credit card balance vs statement is like, super important when it comes to managing your money, ya know? This guide will totally give you the lowdown on what they are and why you gotta keep an eye on ‘em.

So, buckle up and get ready to dive into the world of credit cards and how to stay on top of your financial game.

Understanding Credit Card Balance vs. Statement

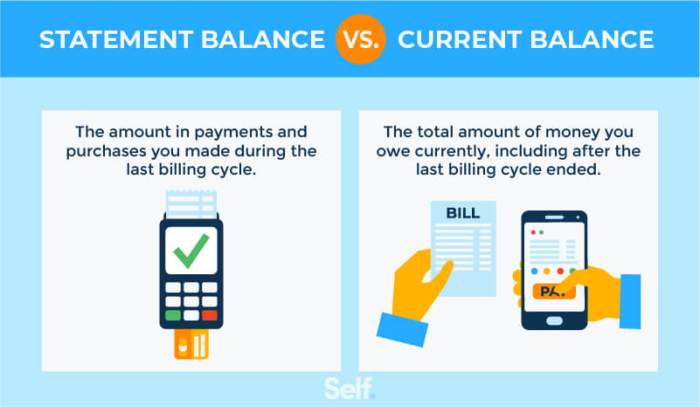

When it comes to credit cards, it’s important to understand the difference between your balance and your statement to manage your finances wisely. Your credit card balance is the total amount you owe to the credit card company, including purchases, fees, and interest. On the other hand, a credit card statement is a summary of your recent transactions, payments, and any charges applied to your account during a specific period, usually a month.

The Relationship Between Balance and Statement

Your credit card balance and statement are closely related but serve different purposes in managing your credit card account. Your balance constantly changes as you make purchases, payments, and incur fees, while your statement provides a snapshot of your account activity for a specific period. It’s essential to review your statement regularly to ensure accuracy and monitor your spending habits. Remember, your statement balance may not always match your current balance due to pending transactions or fees that haven’t been processed yet.

Importance of Monitoring Credit Card Balance and Statement

Regularly checking your credit card balance is crucial to ensure that you are aware of how much you owe and can avoid overspending. It helps you stay on top of your finances and prevent any surprises when it comes time to pay off your balance.

Checking your credit card balance:

It’s important to monitor your credit card balance to track your spending habits and ensure you are not exceeding your budget. By keeping an eye on your balance, you can make informed decisions about future purchases and avoid unnecessary debt.

Reviewing your credit card statement:

Looking over your credit card statement each month allows you to verify all your transactions and detect any unauthorized charges. It helps you identify any errors or fraudulent activity early on, giving you the opportunity to dispute them promptly.

Managing finances effectively:

By monitoring both your credit card balance and statement regularly, you can maintain control over your financial health. It enables you to budget wisely, plan for upcoming expenses, and avoid falling into debt traps. Ultimately, staying vigilant about these aspects helps you stay financially responsible and secure.

Factors Influencing Credit Card Balance and Statement Discrepancies

When it comes to discrepancies between your credit card balance and statement, several factors can come into play. Understanding these factors can help you manage your finances more effectively and avoid unnecessary fees or charges.

Common Reasons for Discrepancies

- Timing of Transactions: Transactions made close to the statement closing date may not reflect on the current statement, leading to differences in balances.

- Returns and Refunds: Refunded purchases may not be reflected on the statement immediately, causing a temporary imbalance.

- Unauthorized Charges: Fraudulent activity or unauthorized charges can result in discrepancies between the balance and statement amounts.

Pending Transactions and Their Impact

- Pending transactions are charges that have been authorized but not yet posted to your account. These can affect your available credit and balance until they are fully processed.

- While pending transactions may not appear on your current statement, they can impact your overall credit card balance and available credit.

Impact of Interest Charges and Fees

- Interest Charges: Accrued interest on outstanding balances can cause discrepancies between the current balance and the statement balance.

- Annual Fees and Late Payment Fees: Additional fees charged by the credit card issuer can also contribute to variations in the balance and statement amounts.

- Cash Advance Fees: Fees incurred for cash advances or other transactions can further impact the overall balance on your credit card statement.

Tips for Reconciling Credit Card Balance with Statement

When it comes to reconciling your credit card balance with the statement, it’s essential to follow a systematic approach to ensure accuracy and avoid any discrepancies that may impact your financial tracking. Here are some tips to help you navigate this process smoothly.

Step-by-Step Guide

- Start by comparing the transactions on your credit card statement with your recent purchases and payments.

- Check for any pending transactions that may not have been included in the statement yet.

- Calculate the total amount of your credit card balance by adding up all your purchases, payments, fees, and interest charges.

- Verify that the total matches the balance stated on your credit card statement.

Best Practices for Resolving Differences

- If you notice any discrepancies between your balance and the statement, double-check all transactions and payments for accuracy.

- Contact your credit card issuer to inquire about any unclear charges or missing payments that may be causing the difference.

- Keep records of all communications with your credit card issuer for future reference.

Ensuring Accuracy for Financial Tracking

- Regularly monitor your credit card transactions and statements to stay on top of your financial activity.

- Set up alerts for large transactions or unusual activity that may indicate fraud or errors.

- Review your credit card statements thoroughly each month to spot any discrepancies early and address them promptly.