Forex breakout trading strategies are the key to success in the dynamic world of Forex trading. From identifying patterns to setting entry and exit points, this overview will guide you through the essential components of breakout trading.

Learn how to capitalize on market movements and make informed decisions that can lead to profitable trades. Dive into the world of breakout strategies and take your trading game to the next level.

Overview of Forex Breakout Trading Strategies

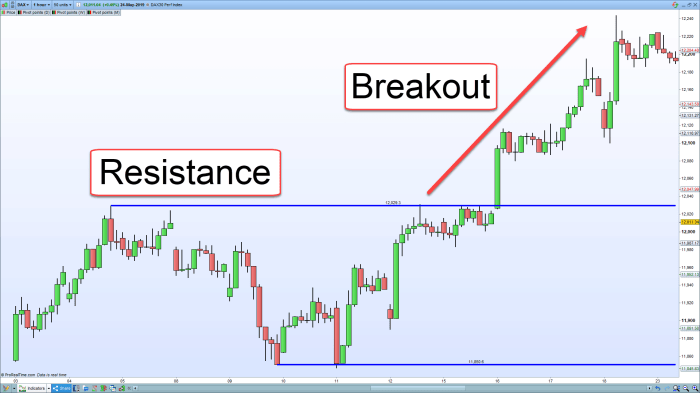

Forex breakout trading strategies involve entering a trade when the price of a currency pair breaks through a key level of support or resistance. This strategy aims to capitalize on the momentum created by the breakout and ride the trend for potential profits.Breakout trading is important in the Forex market because it allows traders to take advantage of significant price movements that can occur when price breaks out of a range or consolidation phase.

By identifying key levels on the price chart where breakouts are likely to occur, traders can position themselves to profit from these moves.

Examples of Successful Breakout Trading Strategies

- One popular breakout trading strategy is the “London Breakout” strategy, which involves identifying the high and low price range during the first few hours of the London trading session and entering trades when price breaks out of this range.

- Another example is the “Bollinger Band Squeeze” strategy, which involves waiting for the Bollinger Bands to contract (indicating low volatility) and then entering a trade when price breaks out of the bands, signaling a potential trend reversal or continuation.

- The “Triangle Breakout” strategy is also commonly used, where traders look for consolidation patterns forming triangles on the price chart and enter trades when price breaks out of the triangle, signaling a potential trend continuation.

Types of Forex Breakout Patterns

Forex breakout patterns are essential for traders looking to capitalize on market movements. By recognizing these patterns on price charts, traders can identify potential trading opportunities and make profitable trades. Let’s explore some common breakout patterns in Forex trading.

Ascending Triangle

An ascending triangle is a bullish continuation pattern formed by a rising trendline and a horizontal resistance level. Traders can look for a breakout above the resistance level to enter a long trade. This pattern indicates that buyers are gaining control and could lead to a significant price movement to the upside.

Double Top and Double Bottom

The double top pattern occurs when price reaches a resistance level twice and fails to break higher, signaling a potential reversal to the downside. Conversely, the double bottom pattern forms when price hits a support level twice and fails to break lower, indicating a possible reversal to the upside. Traders can enter trades based on the breakout of the neckline, confirming the pattern.

Head and Shoulders

The head and shoulders pattern is a reversal pattern consisting of a higher high (head) with two lower highs (shoulders) on either side. This pattern signals a potential trend reversal, with traders looking for a breakout below the neckline to initiate short positions. It is crucial to wait for confirmation of the breakout to avoid false signals.

Pennant

A pennant is a continuation pattern that resembles a small symmetrical triangle. It occurs after a strong price move and indicates a brief consolidation before the trend resumes. Traders can enter trades based on the breakout of the pennant pattern, in the direction of the preceding trend. This pattern can lead to profitable trades if traded correctly.

Conclusion

Recognizing and understanding different Forex breakout patterns is crucial for traders to identify potential trading opportunities and make informed decisions. By studying these patterns and waiting for confirmations, traders can increase their chances of success in the Forex market.

Key Components of a Breakout Trading Strategy

When it comes to breakout trading strategies, there are key components that are essential for success. These components help traders identify potential breakouts, manage risks effectively, and set entry and exit points for profitable trades.

