Yo, so you wanna dive into the world of bond investments, huh? Well, buckle up because we’re about to drop some knowledge bombs on how to make the most out of your moolah with these bond investment tips. From diversification to maximizing returns, we got you covered.

Get ready to level up your investment game and secure that bag, all while learning the ropes of the bond market. Let’s get this bread!

Importance of Diversification in Bond Investments

Diversifying bond investments is crucial for reducing risk and maximizing returns in a portfolio. By spreading your investments across different types of bonds, you can minimize the impact of market fluctuations on your overall investment.

Types of Bonds for Diversification

- Government Bonds: These are considered low-risk investments as they are backed by the government’s credit.

- Corporate Bonds: Offer higher yields but come with a higher risk due to the creditworthiness of the issuing company.

- Municipal Bonds: Issued by state and local governments, these bonds provide tax advantages for investors.

- High-Yield Bonds: Also known as junk bonds, these bonds offer high returns but come with a higher risk of default.

Benefits of Diversification

Diversification can help investors navigate market fluctuations by spreading risk across different assets. For example, if one sector is underperforming, the gains from other sectors can offset potential losses. Additionally, by including bonds with different maturities and credit ratings in your portfolio, you can further reduce risk and enhance overall stability.

Factors to Consider Before Investing in Bonds

When looking to invest in bonds, there are several key factors that investors should take into consideration to make informed decisions. Factors such as credit rating, maturity, and interest rate risk play a crucial role in determining the potential returns and risks associated with bond investments.

Credit Rating

The credit rating of a bond issuer indicates the issuer’s ability to repay the bond’s principal and interest on time. Higher credit ratings typically mean lower risk of default but may offer lower returns. On the other hand, lower-rated bonds come with higher risk but offer the potential for higher returns.

Maturity

The maturity of a bond refers to the length of time until the bond issuer repays the bond’s principal amount. Short-term bonds typically have lower interest rate risk but may offer lower returns, while long-term bonds are exposed to higher interest rate risk but may provide higher yields.

Interest Rate Risk

Interest rate risk refers to the potential impact of changes in interest rates on bond prices. When interest rates rise, bond prices tend to fall, and vice versa. Understanding how interest rate movements can affect bond prices is essential for investors to manage their portfolio effectively.

Economic Conditions

Economic conditions can have a significant impact on bond investments. Factors such as inflation, economic growth, and monetary policy can influence bond prices and yields. Investors need to stay informed about the macroeconomic environment to make well-informed investment decisions.

Investor’s Risk Tolerance and Investment Goals

An investor’s risk tolerance and investment goals play a crucial role in determining the suitable bond investments. Investors with a higher risk tolerance may be more inclined to invest in riskier bonds with the potential for higher returns, while conservative investors may prefer safer bonds with lower risk.

Strategies for Maximizing Returns in Bond Investments

Bond investments can be a great way to diversify your portfolio and generate passive income. However, to maximize returns in bond investments, it’s important to implement strategic approaches that can help you achieve your financial goals. Here are some key strategies to consider:

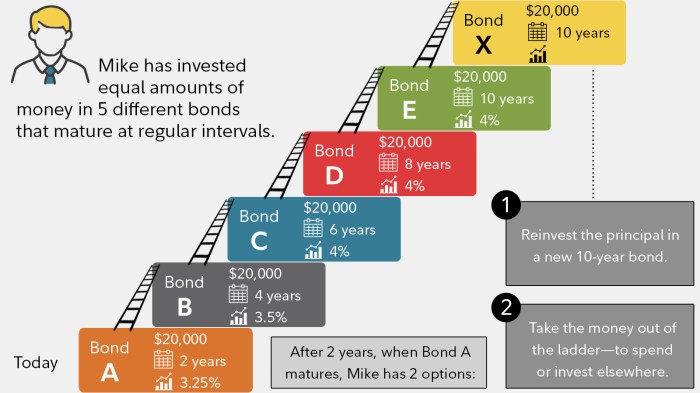

Laddering Strategy

Laddering is a popular strategy used in bond investing to manage interest rate risk and potentially increase returns over time. This strategy involves buying bonds with staggered maturity dates, creating a “ladder” of investments. By reinvesting the proceeds from maturing bonds into new ones, investors can take advantage of changing interest rates and potentially earn higher returns.

Bond Funds

Investing in bond funds can be another effective way to maximize returns in bond investments. Bond funds pool money from multiple investors to invest in a diversified portfolio of bonds. This allows investors to benefit from professional management, instant diversification, and potentially higher returns compared to individual bond investments. It’s important to carefully research and choose bond funds that align with your investment goals and risk tolerance.

Monitoring and Adjusting Investments

Monitoring and adjusting your bond investments over time is crucial to maximizing returns. Keep track of changes in interest rates, credit ratings, and market conditions that may affect the performance of your bonds. Regularly review your portfolio and consider adjusting your investments based on your financial goals, risk tolerance, and market outlook.

Reinvesting Bond Proceeds

Reinvesting bond proceeds is a key strategy to compound returns effectively in bond investments. Instead of cashing out when a bond matures or pays interest, consider reinvesting the proceeds into new bonds or other investment opportunities. This can help you take advantage of compounded growth over time and potentially increase your overall returns.

Risks Associated with Bond Investments

Investing in bonds comes with its fair share of risks that investors need to be aware of in order to make informed decisions. Three main risks associated with bond investments include interest rate risk, credit risk, and inflation risk.

Interest Rate Risk

Interest rate risk is the risk that changes in interest rates will affect the value of a bond. When interest rates rise, the value of existing bonds decreases, as newer bonds offer higher yields. Conversely, when interest rates fall, bond prices increase.

Credit Risk

Credit risk refers to the risk of the bond issuer defaulting on its payments. Bonds issued by companies or governments with lower credit ratings are considered riskier investments, as there is a higher chance of default. In such cases, investors may not receive their interest payments or face losses on their principal investment.

Inflation Risk

Inflation risk is the risk that inflation will erode the purchasing power of the bond’s future cash flows. If the rate of inflation exceeds the yield on a bond, the real return on the investment will be negative. This means that investors may not be able to maintain the same purchasing power over time.

To mitigate potential losses in bond investments, investors can employ risk management techniques such as diversification, investing in bonds with varying maturities and credit ratings, and using stop-loss orders to limit losses in case of adverse market movements. It is essential for investors to understand these risks and implement strategies to protect their investments in the bond market.