Budgeting for Entrepreneurs takes center stage as we dive into the world of financial planning for business owners. Get ready to learn how effective budgeting can transform your entrepreneurial journey!

From creating a solid business budget to allocating funds strategically, this guide will equip you with the tools and knowledge needed to thrive in the competitive business landscape.

Importance of Budgeting for Entrepreneurs

Budgeting is a critical aspect of running a successful business as an entrepreneur. It involves planning and managing finances to ensure that resources are allocated efficiently to meet business goals and objectives. Without a well-thought-out budget, entrepreneurs may face financial challenges that can hinder growth and sustainability.Effective budgeting can have a significant impact on business growth in various ways. By creating a budget, entrepreneurs can track expenses, identify potential cost savings, and allocate resources strategically to maximize profitability.

This helps in making informed decisions, setting realistic financial goals, and monitoring progress towards achieving them.One of the consequences of not having a budget in place for entrepreneurs is the risk of overspending or mismanagement of funds. Without a clear financial plan, it becomes difficult to control expenses, leading to cash flow problems, debt accumulation, and ultimately, business failure. A budget serves as a roadmap for financial success, guiding entrepreneurs in making sound financial decisions and avoiding unnecessary risks.

Creating a Business Budget

Creating a comprehensive budget for your business is crucial for its success. It involves careful planning and consideration of various factors to ensure financial stability and growth.

Steps in Creating a Business Budget, Budgeting for Entrepreneurs

- Assess Your Income: Determine your expected revenue streams and income sources.

- Identify Expenses: List all your fixed and variable costs, including overhead expenses.

- Set Financial Goals: Define your short-term and long-term financial objectives.

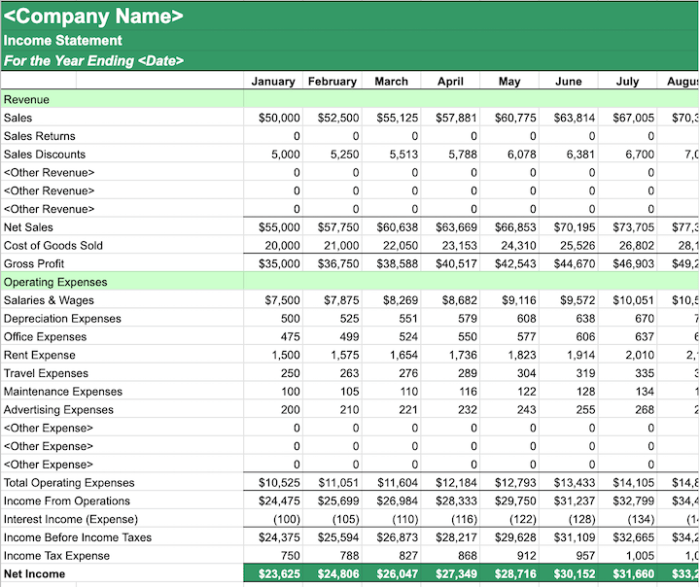

- Create a Budget Template: Use a spreadsheet or budgeting software to organize your financial data.

- Allocate Funds: Distribute your income to cover expenses, investments, and savings.

- Monitor and Adjust: Regularly review your budget, track your actual expenses, and make necessary adjustments.

Budgeting Techniques and Tools for Entrepreneurs

- Traditional Budgeting: Involves creating a detailed budget based on historical data and forecasts.

- Zero-Based Budgeting: Requires justifying every expense from scratch, starting from zero.

- Activity-Based Budgeting: Focuses on activities that drive costs and revenue in the business.

Comparison of Budgeting Methods

| Traditional Budgeting | Modern Digital Solutions |

|---|---|

| Time-consuming process | Automated and efficient |

| Relies on manual data entry | Integrates with accounting software for real-time data |

| Less flexible for adjustments | Allows for easy updates and modifications |

Allocating Funds in a Business Budget

When it comes to running a business, allocating funds in a budget is crucial for success. It involves carefully distributing resources to different aspects of the business to ensure smooth operations and growth. Prioritizing expenses and investments is key, along with having contingency funds for unexpected situations.

Prioritizing Expenses and Investments

- Start by identifying essential expenses such as rent, utilities, and employee salaries. These are crucial for the day-to-day functioning of the business.

- Allocate funds to investments that will help grow the business, such as marketing campaigns, upgrading equipment, or expanding to new markets.

- Consider the return on investment for each expense or investment to ensure they align with the business goals and financial health.

Importance of Contingency Funds and Emergency Reserves

- Set aside a portion of the budget for contingency funds to cover unexpected expenses like equipment breakdowns, sudden market changes, or economic downturns.

- Having emergency reserves can help the business weather tough times without compromising its operations or growth plans.

- Regularly review and adjust the allocation of funds in the budget to accommodate changing circumstances and ensure financial stability.

Monitoring and Adjusting Budgets: Budgeting For Entrepreneurs

Regularly monitoring a business budget is crucial for entrepreneurs to ensure financial stability and success. By keeping a close eye on expenses and revenue, entrepreneurs can identify any discrepancies or areas where adjustments may be needed to stay on track.

Importance of Regularly Monitoring a Business Budget

Monitoring a business budget allows entrepreneurs to track their financial performance and compare it against the initial budget set. This helps in identifying any overspending or underspending in different categories, enabling entrepreneurs to make informed decisions to optimize their resources.

Strategies for Tracking Financial Performance against the Budget

- Utilize accounting software to keep detailed records of expenses and revenue.

- Regularly review financial statements to compare actual performance with the budget.

- Hold monthly or quarterly budget review meetings to discuss any discrepancies and plan necessary adjustments.

- Implement key performance indicators (KPIs) to measure financial goals and track progress.

Making Adjustments to Budgets Based on Changing Circumstances

- Identify areas where overspending or underspending is occurring and reallocate funds accordingly.

- Consider external factors such as market trends or economic changes that may impact the budget and adjust accordingly.

- Be flexible and willing to make necessary changes to the budget to adapt to evolving circumstances.

- Seek input from financial advisors or experts to make informed decisions about budget adjustments.

Long-Term Budgeting Strategies

Long-term budgeting is crucial for entrepreneurs to ensure the sustainability and growth of their businesses. By implementing effective long-term budgeting strategies, entrepreneurs can make informed decisions that support their business goals and objectives.

Role of Forecasting and Projections

Forecasting and projections play a significant role in long-term budget planning for entrepreneurs. By analyzing past financial data and market trends, entrepreneurs can make educated guesses about future revenues, expenses, and cash flow. This allows them to anticipate potential challenges and opportunities, enabling better preparation and allocation of resources in the long run.

- Utilizing financial software tools to conduct accurate financial forecasting.

- Regularly reviewing and updating financial projections based on changing market conditions.

- Considering various scenarios and conducting sensitivity analysis to assess potential risks and opportunities.

Benefits of Long-Term Budgeting

Long-term budgeting helps entrepreneurs in achieving their business goals and ensuring sustainable growth over time. By setting clear financial targets and monitoring progress against them, entrepreneurs can make strategic decisions to drive their businesses forward.

Long-term budgeting allows entrepreneurs to plan for major investments, such as expansion or new product development, with confidence.

- Setting aside funds for future contingencies and emergencies, ensuring business continuity.

- Identifying areas for cost savings and efficiency improvements to maximize profitability.

- Building investor confidence by showcasing a clear financial roadmap for the business’s future.