With Retirement savings plans at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

When it comes to securing your financial future, Retirement savings plans are the key to a smooth ride into retirement. Let’s dive into the world of smart money moves and secure your golden years with style.

Overview of Retirement Savings Plans

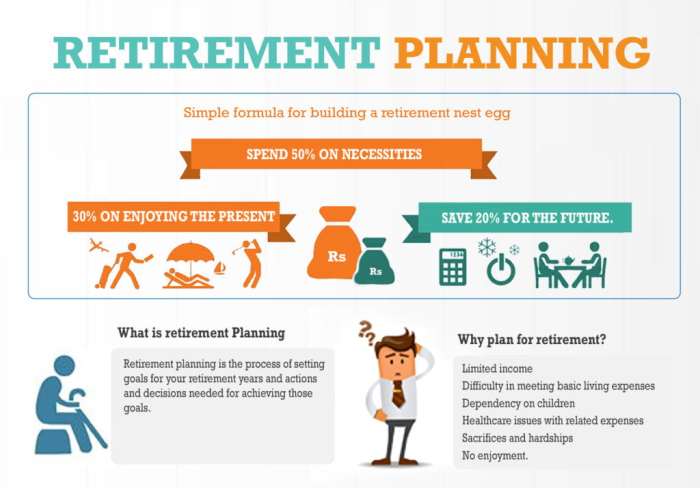

Retirement savings plans are financial tools designed to help individuals save money for their retirement years. By contributing to these plans regularly, individuals can build a nest egg to support themselves when they stop working.

Types of Retirement Savings Plans

- 401(k): A popular employer-sponsored plan that allows employees to contribute a portion of their salary to a retirement account. Some employers may also match a percentage of the employee’s contributions.

- IRA (Individual Retirement Account): A personal retirement account that individuals can open on their own. There are traditional IRAs, where contributions may be tax-deductible, and Roth IRAs, where contributions are made with after-tax dollars.

- 403(b): Similar to a 401(k) but offered to employees of non-profit organizations, schools, and certain religious organizations.

Importance of Starting Early

Starting a retirement savings plan early is crucial because it allows your money to grow over time through compounding interest. By investing early, you can take advantage of the power of compounding to maximize your savings and potentially reach your retirement goals sooner.

Benefits of Retirement Savings Plans

Saving for retirement comes with a variety of benefits, from tax advantages to increased financial security in your golden years. Let’s dive into the perks of retirement savings plans.

Tax Benefits

- Contributions to retirement savings plans like 401(k)s or IRAs are typically tax-deductible, reducing your taxable income for the year.

- Any earnings on your investments within the retirement account grow tax-deferred, allowing your money to compound faster.

- Withdrawals in retirement are taxed at a potentially lower rate, as you may be in a lower tax bracket.

Employer-Sponsored Plans

- Many employers offer retirement plans like 401(k)s with matching contributions, essentially giving you free money to boost your savings.

- Automatic payroll deductions make saving for retirement easy and convenient, ensuring you consistently contribute to your nest egg.

- Employer-sponsored plans often offer a diversified selection of investment options, allowing you to grow your savings over time.

Financial Security in Retirement

- Having a substantial retirement savings can provide peace of mind, knowing you have a financial cushion to support your lifestyle during retirement.

- Retirement plans allow you to plan for the future and create a sustainable income stream once you stop working.

- By starting early and consistently contributing to your retirement savings, you can build a nest egg that will support you throughout your retirement years.

How to Start a Retirement Savings Plan

To begin setting up a retirement savings plan, you must first assess your financial situation and set clear goals for your retirement. Here are the steps involved in starting a retirement savings plan:

Compare Different Retirement Savings Plan Options

When choosing a retirement savings plan, you have several options to consider, including 401(k) plans, IRA (Individual Retirement Account), and pension plans. Here is a comparison of these options:

- 401(k) Plans: These are employer-sponsored retirement plans where you can contribute a portion of your salary, often with an employer match. The contributions are typically deducted from your paycheck before taxes, allowing for tax-deferred growth.

- IRA (Individual Retirement Account): IRAs are individual retirement accounts that allow you to contribute a certain amount each year. There are different types of IRAs, including Traditional IRAs and Roth IRAs, each with its own tax advantages.

- Pension Plans: Pension plans are retirement plans provided by some employers where they guarantee a certain amount of income during retirement based on years of service and salary.

Tips for Choosing the Right Retirement Savings Plan

Choosing the right retirement savings plan depends on your individual financial goals and circumstances. Here are some tips to help you make the best choice:

- Evaluate your current financial situation and determine how much you can afford to contribute to a retirement plan.

- Consider your retirement goals and timeline to determine the level of risk you are willing to take with your investments.

- Compare the tax benefits of each retirement savings plan option to maximize your savings and minimize tax liabilities.

- Take into account any employer contributions or matching funds available with certain retirement plans.

- Consult with a financial advisor to get personalized advice based on your specific needs and goals.

Managing and Maximizing Retirement Savings

When it comes to managing and maximizing retirement savings, there are several key strategies to keep in mind. From maximizing contributions to diversifying your portfolio, these steps can help you build a strong financial foundation for your future.

Maximizing Contributions to Retirement Savings Plans

- Take advantage of employer matching contributions: If your employer offers a matching contribution to your retirement savings plan, make sure you contribute enough to maximize this benefit. It’s essentially free money that can significantly boost your retirement savings.

- Contribute the maximum allowed: Be sure to contribute the maximum amount allowed by your retirement savings plan each year. This can help you take full advantage of tax benefits and compound interest over time.

- Consider catch-up contributions: As you get closer to retirement age, you may be eligible to make catch-up contributions to your retirement savings plan. This can help you make up for any years where you weren’t able to save as much.

The Concept of Diversification Within Retirement Savings Portfolios

- Diversify your investments: It’s important to spread your retirement savings across different types of investments, such as stocks, bonds, and real estate. This can help reduce risk and maximize returns over the long term.

- Rebalance your portfolio regularly: Make sure to review and adjust your investment mix periodically to maintain the desired level of diversification. Rebalancing can help you stay on track with your retirement savings goals.

- Consider professional advice: If you’re unsure about how to diversify your retirement savings portfolio, consider seeking advice from a financial advisor. They can help you create a well-balanced investment strategy based on your risk tolerance and financial goals.

Adjusting Retirement Savings Plans Over Time

- Review your retirement goals: Regularly reassess your retirement savings goals and adjust your contributions accordingly. Life circumstances and financial priorities may change, so it’s important to stay flexible and adapt your savings plan as needed.

- Monitor your progress: Keep track of your retirement savings growth and make adjustments as necessary to stay on target. Consider increasing your contributions or exploring additional savings options if you’re falling behind on your goals.

- Stay informed: Stay informed about changes in retirement savings rules, tax laws, and investment options that may impact your savings plan. Being proactive and staying up-to-date can help you make informed decisions about your retirement savings strategy.