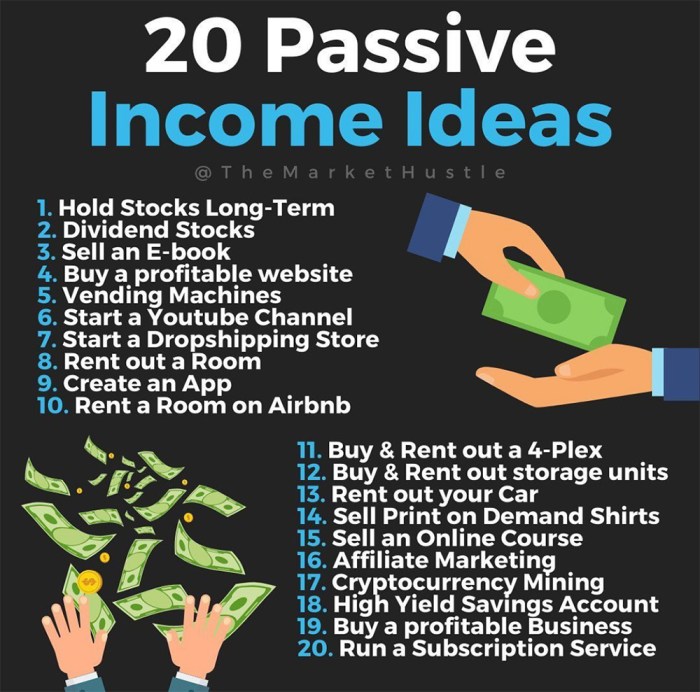

Passive Income Ideas: Looking for ways to make money without actively working? Dive into this guide to discover innovative ideas that can help you earn while you sleep. From real estate investments to online income streams, explore the world of passive income and start building your wealth today.

Passive Income Ideas

Looking to earn money while you sleep? Here are some passive income ideas to get you started!

Real Estate Investments

Investing in rental properties or real estate crowdfunding platforms can generate passive income through rental payments or property appreciation.

Dividend Stocks

By investing in dividend-paying stocks, you can earn passive income through regular dividend payouts without actively trading.

Create an Online Course

Developing and selling an online course on a platform like Udemy can provide passive income as people purchase and enroll in your course.

Peer-to-Peer Lending

Platforms like Lending Club allow you to lend money to individuals or businesses and earn interest on the repayments, generating passive income.

Affiliate Marketing

By promoting products or services through affiliate links on your website or social media, you can earn passive income through commissions on sales.

Passive income is money earned with minimal effort or ongoing work. The benefits of passive income include financial independence, flexibility to pursue other interests, and the potential for long-term wealth accumulation.

Diversifying passive income streams is crucial to mitigate risk and maximize earning potential. By spreading your income across different sources, you can protect yourself from fluctuations in one market or industry.

Successful passive income ventures include individuals who have built successful YouTube channels, invested in high-performing dividend stocks, created profitable online courses, and diversified their income through a combination of real estate investments and affiliate marketing.

Real Estate Investments

Investing in real estate can be a lucrative source of passive income for individuals looking to build wealth over time. By purchasing properties and renting them out or investing in real estate investment trusts (REITs), investors can generate consistent cash flow without actively working for it.

Rental Properties vs. Real Estate Investment Trusts (REITs)

- Rental Properties:

- Owning rental properties allows investors to have full control over their investments and potential for higher returns.

- However, managing rental properties can be time-consuming and require dealing with tenants, maintenance, and other issues.

- Real Estate Investment Trusts (REITs):

- REITs provide investors with a way to invest in real estate without the hassle of property management.

- Investors can buy shares of publicly traded REITs, which offer diversification and passive income through dividends.

Pros and Cons of Investing in Real Estate for Passive Income

- Pros:

- Potential for appreciation in property value over time.

- Stable cash flow through rental income or dividends from REITs.

- Tax benefits such as depreciation deductions and capital gains tax advantages.

- Cons:

- High upfront costs and barriers to entry, such as down payments and property maintenance.

- Market fluctuations and economic conditions can impact property values and rental demand.

- Risk of vacancies, bad tenants, and unexpected expenses affecting profitability.

Tips for Beginners Looking to Invest in Real Estate for Passive Income

- Start by educating yourself about real estate investing through books, courses, and online resources.

- Consider working with a real estate agent or property management company to help you find and manage properties.

- Focus on location, property condition, and rental market trends when selecting investment properties.

- Calculate potential returns, expenses, and risks before making any investment decisions.

Online Passive Income: Passive Income Ideas

In today’s digital age, there are numerous opportunities to generate passive income online. Whether through affiliate marketing, creating digital products, or building an online business, the potential for earning money passively is vast.

Affiliate Marketing

Affiliate marketing is a popular method of earning passive income online. By promoting products or services through unique referral links, individuals can earn a commission for each sale made through their link. This can be a lucrative way to generate passive income, especially if you have a strong online presence and a targeted audience.

- Choose the right affiliate programs that align with your niche or interests.

- Create valuable content that promotes the products or services authentically.

- Focus on building trust with your audience to increase conversions.

- Optimize your affiliate links for maximum visibility and clicks.

Creating Digital Products

Creating and selling digital products is another excellent way to earn passive income online. Whether it’s e-books, online courses, or software, digital products can be created once and sold repeatedly without the need for ongoing maintenance. This can be a scalable income stream that can generate revenue for years to come.

Focus on providing high-quality, valuable digital products that solve a specific problem or meet a need in the market.

- Research your target audience and identify their pain points to create products that resonate with them.

- Utilize platforms like Teachable or Gumroad to host and sell your digital products.

- Market your digital products through email marketing, social media, and other online channels to reach a wider audience.

- Collect feedback from customers to improve your products and increase sales over time.

Building a Successful Online Passive Income Business

Building a successful online passive income business requires dedication, strategic planning, and continuous effort. It’s essential to diversify your income streams, automate processes where possible, and stay updated on industry trends to maximize your earning potential.

- Identify profitable niches and opportunities for passive income generation.

- Invest in tools and resources that can streamline your online business operations.

- Stay consistent with your content creation and marketing efforts to attract and retain customers.

- Monitor your financial performance and make data-driven decisions to optimize your passive income streams.

Stock Market Investments

Investing in the stock market can be a great way to generate passive income through various avenues such as dividend-paying stocks, index funds, and ETFs.

Dividend-paying Stocks

Dividend-paying stocks are shares of companies that distribute a portion of their earnings to shareholders on a regular basis. By investing in these stocks, investors can receive a steady stream of passive income in the form of dividends.

Index Funds and ETFs

Index funds and Exchange-Traded Funds (ETFs) are popular options for passive income investors. These funds pool together money from multiple investors to buy a diversified portfolio of stocks or bonds, providing a passive way to invest in the market without the need for individual stock selection.

Individual Stocks vs. Funds

When it comes to investing for passive income, individual stocks offer the potential for higher returns but also come with higher risks. On the other hand, funds like index funds and ETFs provide diversification and lower risk, making them more suitable for passive income strategies.

Tips for Beginners, Passive Income Ideas

- Start with research: Understand the basics of the stock market and different investment options.

- Consider diversification: Spread your investments across different sectors and asset classes to reduce risk.

- Set realistic goals: Have a clear investment plan and timeline for your passive income goals.

- Utilize dollar-cost averaging: Invest a fixed amount regularly to benefit from market fluctuations over time.

- Consult with a financial advisor: Seek professional advice to help you make informed decisions and optimize your passive income strategy.