So, you wanna know all about your credit history report, huh? Well, buckle up because we’re diving into the nitty-gritty details that’ll have you understanding this financial document like a pro.

From what it contains to how it’s used, we’re breaking it all down for you.

Understanding Credit History Report

When it comes to your credit history report, it’s like your financial report card that tells people how responsible you are with money. It’s important because it can affect your ability to get loans, rent an apartment, or even get a job.

Information in a Credit History Report

- Your personal information like name, address, and social security number.

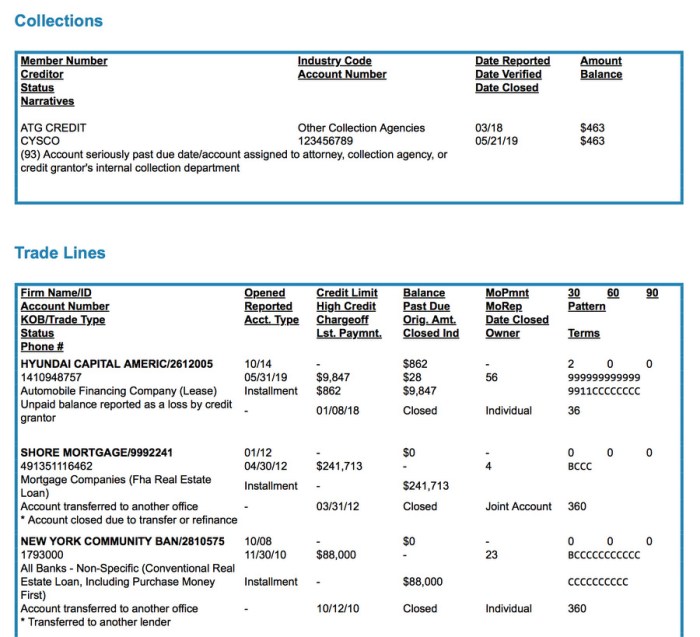

- A list of your credit accounts and payment history.

- Any bankruptcies, foreclosures, or other negative marks on your credit.

Uses of Credit History Reports

- Lenders: They use your credit history to determine if you’re a risky borrower and decide whether to approve your loan application.

- Employers: Some employers check credit reports to see if you’re responsible and trustworthy, especially for jobs that involve handling money or sensitive information.

- Landlords: Landlords may look at your credit report to decide if you’ll be a reliable tenant who pays rent on time.

Obtaining a Credit History Report

When you need to get your hands on your credit history report, there are a few ways to go about it. Here’s how you can make it happen.

Requesting from Credit Bureaus

- Equifax, Experian, and TransUnion are the major credit bureaus that you can request your credit history report from.

- You can visit their websites to request the report online, or you can contact them via phone or mail.

Methods of Obtaining

- Online: The quickest and most convenient way to get your credit history report is by requesting it online through the credit bureaus’ websites.

- Mail: You can also send a written request via mail to the credit bureaus, but this method may take longer to receive your report.

- Phone: If you prefer speaking to a representative, you can call the credit bureaus to request your credit history report over the phone.

Frequency of Requesting Free Credit Reports

- By federal law, you are entitled to one free credit history report from each of the three major credit bureaus every 12 months.

- To ensure accuracy and monitor for any suspicious activity, it’s recommended to request one report from a different bureau every four months.

Interpreting a Credit History Report

Understanding your credit history report is crucial for managing your financial health. Here are some key components to look out for when interpreting your report:

Credit Score

Your credit score is a three-digit number that represents your creditworthiness. The higher the score, the better your credit standing. A good credit score can open doors to better interest rates and loan approval.

Payment History

Your payment history shows how you’ve managed your debts in the past. It includes information on whether you’ve made payments on time, missed any payments, or defaulted on loans. A positive payment history can boost your credit score.

Credit Inquiries

Credit inquiries are records of who has accessed your credit report. Too many inquiries in a short period can signal to lenders that you are desperate for credit, which may negatively impact your credit score.

Analyzing and interpreting the information in your credit history report involves looking for any errors, identifying areas for improvement, and understanding how your financial habits affect your credit score. Here are some tips on how to improve your credit history based on your report’s findings:

- Pay your bills on time to establish a positive payment history.

- Keep your credit utilization ratio low by not maxing out your credit cards.

- Monitor your credit report regularly to check for errors and fraudulent activity.

- Avoid opening multiple new credit accounts in a short period.

- Negotiate with creditors to settle any outstanding debts or payment arrangements.

Disputing Errors on a Credit History Report

If you spot inaccuracies or errors on your credit history report, it’s essential to take immediate action to rectify the situation. Disputing errors can help maintain the accuracy of your credit profile and prevent any negative impact on your credit score.

Importance of Regularly Reviewing and Monitoring Credit History Reports

Regularly reviewing and monitoring your credit history reports is crucial to ensuring the information is accurate and up-to-date. By keeping an eye on your reports, you can quickly identify any discrepancies or errors that may arise. This proactive approach allows you to take necessary steps to dispute and correct any inaccuracies before they escalate into a bigger issue.

Strategies for Resolving Disputes with Credit Bureaus and Creditors

- Initiate a formal dispute: Contact the credit bureau in writing to dispute any errors on your report. Provide supporting documents or evidence to strengthen your case.

- Communicate with creditors: Reach out to the creditors that have reported inaccurate information and request corrections. Keep a record of all communications for future reference.

- Follow up regularly: Stay engaged in the dispute resolution process by following up with both the credit bureaus and creditors to ensure timely resolution.

- Consider seeking legal help: If the dispute remains unresolved, consider seeking assistance from a credit repair organization or legal professional specialized in credit issues.