Risk Management Techniques

Implementing proper risk management techniques is crucial when trading breakouts. Traders should consider setting stop-loss orders to limit potential losses and avoid overexposure to the market. Additionally, using proper position sizing based on account size and risk tolerance can help protect capital in case of adverse price movements.

Setting Entry and Exit Points

Setting entry and exit points for breakout trades involves identifying key levels of support and resistance. Traders can enter a trade once the price breaks above resistance or below support, signaling a potential breakout. Using technical indicators such as moving averages or momentum oscillators can help confirm breakout signals and determine optimal entry and exit points for trades.

Monitoring Price Action

Traders should continuously monitor price action after entering a breakout trade. It is essential to adjust stop-loss orders as the trade progresses to lock in profits and minimize losses. Additionally, trailing stop-loss orders can be used to protect profits and allow trades to run in the direction of the breakout.

Technical Indicators for Breakout Trading

When it comes to Forex breakout trading, technical indicators play a crucial role in helping traders identify potential breakout opportunities and confirming signals before making trading decisions.

Popular Technical Indicators

- Bollinger Bands: These bands help traders identify volatility and potential breakout points by showing upper and lower boundaries.

- Relative Strength Index (RSI): RSI is used to determine overbought or oversold conditions, which can indicate a potential breakout.

- Moving Averages: Traders often use moving averages to identify trends and potential breakout points when the price crosses above or below the moving average.

How Indicators Confirm Breakout Signals

Indicators help confirm breakout signals by providing additional insight into the market conditions. For example, if the price breaks above a key resistance level and the RSI indicates overbought conditions, it can confirm a bullish breakout signal. Similarly, if the price breaks below a support level and the Bollinger Bands show increased volatility, it can confirm a bearish breakout signal.

Comparing Indicator Effectiveness

| Indicator | Effectiveness in Breakout Strategies |

|---|---|

| Bollinger Bands | Effective in identifying volatility and potential breakout points. |

| Relative Strength Index (RSI) | Useful in determining overbought or oversold conditions before breakouts. |

| Moving Averages | Helpful in identifying trend changes and breakout opportunities. |

Developing a Breakout Trading Plan

Creating a breakout trading plan is essential for success in the forex market. It involves outlining your entry and exit points, risk management strategies, and overall approach to trading breakouts.

Steps in Creating a Breakout Trading Plan, Forex breakout trading strategies

- Identify key support and resistance levels: Determine the price levels at which breakouts are likely to occur.

- Set entry and exit points: Decide at what price you will enter a trade and where you will take profits or cut losses.

- Establish risk management rules: Define how much you are willing to risk on each trade to protect your capital.

- Implement trade size guidelines: Determine the appropriate position size based on your risk tolerance and account size.

Significance of Backtesting Breakout Strategies

Backtesting breakout strategies involves testing your trading plan on historical data to assess its viability and profitability. It helps traders identify strengths and weaknesses in their strategies and make necessary adjustments before risking real money.

Tips for Refining and Adjusting a Trading Plan

- Monitor market conditions: Stay informed about economic events and news that may impact your breakout trading strategy.

- Review and analyze past trades: Evaluate the performance of your trades to identify patterns and areas for improvement.

- Stay flexible: Be willing to adapt your trading plan based on changing market conditions and trends.

- Seek feedback: Consider seeking advice from experienced traders or mentors to help refine your breakout trading plan.

Case Studies of Successful Breakout Trades: Forex Breakout Trading Strategies

In this section, we will analyze real-life examples of profitable breakout trades in the Forex market and break down the factors that contributed to their success.

EUR/USD Breakout Trade

- One successful breakout trade involved the EUR/USD currency pair, where a clear resistance level was identified at 1.2000.

- Traders observed a series of higher lows indicating a potential breakout above the resistance level.

- When the price broke above 1.2000 with strong momentum, traders entered long positions.

- The trade was successful as the price continued to rise, hitting new highs and allowing traders to profit.

GBP/JPY Breakout Trade

- Another example of a successful breakout trade was seen in the GBP/JPY pair, where a symmetrical triangle pattern formed.

- Traders waited for a breakout above the upper trendline of the triangle pattern to enter long positions.

- The breakout was accompanied by high trading volume, confirming the strength of the move.

- As the price surged higher after the breakout, traders were able to capitalize on the upward momentum and secure profits.