Planning for healthcare costs in retirement sets the stage for this exciting journey, giving readers a sneak peek into the world of financial preparedness in the golden years.

As we delve into the intricacies of healthcare expenses post-retirement, a wealth of information awaits to empower individuals in making informed decisions for their future.

Understanding Healthcare Costs in Retirement

Planning for healthcare costs in retirement is crucial to ensure financial security and well-being during your golden years. Without proper planning, unexpected medical expenses can quickly deplete your retirement savings, leaving you financially vulnerable.

Common Healthcare Expenses in Retirement

- Medicare premiums and out-of-pocket costs

- Prescription drugs

- Long-term care services

- Dental and vision care

- Medical equipment and supplies

Statistics on Healthcare Costs Impacting Retirement Savings

According to a report by Fidelity, a 65-year-old couple retiring in 2021 can expect to spend an average of $300,000 on healthcare expenses throughout retirement. This staggering amount highlights the importance of saving and planning for healthcare costs in advance.

Factors Affecting Healthcare Costs in Retirement

In retirement, healthcare costs can be significantly influenced by various factors that impact expenses over time.

Inflation Impact on Healthcare Expenses

Inflation plays a crucial role in increasing healthcare expenses over time. As prices for medical services, prescription drugs, and healthcare facilities rise due to inflation, retirees may find it challenging to afford necessary healthcare services. It is essential for retirees to consider the impact of inflation on healthcare costs and plan accordingly.

Chronic Conditions and Increased Healthcare Costs

Retirees with chronic conditions may face higher healthcare costs in retirement. Managing ongoing health issues, such as diabetes, heart disease, or arthritis, often requires frequent medical visits, prescription medications, and specialized treatments. These additional expenses can significantly add to overall healthcare costs for retirees with chronic conditions.

Comparison of Healthcare Costs for Different Retirement Ages

The age at which an individual retires can have a significant impact on healthcare costs in retirement. Retiring earlier may mean a longer retirement period with potentially higher healthcare expenses over time. On the other hand, delaying retirement can allow individuals to continue receiving employer-sponsored health insurance, reducing out-of-pocket healthcare costs. It is crucial for retirees to evaluate and compare healthcare costs based on different retirement ages to make informed decisions about their financial planning.

Strategies for Managing Healthcare Costs

In retirement, managing healthcare costs is crucial to ensure financial stability and peace of mind. By implementing effective strategies, you can better estimate expenses, leverage insurance options, and prioritize preventive care to reduce overall healthcare costs.

Estimating Future Healthcare Expenses

Estimating future healthcare expenses in retirement can be challenging but essential for financial planning. Consider factors such as current health status, family medical history, and potential healthcare needs based on age and lifestyle. Utilize online calculators, consult with financial advisors, and review historical medical expenses to create a realistic estimate.

Role of Insurance in Managing Healthcare Costs

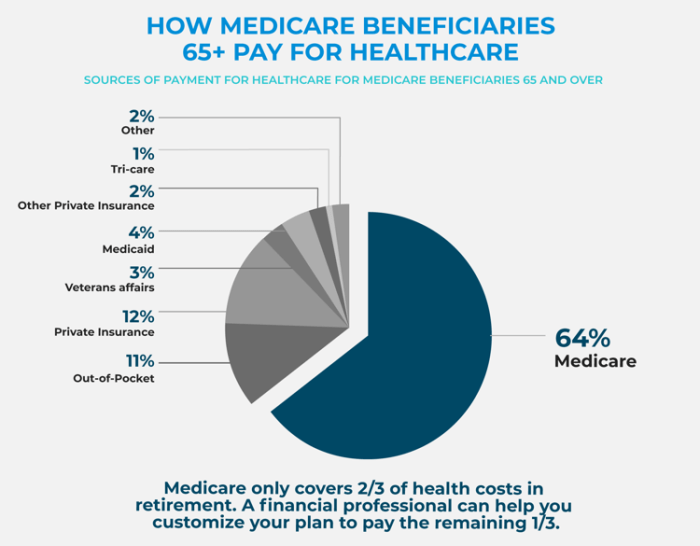

Insurance, such as Medicare and Medigap policies, plays a significant role in managing healthcare costs in retirement. Medicare provides basic coverage for hospital and medical services, while Medigap plans offer additional benefits to fill gaps in coverage. Evaluate different insurance options, compare costs and coverage, and choose a plan that aligns with your healthcare needs and budget.

Reducing Healthcare Costs Through Healthy Living and Preventive Care

One effective way to manage healthcare costs is by prioritizing healthy living and preventive care. Maintain a balanced diet, engage in regular exercise, avoid unhealthy habits like smoking, and attend routine check-ups and screenings. By proactively managing your health, you can prevent costly medical conditions, reduce the need for extensive treatments, and lower overall healthcare expenses.

Investment Options for Covering Healthcare Expenses

Investing in the right vehicles is crucial when planning for healthcare costs in retirement. Let’s explore some options that can help you manage these expenses effectively.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are a tax-advantaged way to save for medical expenses in retirement. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This makes HSAs a powerful tool for covering healthcare costs in retirement.

Pros and Cons of Long-Term Care Insurance

Long-term care insurance can help cover expenses for services not typically covered by traditional health insurance. However, it’s essential to weigh the pros and cons before investing in this type of insurance. While it can provide financial protection for long-term care needs, premiums can be expensive, and coverage may vary. It’s crucial to carefully assess your individual needs before deciding if long-term care insurance is the right choice for you.