Yo, diving into Health savings accounts (HSAs) is like discovering a hidden treasure trove of financial wellness. So buckle up, ‘cause we’re about to break it down for you in true hip style, keeping it real and informative.

Now, let’s get down to business and explore the ins and outs of HSAs to level up your financial game.

Overview of Health Savings Accounts (HSAs)

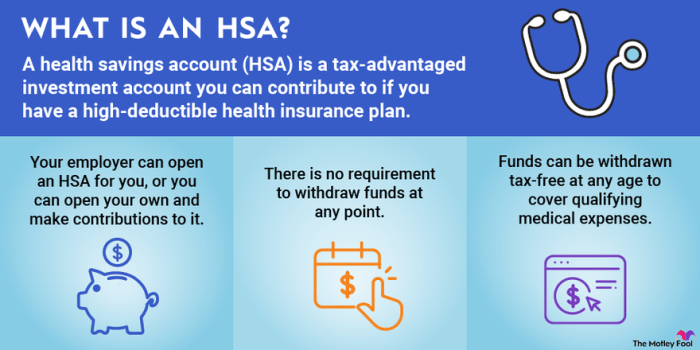

Health Savings Accounts (HSAs) are a type of savings account that allows individuals to set aside money on a pre-tax basis to pay for qualified medical expenses. These accounts are typically paired with a high-deductible health plan (HDHP) and offer tax advantages to help individuals save for current and future healthcare costs.

Key Features of HSAs

- Contributions are tax-deductible: The money you contribute to an HSA is tax-deductible, reducing your taxable income.

- Tax-free withdrawals for qualified medical expenses: Any withdrawals used for eligible medical expenses are tax-free.

- Roll-over balance: Unlike flexible spending accounts (FSAs), the funds in an HSA can roll over from year to year, allowing you to save for future healthcare costs.

- Portability: HSAs are portable, meaning you can keep your account even if you change jobs or health insurance plans.

Benefits of Using an HSA for Healthcare Expenses

- Lower healthcare costs: By using pre-tax dollars to pay for medical expenses, you can reduce your out-of-pocket costs.

- Tax advantages: Contributions are tax-deductible, and any interest or investment earnings in the account grow tax-free.

- Financial flexibility: HSAs provide a way to save for future medical expenses, giving you peace of mind for unexpected healthcare needs.

Comparison to Other Healthcare Savings Options

- HSAs vs. FSAs: Unlike FSAs, funds in an HSA roll over from year to year and are portable, giving you more flexibility and control over your healthcare savings.

- HSAs vs. HRAs: While Health Reimbursement Arrangements (HRAs) are funded solely by the employer, HSAs allow individuals to contribute and control their own funds for healthcare expenses.

Eligibility and Contribution Limits

To open an HSA, individuals must be covered by a high-deductible health plan (HDHP) and cannot be enrolled in Medicare. They cannot be claimed as a dependent on someone else’s tax return.

Eligibility Criteria

- To be eligible for an HSA, individuals must be covered by a high-deductible health plan (HDHP).

- They cannot be enrolled in Medicare.

- They cannot be claimed as a dependent on someone else’s tax return.

Contribution Limits

For 2021, the contribution limit for individuals is $3,600, and for families, it is $7,200. Individuals age 55 and older can make an additional catch-up contribution of $1,000.

Tax-Deductible Contributions

- Contributions made to an HSA are tax-deductible, meaning they can reduce taxable income for the year.

- This provides a tax advantage to individuals who contribute to their HSA.

- Contributions can be made by the account holder, their employer, or both.

Penalties for Exceeding Contribution Limits

If individuals exceed the contribution limits, they may face a 6% excise tax on the excess amount. It is important to monitor contributions to avoid penalties and stay within the allowable limits.

Using Funds from HSAs

When it comes to utilizing funds from your Health Savings Account (HSA), there are specific guidelines and options available to account holders.

Qualifying Medical Expenses

HSAs can be used to pay for a wide range of medical expenses, including but not limited to:

- Doctor visits

- Prescription medications

- Dental care

- Vision care

- Medical equipment

Flexibility for Non-Medical Expenses After Retirement

After reaching retirement age, individuals can withdraw funds from their HSA for non-medical expenses without facing any penalties. However, income tax will still apply to these withdrawals.

Reimbursing Yourself for Medical Expenses

If you pay for a qualified medical expense out of pocket, you can reimburse yourself from your HSA at any time. It’s important to keep records of these expenses for tax purposes.

Investment Options and Growth

Investment options within an HSA allow individuals to grow their funds over time by investing in various financial instruments.

Investment Options Available

- Stocks: Investing in individual stocks or exchange-traded funds (ETFs) can offer the potential for higher returns but also come with higher risk.

- Mutual Funds: Mutual funds allow for diversification by pooling money with other investors to invest in a range of securities.

- Bonds: Bonds provide a more conservative investment option with fixed interest payments over time.

- Money Market Accounts: These accounts offer low-risk investments with stable returns, usually yielding slightly higher interest rates compared to regular savings accounts.

Tax-Free Growth

Investing HSA funds allows for tax-free growth, meaning any interest, dividends, or capital gains earned within the account are not subject to taxation. This can significantly boost savings over the long term.

Maximizing Growth Strategies

- Regular Contributions: Consistently contributing to your HSA and investing those funds can help maximize growth over time.

- Reinvesting Earnings: Reinvesting any dividends or capital gains earned can compound growth and accelerate the accumulation of savings.

- Monitoring Performance: Keeping track of the performance of your investments and adjusting your portfolio as needed can help optimize growth potential.

Importance of Considering Investment Options

Considering investment options is crucial for long-term savings within an HSA as it can significantly impact the growth potential of your funds. By choosing the right mix of investments based on your risk tolerance and financial goals, you can work towards building a substantial nest egg for future healthcare expenses.