Alright, buckle up because we’re diving into the world of compound interest investments! This topic is about to blow your mind with its potential for making that sweet cash flow. Get ready to learn how your money can work for you in ways you never imagined!

Now, let’s break down the nitty-gritty details of how compound interest investments can take your financial game to the next level.

Definition of Compound Interest Investments

Compound interest investments are like the gift that keeps on giving, but in the financial world. It’s all about earning interest on both the initial investment and the interest that accumulates over time. This means your money can grow faster and faster as time goes on.

How Compound Interest Works for Investment Purposes

When you invest money with compound interest, you’re basically letting your money work for you. The interest you earn gets added back to your initial investment, creating a bigger base for the next round of interest. This cycle repeats and accelerates the growth of your investment over time.

- Let’s say you invest $1,000 at a 5% annual interest rate. After the first year, you’ll earn $50 in interest, making your total investment $1,050.

- Now, in the second year, you’ll earn 5% interest on $1,050, which is $52.50. Your total investment grows to $1,102.50.

- As time goes on, your investment keeps growing exponentially, thanks to the power of compound interest.

Benefits of Compound Interest Investments

Investing in compound interest is like planting seeds in a money garden that grows over time. Your money makes money, and that’s where the magic happens. Let’s dive into the benefits of compound interest investments and see why it’s a smart move for long-term wealth building.

1. Higher Returns Over Time

When you invest in compound interest, your money snowballs and grows exponentially. The interest you earn starts earning its own interest, leading to a compounding effect. Over time, you’ll see significant growth in your investment compared to simple interest investments.

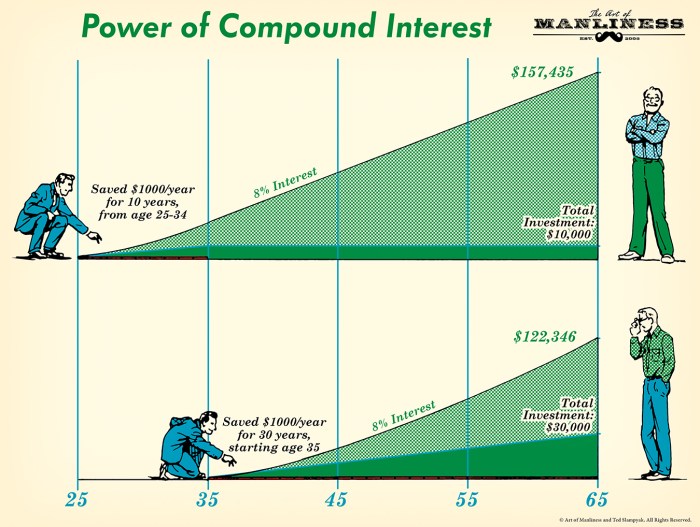

2. Time is Your Best Friend

Compound interest thrives on time. The longer you let your money sit and grow, the more it will multiply. Starting early gives you a huge advantage, as even small investments can turn into substantial wealth over time.

3. Diversification and Risk Management

Investing in compound interest allows you to diversify your portfolio and spread your risk across different asset classes. This helps in minimizing losses and maximizing gains, ensuring a more stable and secure investment strategy.

4. Long-Term Wealth Accumulation

Compound interest is a powerful tool for building long-term wealth. By reinvesting your earnings, you can harness the full potential of compounding and watch your investment portfolio grow steadily over the years. It’s all about patience and consistency in nurturing your money tree.

5. Tax Benefits

Certain compound interest investments come with tax advantages, such as retirement accounts like 401(k) or IRAs. These tax-deferred accounts allow your money to grow without being taxed immediately, giving you more capital to compound over time.

6. Automatic Growth

With compound interest investments, your money grows on autopilot. You don’t have to actively manage your investments constantly. Just sit back, relax, and watch your wealth grow steadily over time without much effort on your part.

Strategies for Maximizing Compound Interest Returns

Compound interest investments can be a great way to grow your money over time, but maximizing your returns requires some strategic planning. By understanding the power of compounding and implementing smart investment strategies, you can make the most out of your investment. Here are some key strategies to help you optimize your compound interest returns:

Reinvest Earnings

When you earn interest on your initial investment, instead of cashing out, consider reinvesting those earnings back into the investment. This will allow you to earn interest on your interest, leading to exponential growth over time. As your investment grows, so will your returns, thanks to the power of compounding.

Diversify Your Portfolio

Diversification is key to managing risk and maximizing returns. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of volatility in any one area. This can help protect your investments while still allowing you to benefit from compound interest growth.

Regularly Contribute to Your Investments

Consistently adding money to your investment portfolio can help accelerate compound interest growth. By making regular contributions, you can take advantage of dollar-cost averaging, which can help smooth out market fluctuations and potentially increase your overall returns over time.

Monitor and Adjust Your Investments

It’s important to regularly review your investment portfolio and make adjustments as needed. Keep an eye on market trends, interest rates, and the performance of your investments. By staying informed and proactive, you can make strategic changes to maximize your compound interest returns.

Take Advantage of Employer Matching Programs

If your employer offers a retirement savings plan with a matching contribution, take full advantage of this benefit. Employer matching programs essentially provide free money towards your investments, helping to boost your compound interest returns without any additional effort on your part.

Risks and Considerations with Compound Interest Investments

When it comes to investing in compound interest, there are some risks and considerations you need to keep in mind to make sure you’re making the right moves. Let’s break it down!

Potential Risks Associated with Compound Interest Investments

- Market Volatility: Fluctuations in the market can impact the value of your investments.

- Inflation: The rate of inflation can erode the real value of your returns over time.

- Liquidity Risk: Some investments may not be easily converted to cash when needed.

Factors Impacting the Effectiveness of Compound Interest

Time horizon, interest rate, and the frequency of compounding can all affect how effective compound interest investments are in growing your wealth.

Tips for Mitigating Risks while Investing in Compound Interest

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk.

- Regularly Monitor Your Investments: Stay informed about market trends and adjust your portfolio accordingly.

- Stay Patient: Compound interest works best over the long term, so avoid making impulsive decisions based on short-term fluctuations.