Yo, get ready to dive into the world of 401(k) investment options! This topic is all about making that dough and securing your future, so buckle up and let’s get this party started.

Let’s break down the different types of investment options, understand the risks involved, and learn how to make those big bucks work for you.

Understanding 401(k) Investment Options

401(k) investment options are the different choices individuals have within their 401(k) retirement plan to allocate their contributions. These options allow individuals to invest their retirement savings in various financial instruments to grow their wealth over time.

Types of 401(k) Investment Options

- Stocks: Investing in individual company stocks or exchange-traded funds (ETFs) can offer higher growth potential but also come with higher risk.

- Bonds: Bonds are debt securities issued by corporations or governments, providing a fixed income stream but with lower potential returns compared to stocks.

- Mutual Funds: These are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Target-Date Funds: These funds automatically adjust their asset allocation based on the target retirement date, becoming more conservative as the individual gets closer to retirement.

- Real Estate Investment Trusts (REITs): REITs invest in real estate properties and distribute rental income to investors, offering diversification outside of traditional stocks and bonds.

Benefits of Diversifying 401(k) Investment Options

Diversifying 401(k) investment options can help reduce risk by spreading investments across different asset classes. This strategy can potentially lower the impact of market volatility on the overall portfolio performance. Additionally, diversification allows individuals to capture returns from various sectors of the economy, maximizing growth opportunities while minimizing potential losses.

Risk Assessment

When it comes to choosing 401(k) investment options, understanding your risk tolerance is crucial. Risk tolerance refers to how much volatility or uncertainty you are comfortable with in your investments. This factor greatly influences the selection of 401(k) investment options because different options come with varying levels of risk.

Influence of Risk Tolerance

- Your risk tolerance will determine whether you opt for more aggressive investment options with higher potential returns but also higher risk, or conservative options with lower risk but potentially lower returns.

- Young investors with a higher risk tolerance may lean towards aggressive options to maximize growth potential over the long term, while those nearing retirement might choose more conservative options to protect their savings.

Importance of Assessing Risk

- Assessing risk is crucial because it helps align your investment choices with your financial goals and comfort level. Understanding and managing risk can lead to a more balanced and suitable investment portfolio.

- By evaluating risk, you can make informed decisions that match your risk tolerance, time horizon, and overall financial situation, ultimately working towards achieving your retirement objectives.

Comparison of Risk Levels

- 401(k) investment options typically range from low-risk options like stable value funds to high-risk options like aggressive growth funds or individual stocks.

- Low-risk options offer more stability but lower potential returns, while high-risk options have the potential for higher returns but come with increased volatility and the risk of losses.

- It’s important to diversify your investment portfolio across different risk levels to mitigate overall risk and optimize potential returns based on your risk tolerance and investment goals.

Asset Allocation

When it comes to your 401(k) investment options, asset allocation plays a critical role in determining the overall performance of your portfolio. Asset allocation refers to the distribution of your investments across different asset classes such as stocks, bonds, and cash equivalents. By diversifying your investments, you can manage risk and potentially increase returns over the long term.

Diversified Asset Allocation Strategies

- Target-Date Funds: These funds automatically adjust your asset allocation based on your target retirement date. They typically start with a higher allocation to stocks when you are young and gradually shift towards more conservative investments as you approach retirement.

- Risk-Based Allocation: This strategy involves allocating assets based on your risk tolerance. For example, if you are a conservative investor, you may have a higher allocation to bonds and cash equivalents, while aggressive investors may have a higher allocation to stocks.

- Balanced Portfolio: A balanced portfolio consists of a mix of different asset classes to achieve a specific risk-return profile. For example, a 60% allocation to stocks and 40% to bonds can provide a balanced approach to growth and income.

Impact on Long-Term Investment Growth

Proper asset allocation is crucial for achieving your long-term investment goals. By diversifying your portfolio across different asset classes, you can reduce risk and potentially enhance returns over time. It also helps you weather market volatility and maintain a more stable investment strategy.

Investment Performance

When it comes to your 401(k) savings, understanding how investment performance can impact your overall balance is crucial. The performance of your investments directly influences the growth of your retirement savings over time.

Comparing Historical Performance Data

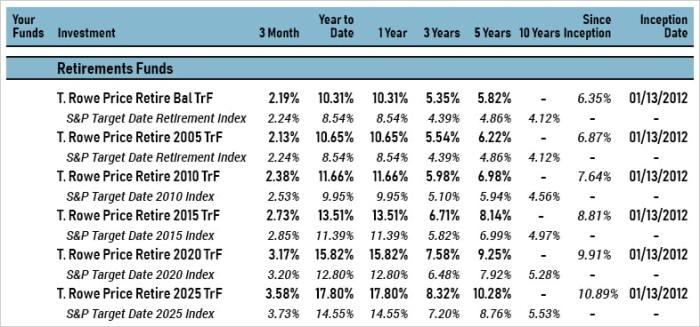

- Looking at historical performance data of various 401(k) investment options can give you insight into how different assets have behaved in the past.

- By comparing this data, you can assess the risk and return potential of each investment option and make informed decisions about your portfolio.

- It’s important to consider both short-term and long-term performance trends to understand how investments have performed in different market conditions.

Monitoring and Evaluating Investment Performance

- Regularly monitoring the performance of your investments within your 401(k) plan is essential to ensure you are on track to meet your retirement goals.

- Set specific benchmarks or goals for your investments and compare the actual performance against these targets.

- Review your investment performance at least annually and consider rebalancing your portfolio if needed to align with your risk tolerance and financial objectives.