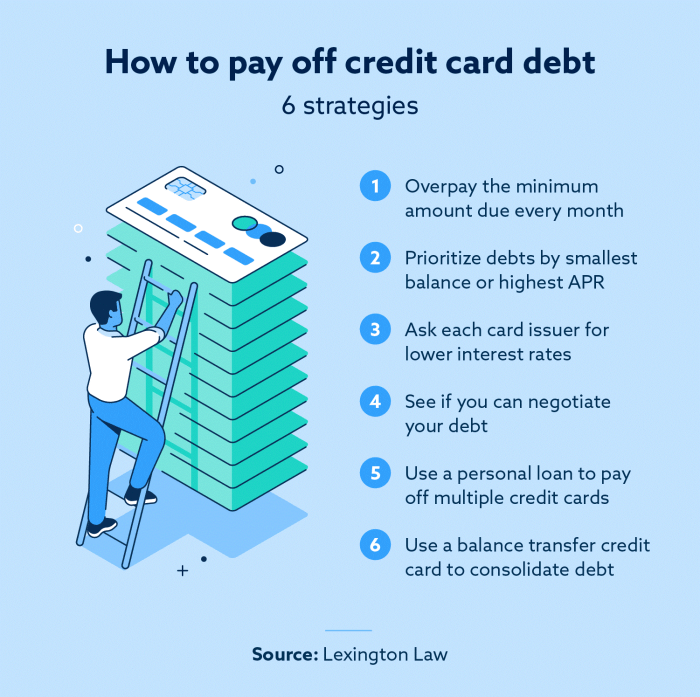

Strategies for Paying Off Credit Card Debt

Paying off credit card debt can be overwhelming, but there are effective strategies to help you tackle it and become debt-free.

Snowball Method for Paying Off Credit Card Debt

The snowball method is a debt reduction strategy where you focus on paying off your smallest debt first while making minimum payments on the other debts. Once the smallest debt is paid off, you roll that payment into the next smallest debt, creating a snowball effect that helps you pay off all your debts faster. This method can provide a psychological boost as you see debts being eliminated one by one.

Avalanche Method for Paying Off Credit Card Debt

The avalanche method involves paying off debts starting with the one that has the highest interest rate. By tackling high-interest debts first, you can save money on interest payments in the long run. This method may not provide the same immediate gratification as the snowball method, but it can save you more money overall.

Debt Consolidation vs. Debt Settlement

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage and potentially reducing your overall interest payments. On the other hand, debt settlement involves negotiating with creditors to settle debts for less than what you owe. While debt consolidation can help you pay off debts more efficiently, debt settlement can negatively impact your credit score and may result in tax consequences for the forgiven debt.

Creating a Repayment Plan

To tackle credit card debt effectively, it’s crucial to create a solid repayment plan. This plan will help you stay organized and focused on paying off your debt efficiently.

Steps to Create a Budget for Debt Repayment

- Calculate your total debt: Start by listing down all your credit card balances and interest rates to get a clear picture of what you owe.

- Assess your income and expenses: Determine how much money you have coming in each month and what your essential expenses are.

- Create a budget: Allocate a specific amount of money towards debt repayment each month while ensuring you can still cover your essential expenses.

Importance of Setting SMART Goals

Setting SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) is essential when creating a repayment plan. It helps you track your progress and stay motivated throughout the debt payoff journey.

Tips on Negotiating Lower Interest Rates

- Do your research: Understand current interest rates and credit card offers to have leverage when negotiating with your credit card company.

- Contact your credit card company: Reach out to your credit card issuer and politely ask for a lower interest rate based on your payment history and loyalty as a customer.

- Consider balance transfer options: If negotiating directly doesn’t work, explore balance transfer offers with lower interest rates to save money on finance charges.

Additional Tips for Managing Credit Card Debt

Paying off credit card debt can be challenging, but with the right strategies, you can take control of your financial situation and work towards a debt-free future.

Avoiding New Debt

- Avoid using credit cards for unnecessary purchases while paying off existing balances. Stick to a budget and prioritize paying down your debt.

- Avoid opening new credit accounts or taking on additional loans that can increase your debt burden.

- Consider using cash or debit cards for everyday expenses to prevent adding to your credit card balances.

Credit Utilization and Debt Repayment

- Keep your credit utilization ratio low by using only a small percentage of your available credit. This can positively impact your credit score and make it easier to pay off debt.

- Focus on paying off credit cards with high utilization rates or high-interest rates first to reduce overall debt faster.

- Monitor your credit score regularly to track improvements as you pay down your balances.

Benefits of Credit Counseling Services

- Seeking help from a credit counseling service can provide you with a personalized debt repayment plan and financial advice tailored to your situation.

- Credit counselors can negotiate with creditors on your behalf to lower interest rates or set up more manageable payment arrangements.

- Professional guidance can help you develop healthy financial habits and avoid falling back into debt in the future.