Credit Score Improvement sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Understanding the ins and outs of credit scores, factors affecting them, and strategies for improvement is key to financial success. Let’s dive in and explore how you can take charge of your credit score today!

Understanding Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness, indicating how likely they are to repay borrowed money. These scores are calculated based on various factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit accounts.

The Importance of Having a Good Credit Score

Maintaining a good credit score is crucial as it can impact your ability to secure loans, credit cards, and even determine the interest rates you are offered. A higher credit score indicates financial responsibility and can lead to better financial opportunities and lower borrowing costs.

Difference between FICO and VantageScore Credit Scoring Models, Credit Score Improvement

- FICO Score: The FICO score is the most commonly used credit scoring model in the United States. It ranges from 300 to 850 and is based on information from the three major credit bureaus – Equifax, Experian, and TransUnion.

- VantageScore: VantageScore is another credit scoring model that ranges from 300 to 850. It was created by the three major credit bureaus to provide a more consistent credit scoring system across the industry.

Factors Affecting Credit Scores

When it comes to credit scores, several key factors can have a significant impact on whether your score goes up or down. Understanding these factors is crucial for improving your creditworthiness.

Positive Factors Influencing Credit Scores

- On-time payments: Making timely payments on your credit accounts shows lenders that you are reliable and can manage your debts responsibly.

- Low credit utilization: Keeping your credit card balances low in relation to your credit limit demonstrates that you are not overly reliant on credit and can manage your debts effectively.

- Diverse credit mix: Having a mix of different types of credit, such as credit cards, loans, and a mortgage, can show that you can handle various financial responsibilities.

- Long credit history: A longer credit history can provide a more comprehensive picture of your credit behavior and stability, which can positively impact your credit score.

Impact of Late Payments and High Credit Card Balances

Late payments and high credit card balances can have a detrimental effect on your credit score. Late payments can signal to lenders that you may be struggling financially or are not responsible with your debts, leading to a decrease in your credit score. High credit card balances, especially when they are close to your credit limit, can indicate that you are heavily reliant on credit, which can also lower your credit score.

Significance of Credit Utilization Ratio

Credit utilization ratio plays a crucial role in determining your credit score. It is calculated by dividing your total credit card balances by your total credit card limits and then multiplying by 100 to get a percentage. A lower credit utilization ratio is generally better for your credit score, as it shows that you are not maxing out your credit cards and can manage your credit responsibly. Keeping your credit utilization ratio below 30% is considered ideal for improving your credit score.

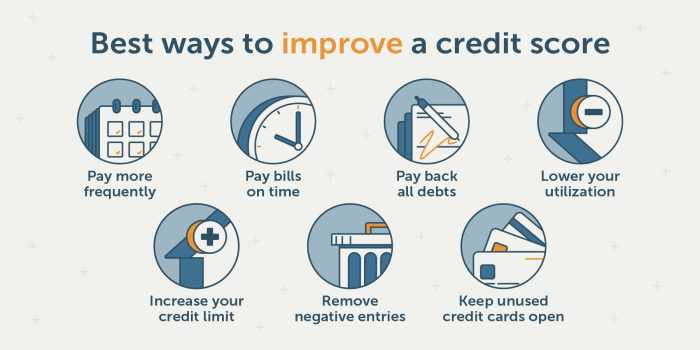

Strategies for Credit Score Improvement

Improving your credit score is crucial for financial stability and access to better borrowing opportunities. By following these strategies, you can boost your credit score and secure a healthier financial future.

Pay Bills on Time

One of the most impactful ways to improve your credit score is to pay your bills on time consistently. Late payments can significantly lower your score, so make sure to set up automatic payments or reminders to avoid missing any deadlines.

Reduce Credit Card Debt

High credit card balances can harm your credit score. To improve your score, focus on reducing your credit card debt by paying off balances and avoiding maxing out your cards. Aim to keep your credit utilization ratio below 30% to boost your score.

Monitor Credit Reports Regularly

Regularly monitoring your credit reports is essential for identifying errors or discrepancies that could be negatively impacting your score. By checking your reports regularly, you can spot inaccuracies and take steps to correct them, ultimately improving your credit score.

Building Credit History: Credit Score Improvement

Building a positive credit history is crucial for financial success. Lenders use your credit history to determine your creditworthiness when you apply for loans or credit cards. A strong credit history can help you qualify for lower interest rates and better terms on credit products.

Impact of Opening New Credit Accounts

- Opening new credit accounts can initially lower your credit score due to the hard inquiry that occurs when a lender checks your credit report.

- However, over time, responsibly managing these new accounts by making on-time payments and keeping balances low can improve your credit score.

- Having a mix of credit accounts, such as credit cards, installment loans, and a mortgage, can also positively impact your credit score.

Strategies for Managing Credit Responsibly

- Pay your bills on time every month to establish a positive payment history.

- Keep your credit card balances low relative to your credit limits to maintain a low credit utilization ratio.

- Avoid opening multiple new credit accounts within a short period to minimize the impact on your credit score.

- Regularly review your credit report for errors and dispute any inaccuracies to ensure your credit history is reported correctly.

Credit Score Monitoring Tools

Monitoring your credit score is crucial for maintaining financial health and making informed decisions. There are several popular tools and platforms available to track your credit score and improve your overall creditworthiness.

Credit Karma

- Credit Karma is a free platform that provides access to your credit scores from TransUnion and Equifax.

- Features include credit score monitoring, credit report updates, and personalized recommendations for improving your credit.

- Utilize Credit Karma’s credit score simulator to see how different financial actions can impact your credit score.

myFICO

- myFICO offers credit monitoring services and access to FICO scores, which are commonly used by lenders to assess creditworthiness.

- Features include credit score alerts, identity theft protection, and credit report monitoring.

- Use myFICO’s Score Simulator to understand how specific financial behaviors can affect your FICO score.

Credit Sesame

- Credit Sesame provides free credit monitoring services, including access to your credit score and credit report information.

- Features include credit score analysis, personalized recommendations for improving your credit, and identity theft protection.

- Utilize Credit Sesame’s credit score tracker to monitor changes in your credit score over time.