Hey there, buckle up for a wild ride as we dive into the world of auto loan refinancing options. Get ready to revamp your car loan game with some killer strategies and insights that will blow your mind!

Now, let’s break down the nitty-gritty details of how you can take control of your auto loan and save some serious cash along the way.

Understanding Auto Loan Refinancing Options

When it comes to auto loan refinancing, it’s like giving your ride a fresh new paint job. You’re basically swapping out your current car loan for a new one with better terms and interest rates.

Benefits of Refinancing an Auto Loan

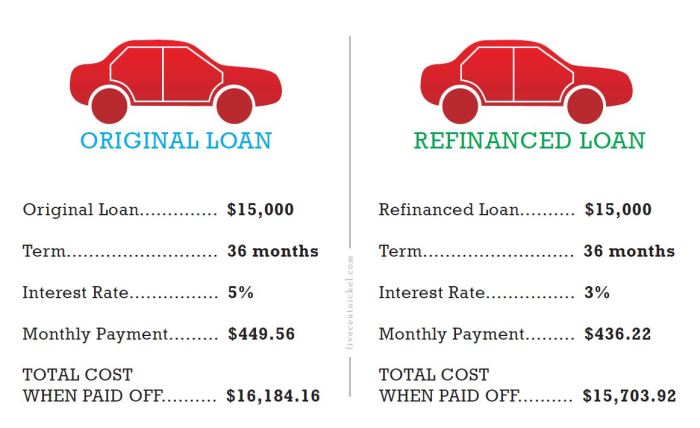

Refinancing your auto loan can help you save some serious cash in the long run. By scoring a lower interest rate, you can decrease your monthly payments and potentially pay off your loan faster. Plus, you might even be able to snag some extra cash in your pocket if you have equity in your car.

How Auto Loan Refinancing Works

Here’s the lowdown: when you refinance your auto loan, a new lender pays off your existing loan and sets you up with a new one. This new loan often comes with better terms, like a lower interest rate or extended repayment period. It’s like hitting the reset button on your car loan.

Comparing Auto Loan Refinancing with Other Financing Options

Let’s be real, auto loan refinancing can be a game-changer compared to other financing options. Unlike trading in your car or taking out a personal loan, refinancing allows you to keep your current ride while potentially lowering your monthly payments. It’s like upgrading to the latest model without breaking the bank.

Factors to Consider Before Refinancing

When it comes to refinancing your auto loan, there are a few key factors you should consider before making a decision. From timing to credit score, these elements play a crucial role in determining whether refinancing is the right option for you.

Timing is Everything

- Consider refinancing when interest rates are lower than what you currently have on your auto loan. This can help you save money in the long run.

- Wait until you have a good payment history on your current loan. Lenders will look at your payment history to determine your eligibility for refinancing.

Credit Score Matters

- Your credit score is a major factor in determining the interest rate you will receive when refinancing. The higher your credit score, the lower your interest rate is likely to be.

- Improving your credit score before refinancing can help you secure a better interest rate, saving you money over the life of the loan.

Interest Rates Impact Refinancing Decisions

- Keep an eye on current interest rates in the market. If they are significantly lower than what you’re currently paying, it may be a good time to consider refinancing.

- Compare the interest rates offered by different lenders to ensure you are getting the best deal possible.

Types of Auto Loan Refinancing Options

When it comes to auto loan refinancing, there are several options available to borrowers. Each type of refinancing has its own set of advantages and disadvantages, so it’s essential to understand the differences before making a decision.

Traditional Refinancing

Traditional refinancing involves replacing your current auto loan with a new loan, typically with better terms such as a lower interest rate or extended repayment period. This can help lower your monthly payments and save you money in the long run.

Cash-Back Refinancing

Cash-back refinancing allows borrowers to refinance their auto loan for more than the current amount owed on the vehicle. The borrower receives the difference in cash, which can be used for other expenses. However, this option may result in a higher loan balance and interest costs.

Rate-and-Term Refinancing

Rate-and-term refinancing involves changing the interest rate or loan term of your existing auto loan. This can help you secure a lower interest rate or shorten the repayment period, ultimately saving you money on interest over time.

Differences Between Fixed-Rate and Variable-Rate Refinancing

Fixed-rate refinancing offers a stable interest rate throughout the life of the loan, providing predictability in monthly payments. On the other hand, variable-rate refinancing offers an interest rate that can fluctuate based on market conditions, potentially resulting in lower initial rates but higher payments later on.

Pros and Cons of Each Refinancing Option

– Traditional Refinancing:

– Pros: Lower interest rates, extended repayment terms.

– Cons: May incur additional fees, lengthen the loan term.

– Cash-Back Refinancing:

– Pros: Receive cash for other expenses.

– Cons: Higher loan balance, increased interest costs.

– Rate-and-Term Refinancing:

– Pros: Lower interest rates, shorter repayment period.

– Cons: May have higher monthly payments.

Lenders Offering Auto Loan Refinancing

Some lenders that offer auto loan refinancing options include:

– LightStream

– Capital One

– Bank of America

Process of Refinancing an Auto Loan

When it comes to refinancing an auto loan, there are several steps involved in the process. Let’s break it down to make it easier to understand.

Step-by-Step Process

- 1. Research Lenders: Look for reputable lenders who offer auto loan refinancing.

- 2. Check Your Credit: Ensure your credit score is in good shape to qualify for better refinancing terms.

- 3. Gather Documentation: Prepare documents such as current loan information, income verification, and identification.

- 4. Submit Application: Complete the refinancing application with the new lender.

- 5. Review Offers: Compare the offers from different lenders to choose the best option for your financial situation.

- 6. Close the Loan: Once you accept an offer, finalize the details and close the refinanced loan.

Documentation Required

- 1. Current auto loan details

- 2. Proof of income

- 3. Identification documents

- 4. Vehicle information

Fees Involved

- 1. Application fee

- 2. Title transfer fee

- 3. Prepayment penalty (if applicable)

- 4. Origination fee

Common Challenges to Avoid

- 1. Not comparing offers from multiple lenders

- 2. Ignoring the impact of fees on overall savings

- 3. Extending the loan term without considering long-term costs

- 4. Failing to understand the terms and conditions of the new loan