Alright, listen up peeps! We’re diving into the world of capital appreciation strategies – aka making that money grow! Get ready for a rollercoaster of financial wisdom that’ll have you seeing dollar signs in no time.

So, buckle up and let’s explore the ins and outs of how to make your investments work harder for you.

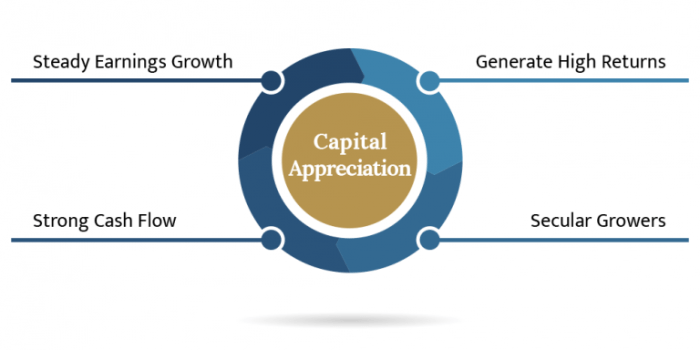

Overview of Capital Appreciation Strategies

Capital appreciation is when the value of an asset increases over time, resulting in a higher price than what was initially paid. This can happen due to various factors such as market demand, improvements in the asset, or overall economic conditions.

Investors often focus on capital appreciation strategies to grow their wealth over the long term. By identifying assets with the potential to increase in value, they aim to maximize their returns and build a solid financial portfolio.

Examples of Assets for Capital Appreciation

- Stocks: Investing in companies with strong growth potential can lead to significant capital appreciation as the stock price rises.

- Real Estate: Properties in desirable locations or undergoing development can experience substantial appreciation in value over time.

- Cryptocurrency: Digital currencies like Bitcoin have shown dramatic capital appreciation, attracting investors seeking high returns.

Types of Capital Appreciation Strategies

When it comes to making those big bucks in the stock market, you gotta have some solid strategies up your sleeve. Let’s dive into a few types of capital appreciation strategies that can help you grow your moolah!

Buy and Hold Strategy

So, you wanna play the long game, huh? The buy and hold strategy is all about picking some juicy stocks and holding onto them for the long haul. You gotta have some serious patience for this one, but if you believe in the companies you invest in, it can pay off big time in the end.

Growth Investing

Who doesn’t wanna see their money grow, am I right? Growth investing is all about picking those high-flying companies that are expected to grow at a rapid pace. You’re basically betting on the future success of these companies, so you better do your homework and pick wisely.

Value Investing vs. Growth Investing

Alright, so here’s the deal – value investing is more about finding those undervalued gems in the market. You’re looking for companies that are trading below their intrinsic value, so you can swoop in and make a profit when the market catches on. On the other hand, growth investing is all about those high-growth potential stocks that might not be cheap, but have the potential to skyrocket in value. It’s like choosing between a slow and steady tortoise or a fast and furious hare – both can win the race, but in different ways.

Factors Influencing Capital Appreciation

When it comes to boosting that capital appreciation, there are a few key factors that can make or break your game. Let’s dive into how market conditions, economic indicators, and company performance play a major role in determining the success of your capital appreciation strategies.

Market Conditions affecting Capital Appreciation

Market conditions can be a real game-changer when it comes to capital appreciation. Factors like supply and demand, investor sentiment, geopolitical events, and overall economic health can all impact how your investment grows. Keep an eye on these factors to stay ahead of the curve and maximize those gains.

Impact of Economic Indicators on Capital Appreciation Strategies

Economic indicators are like the secret sauce to your capital appreciation strategies. Pay attention to key indicators like GDP growth, inflation rates, interest rates, and employment numbers. These indicators can give you valuable insights into the health of the economy and help you make informed decisions to boost your capital appreciation game.

Company Performance and its Influence on Capital Appreciation

When it comes to capital appreciation, company performance is a major player. Keep tabs on a company’s financial health, revenue growth, profitability, and market position. A solid company performance can lead to higher stock prices and increased capital appreciation. On the flip side, poor performance can drag down your gains faster than you can say “sell!”

Risk Management in Capital Appreciation Strategies

When it comes to capital appreciation strategies, managing risks is crucial to ensure long-term success. In this section, we will explore the role of diversification in risk management, how leverage can impact strategies, and specific risk mitigation techniques.

Diversification for Risk Management

Diversification plays a key role in managing risks in capital appreciation strategies. By spreading investments across different asset classes, industries, or geographic regions, investors can reduce the impact of negative events on their portfolio. This helps to minimize the overall risk and volatility, ultimately improving the chances of achieving capital appreciation over time.

Impact of Leverage

Leverage can significantly impact capital appreciation strategies by amplifying both gains and losses. While leverage can potentially enhance returns, it also increases the level of risk involved. If investments move against the investor, the losses can be magnified, leading to significant setbacks. Therefore, it is essential to carefully manage leverage and consider the associated risks when implementing capital appreciation strategies.

Risk Mitigation Techniques

There are several risk mitigation techniques specifically tailored to capital appreciation strategies. One common approach is setting stop-loss orders, which automatically sell a security when it reaches a predetermined price. This helps limit potential losses and protect gains. Another technique is using options contracts to hedge against downside risk, providing a level of protection in volatile markets. Additionally, maintaining a balanced and diversified portfolio can also help mitigate risks and enhance long-term returns.