Yo, peep this – the credit card debt snowball method is about to take you on a wild ride through the world of financial freedom. Get ready for a rollercoaster of a journey that will have you saying ‘cha-ching’ in no time!

Now, let’s dive into the nitty-gritty details of how this method works and how it can help you crush that pesky credit card debt once and for all.

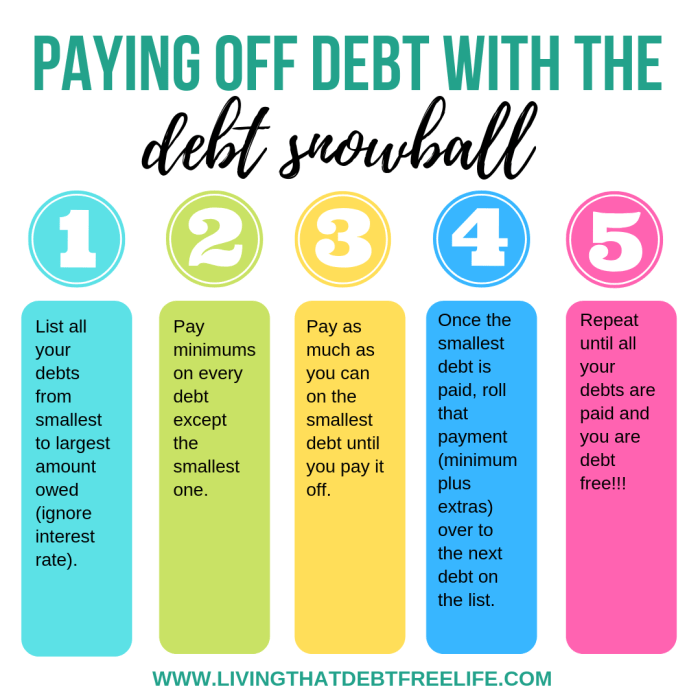

Overview of Credit Card Debt Snowball Method

The credit card debt snowball method is a debt reduction strategy where you pay off your debts from smallest to largest, regardless of interest rates. This method focuses on building momentum by starting with small victories and gaining motivation to tackle larger debts.

Origin of the Snowball Method

The snowball method was popularized by personal finance expert Dave Ramsey. He introduced this strategy as part of his Financial Peace University program to help individuals get out of debt and achieve financial freedom.

Key Principles of the Snowball Method

- Start by listing all your debts from smallest to largest amount owed.

- Make minimum payments on all debts except the smallest one.

- Allocate any extra funds towards paying off the smallest debt first.

- Once the smallest debt is paid off, roll that payment amount into the next smallest debt.

- Repeat this process until all debts are paid off.

Benefits of Using the Snowball Method

- Provides a sense of accomplishment by paying off smaller debts quickly.

- Boosts motivation to continue the debt repayment journey.

- Creates a clear and structured plan for getting out of debt.

- Helps in building healthy financial habits for the future.

Steps to Implement the Credit Card Debt Snowball Method

To kick off the credit card debt snowball method, you gotta get your game plan ready and follow these steps to start crushing that debt!

List Debts from Smallest to Largest

When listing your debts, start small and work your way up to the big boys. This means ranking your credit card debts from the smallest balance to the largest. It’s like lining up your opponents in a video game – take down the weaker ones first!

- Start by listing all your credit card debts with their outstanding balances.

- Arrange them from smallest to largest balance.

- This helps you tackle the smaller debts quickly and gain momentum.

Allocate Payments to Each Debt

Once you’ve got your list sorted, it’s time to start allocating your payments strategically. Here’s how you can do it:

- Make minimum payments on all your debts to avoid late fees and penalties.

- Take any extra cash you have and put it towards paying off the smallest debt first.

- Once the smallest debt is paid off, roll that payment amount into the next debt on your list.

- Repeat this process until you’ve knocked out all your credit card debts.

Stay Motivated Throughout the Process

Staying motivated is key to winning the credit card debt snowball game. Here are some strategies to keep you pumped up:

“Every time you pay off a debt, celebrate your victory! Treat yo’self to something small but satisfying.”

- Track your progress visually by creating a debt payoff chart or using a debt repayment app.

- Find an accountability partner to cheer you on and keep you focused on your goal.

- Reward yourself for hitting milestones along the way, like every $1,000 of debt paid off.

Comparison with Other Debt Repayment Strategies

When it comes to tackling debt, there are several strategies to choose from. One popular method often compared to the snowball method is the avalanche method. Let’s take a closer look at how these two approaches differ and when one might be more advantageous than the other.

Snowball Method vs. Avalanche Method

The snowball method involves paying off debts starting with the smallest balance first, regardless of interest rate, while making minimum payments on all other debts. On the other hand, the avalanche method focuses on paying off debts with the highest interest rates first, potentially saving money on interest payments in the long run.

- Pros of Snowball Method:

- Provides a psychological boost by quickly eliminating smaller debts.

- Helps build momentum and motivation to continue paying off larger debts.

- Cons of Snowball Method:

- May result in paying more interest over time compared to the avalanche method.

- Not the most cost-effective approach for those with high-interest debts.

Situations Where Snowball Method Works Best

The snowball method can be particularly effective for individuals who need a confidence boost early on in their debt repayment journey. It can also work well for those with multiple smaller debts that feel overwhelming and are looking for a way to simplify their repayment process.

Scenarios Where Snowball Method is Not Ideal

If you have debts with significantly higher interest rates compared to others, the avalanche method may help save more money in the long term. Additionally, individuals who are solely focused on minimizing interest costs and are not concerned about the psychological benefits of quick wins may find the snowball method less appealing.

Tips and Tricks for Success with the Credit Card Debt Snowball Method

When it comes to tackling credit card debt using the snowball method, there are some key tips and tricks that can help you stay on track and accelerate your debt repayment journey.

Stay Motivated and Consistent

- Keep your eye on the prize: visualize your debt-free future to stay motivated.

- Set small, achievable goals to celebrate your progress along the way.

- Consistency is key: make your debt payments a non-negotiable part of your budget.

Avoid Common Pitfalls

- Avoid accumulating new debt while paying off existing balances.

- Don’t skip payments or pay less than the minimum amount due.

- Avoid using credit cards for unnecessary purchases during your debt repayment journey.

Customize the Method to Fit Your Situation

- Consider prioritizing high-interest debts first for maximum savings.

- Adjust the order of repayment based on your financial goals and needs.

- Explore balance transfer options or debt consolidation if it makes sense for your situation.

Real-Life Success Stories

- Emily managed to pay off $10,000 in credit card debt in just 12 months using the snowball method.

- John combined the snowball method with a side hustle and paid off his debts three years ahead of schedule.

- Sarah stayed committed to her debt repayment plan and became debt-free in two years, inspiring her friends to do the same.