So, like, you wanna be financially strong and secure, right? Well, building financial resilience is like the key to making sure you’re all set for whatever life throws at you. This is where you buckle up and get ready to dive into the world of smart money moves and solid planning.

Understanding Financial Resilience

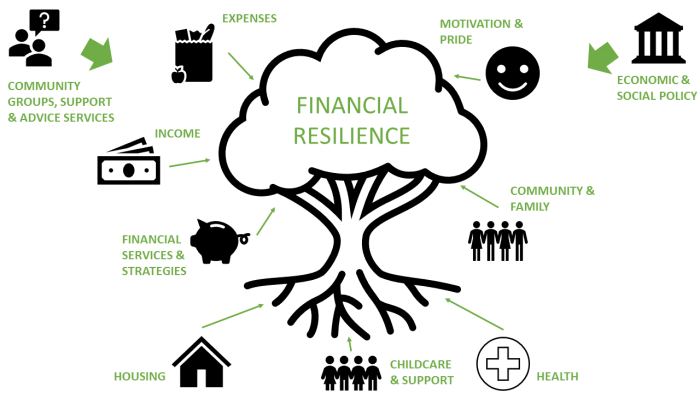

Financial resilience refers to the ability to withstand financial shocks and unexpected expenses without being pushed into financial distress. It involves having a financial safety net in place to weather challenging times and bounce back from financial setbacks. Building financial resilience is crucial for individuals and families to secure their financial well-being and achieve long-term financial stability.

Factors Contributing to Building Financial Resilience

Building financial resilience involves a combination of factors that work together to strengthen one’s financial position. Some key factors that contribute to building financial resilience include:

- Emergency Savings: Having a sufficient emergency fund to cover unexpected expenses such as medical bills, car repairs, or job loss is essential for financial resilience. This fund acts as a financial cushion during tough times.

- Income Diversity: Having multiple sources of income can help mitigate the impact of a sudden loss of income from one source. Diversifying income streams through side hustles, investments, or freelance work can boost financial resilience.

- Debt Management: Keeping debt levels in check and having a plan to pay off debt can improve financial resilience. High levels of debt can drain financial resources and make it challenging to cope with unexpected expenses.

- Insurance Coverage: Having adequate insurance coverage for health, home, car, and life can protect against financial losses due to unforeseen events. Insurance acts as a safety net to prevent financial ruin in case of emergencies.

Financial Resilience vs. Financial Stability

While financial resilience and financial stability are related concepts, they differ in their focus and scope:

- Financial resilience emphasizes the ability to bounce back from financial setbacks and adapt to changing circumstances, while financial stability refers to a more enduring state of financial well-being and security.

- Financial resilience involves being prepared for unexpected events and having the flexibility to navigate financial challenges, whereas financial stability focuses on achieving a consistent and secure financial position over time.

- Financial resilience is more about the ability to withstand short-term financial shocks, while financial stability is about maintaining a solid financial foundation in the long run.

Creating an Emergency Fund

Having an emergency fund is crucial for building financial resilience. It acts as a safety net during unexpected situations like job loss, medical emergencies, or car repairs, helping you avoid going into debt.

Purpose of an Emergency Fund

An emergency fund serves as a financial cushion to cover unforeseen expenses without disrupting your regular budget. It provides peace of mind knowing you have funds set aside for emergencies.

Determining the Size of an Emergency Fund

- Financial experts recommend saving 3 to 6 months’ worth of living expenses in your emergency fund.

- Consider factors like your monthly expenses, job stability, and any dependents when calculating the appropriate size.

- Adjust the size of your emergency fund based on your individual circumstances and risk tolerance.

Setting Up and Maintaining an Emergency Fund

- Open a separate savings account specifically for your emergency fund to prevent using it for non-emergencies.

- Automate regular contributions to your emergency fund to ensure consistent savings.

- Revisit and reassess your emergency fund periodically to adjust for changes in expenses or income.

- Avoid tapping into your emergency fund for non-urgent expenses to preserve its intended purpose.

Managing Debt Wisely

When it comes to managing debt, it’s crucial to have a solid plan in place to avoid falling into financial trouble. By implementing strategies to reduce debt and making smart repayment decisions, you can enhance your financial resilience and overall stability.

Different Debt Repayment Methods

- Snowball Method: This approach involves paying off your smallest debts first while making minimum payments on larger debts. As each small debt is cleared, you gain momentum and motivation to tackle larger debts.

- Avalanche Method: With this method, you focus on paying off debts with the highest interest rates first. By targeting high-interest debts, you can save money in the long run and become debt-free faster.

- Debt Consolidation: Consolidating multiple debts into a single loan with a lower interest rate can simplify your repayment process and potentially reduce your overall interest payments.

Tips for Avoiding Debt Traps

- Create a Budget: Keeping track of your expenses and income can help you avoid overspending and accumulating unnecessary debt.

- Avoid Impulse Purchases: Before making a purchase, take a moment to consider if it’s a need or a want. Avoiding impulse buys can prevent you from adding to your debt load.

- Build an Emergency Fund: Having savings set aside for unexpected expenses can prevent you from relying on credit cards or loans during financial emergencies.

- Negotiate with Creditors: If you’re struggling to make debt payments, don’t hesitate to contact your creditors to discuss potential repayment options or hardship programs.

Building Multiple Income Streams

In today’s fast-paced world, having multiple streams of income is key to financial resilience. By diversifying your income sources, you can better protect yourself against unexpected financial setbacks and create a more stable financial future for yourself.

The Benefits of Diversifying Income Sources

- Diversification reduces the risk of relying on a single source of income, making you less vulnerable to job loss or economic downturns.

- Having multiple income streams can increase your overall earning potential and help you reach your financial goals faster.

- It allows you to explore different passions and interests while still generating income, leading to a more fulfilling and balanced life.

Various Ways to Generate Additional Income Streams

- Start a side hustle or freelance gig in your spare time, such as graphic design, writing, tutoring, or consulting.

- Invest in the stock market, real estate, or other assets that can generate passive income over time.

- Monetize your hobbies or skills by selling products online, teaching classes, or offering services to others.

Examples of Passive Income Opportunities

- Investing in dividend-paying stocks or bonds that provide regular income without requiring active involvement.

- Renting out a property or room on platforms like Airbnb to generate rental income.

- Creating digital products like e-books, online courses, or stock photography that can be sold repeatedly with minimal effort.

Planning for the Future

Planning for the future is crucial when it comes to building financial resilience. It involves setting long-term goals and creating a roadmap to achieve them. By planning ahead, you can secure your financial stability and be better prepared for any unexpected challenges that may come your way.

Retirement Planning and Financial Resilience

Retirement planning is a key component of building financial resilience. It involves saving and investing money for your retirement years, ensuring that you have enough funds to maintain your lifestyle when you stop working. By starting early and contributing regularly to retirement accounts such as 401(k) or IRA, you can build a nest egg that will provide financial security in your golden years.

Strategies for Investing Wisely

Investing wisely is essential for securing future financial stability. Diversifying your investment portfolio, staying informed about the market trends, and seeking professional advice are all important strategies to consider. By investing in a mix of assets such as stocks, bonds, and real estate, you can minimize risks and maximize returns over the long term.