Ready to dive into the world of buying stocks? Buckle up as we take you on a ride filled with key insights and strategies to help you navigate the stock market like a pro.

From understanding the basics to setting clear objectives and building a solid stock portfolio, this guide has got you covered with all the essential tips you need to succeed in the stock market game.

Understand the Basics

To start investing in stocks, it’s crucial to understand some key terms and concepts that form the foundation of the stock market. Let’s break it down for you:

Stock: A stock represents ownership in a company. When you buy a stock, you are essentially buying a small piece of that company.

Shares: Stocks are divided into shares, which are units of ownership. The more shares you own, the more ownership you have in the company.

Dividends: Some companies pay out a portion of their profits to shareholders in the form of dividends. It’s like a reward for investing in the company.

Market Capitalization: This is the total value of a company’s outstanding shares of stock. It is calculated by multiplying the number of outstanding shares by the current stock price.

Types of Stocks

- Common Stocks: These are the most common type of stock that people invest in. They come with voting rights at shareholder meetings and offer the potential for capital appreciation.

- Preferred Stocks: These stocks come with a fixed dividend payment and are considered less risky than common stocks. However, they usually don’t come with voting rights.

Importance of Research

Research is key before investing in stocks. It’s important to understand the company you are investing in, its financial health, growth potential, and the overall market conditions. Doing thorough research can help you make informed decisions and mitigate risks.

Setting Objectives

Setting clear financial goals before buying stocks is crucial for a successful investment strategy. By defining your objectives, whether it’s saving for retirement, buying a house, or funding your child’s education, you can tailor your stock purchases to align with these goals.

Importance of Setting Financial Goals

- Setting financial goals helps you determine the amount of risk you are willing to take with your investments.

- It provides a roadmap for your investment decisions, guiding you on which stocks to buy and when to sell.

- Having clear objectives allows you to measure your progress and make adjustments as needed to stay on track.

Influence of Risk Tolerance

- Understanding your risk tolerance is essential in determining the type of stocks that are suitable for your portfolio.

- Investors with a high risk tolerance may choose more volatile stocks with potential for higher returns, while those with a low risk tolerance may opt for more stable investments.

- Balancing risk and return based on your tolerance level is key to building a diversified portfolio that aligns with your financial goals.

Significance of a Diversified Portfolio

- Creating a diversified portfolio reduces the impact of any single stock’s performance on your overall investment.

- By spreading your investments across different sectors and asset classes, you can lower your overall risk exposure.

- Diversification can help you capture growth opportunities while minimizing potential losses, enhancing the stability of your portfolio.

Researching Stocks

Researching individual stocks is crucial to making informed investment decisions. By analyzing financial statements and historical performance, you can gain valuable insights into the health and potential growth of a company.

Analyzing Company Fundamentals

- Look at the company’s earnings: Evaluate the profitability of the company by analyzing its earnings over time. Consistent growth in earnings is a positive sign.

- Examine revenue trends: Revenue growth is a key indicator of a company’s ability to generate income. Look for steady growth or stability in revenue.

- Assess debt levels: High levels of debt can be a red flag for investors. Make sure to check the company’s debt-to-equity ratio to understand its financial health.

Market Trends and Economic Indicators

- Monitor market trends: Pay attention to overall market trends and how they may impact the stock you are researching. Factors like interest rates, inflation, and geopolitical events can influence stock prices.

- Use economic indicators: Keep an eye on economic indicators like GDP growth, unemployment rates, and consumer spending. These indicators can provide valuable insights into the broader economic environment.

Choosing a Broker

When it comes to buying stocks, choosing the right broker is crucial. Whether you opt for a full-service broker or a discount broker, each has its own set of pros and cons that you need to consider before making a decision.

Types of Brokers

- Full-Service Brokers: These brokers offer a range of services including investment advice, research reports, and personalized recommendations. However, they usually charge higher fees for their services.

- Discount Brokers: These brokers provide a no-frills approach to trading, offering lower commission fees but fewer additional services and support.

Factors to Consider

- Fee Structure: Compare the commission fees and any additional charges that each broker imposes.

- Trading Platform: Look for a user-friendly platform with tools and resources that align with your trading style and needs.

- Customer Service: Consider the level of support and assistance the broker offers, especially in times of need.

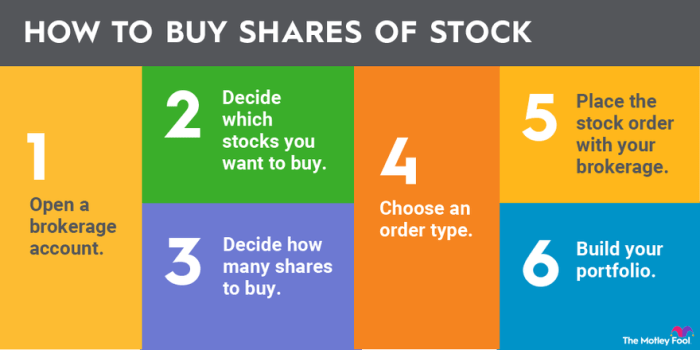

Opening a Brokerage Account

Before opening a brokerage account, ensure you have all the necessary documents and information ready, such as identification and financial details.

Placing Stock Orders

- Market Orders: These orders are executed at the current market price and are typically filled quickly.

- Limit Orders: With limit orders, you specify the maximum price you are willing to pay to buy or the minimum price you are willing to accept to sell.

Building a Stock Portfolio

Building a stock portfolio is like putting together a puzzle – you want to make sure all the pieces fit together to achieve your financial goals. It’s important to have a balanced portfolio to minimize risk and maximize returns over time.

Strategies for Building a Balanced Stock Portfolio

- Diversification is key: Spread your investments across different industries, sectors, and asset classes to reduce risk.

- Consider your risk tolerance: Choose a mix of stocks that align with how much risk you are willing to take.

- Regularly review and rebalance: Make sure your portfolio reflects your current financial goals and market conditions.

- Focus on long-term growth: Invest in companies with strong fundamentals and growth potential for sustainable returns.

Importance of Monitoring and Adjusting Your Portfolio

Keeping a close eye on your portfolio is crucial to ensure it continues to align with your financial objectives. Market conditions change, and so should your investments.

Remember, the key to success is not just picking the right stocks, but also knowing when to buy, sell, or hold onto them.

Evaluating the Performance of Your Stock Portfolio

- Compare your returns to a benchmark index to see how your portfolio is performing relative to the market.

- Assess the risk-adjusted returns to understand if your portfolio is providing enough return for the level of risk you are taking.

- Analyze individual stock performance to identify winners and losers in your portfolio. Consider trimming or adding positions accordingly.

- Track your portfolio’s overall diversification to ensure you are not overly exposed to any one stock or sector.