Alright peeps, when it comes to paying off your debts, you’ve got two main strategies: debt avalanche and snowball method. These methods are like your secret weapons in the battle against debt. Get ready to dive into the nitty-gritty and figure out which one suits you best!

Now, let’s break it down – debt avalanche vs snowball method, which one will help you kick debt’s butt?

Introduction to Debt Repayment Methods

When it comes to paying off debt, two popular methods that people often use are the debt avalanche and debt snowball strategies. These methods provide a structured approach to tackling debts and can help individuals become debt-free faster.

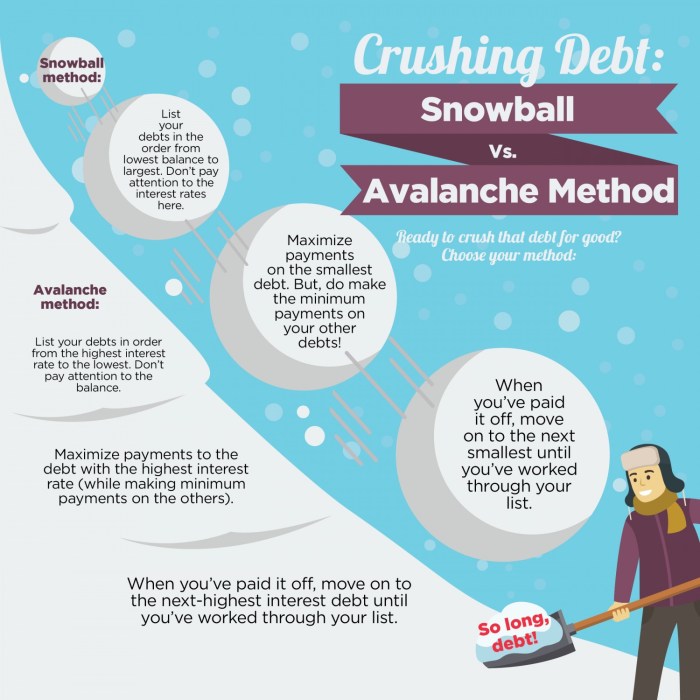

The debt avalanche method involves paying off debts with the highest interest rates first, while making minimum payments on all other debts. This approach focuses on saving money in the long run by reducing the amount of interest paid over time.

On the other hand, the debt snowball method involves paying off debts from smallest to largest regardless of interest rate. This method aims to build momentum and motivation by quickly eliminating smaller debts, which can lead to a sense of accomplishment and keep individuals motivated to continue paying off larger debts.

Key Differences Between Debt Avalanche and Snowball Approaches

- The debt avalanche method focuses on paying off debts with the highest interest rates first, saving money on interest payments in the long run.

- The debt snowball method focuses on paying off smaller debts first to build momentum and motivation.

- While the debt avalanche method may save more money overall, the debt snowball method can provide a psychological boost by eliminating debts quickly.

Debt Avalanche Method

When it comes to tackling your debts like a boss, the debt avalanche method is one savvy approach to consider. This method involves strategically paying off debts based on interest rates, starting with the highest interest rate first.

How Debt Avalanche Method Works

So, here’s the lowdown on how it all goes down with the debt avalanche method:

- List out all your debts from highest interest rate to lowest.

- Make minimum payments on all debts except the one with the highest interest rate.

- Put all your extra cash towards paying off the debt with the highest interest rate.

- Once that debt is paid off, move on to the next one with the next highest interest rate.

- Repeat this process until you’re debt-free and feeling fly!

Benefits and Drawbacks

Now, let’s break it down like a pro and talk about the perks and pitfalls of the debt avalanche method:

- Benefits: By focusing on high-interest debts first, you can save money in the long run by cutting down on interest payments. Plus, you’ll feel like a financial rockstar as you see those high-interest debts disappear.

- Drawbacks: The debt avalanche method can take longer to see progress on smaller debts, which might test your patience. It also requires strict discipline to stick to the plan and resist the urge to splurge.

Debt Snowball Method

The debt snowball method is a debt repayment strategy where you focus on paying off your smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, you roll that payment into the next smallest debt, creating a snowball effect that helps you tackle larger debts over time.

Comparison with Debt Avalanche Method

The debt snowball method differs from the debt avalanche method in that it prioritizes debts based on balance size, not interest rates. While the debt avalanche method focuses on paying off debts with the highest interest rates first, the debt snowball method prioritizes quick wins by eliminating smaller debts first. This can provide a psychological boost and motivation to continue the debt repayment journey.

Real-Life Scenarios for Debt Snowball Method

- In a scenario where you have multiple small debts with varying interest rates, the debt snowball method can be effective in providing a sense of accomplishment and progress as you eliminate each debt.

- If you are struggling with debt and need a method that offers quick wins to stay motivated, the debt snowball method may be a better fit than the debt avalanche method.

- For individuals who prefer a straightforward approach to debt repayment without worrying about interest rates, the debt snowball method can offer a clear and manageable strategy.

Which Method is Right for You?

Deciding between the debt avalanche and snowball methods can be tough, but the right choice depends on your financial goals and personal preferences. Let’s break it down to help you figure out which one suits you best.

Scenario

Imagine you have two types of debts: a high-interest credit card balance of $5,000 and a lower-interest personal loan of $10,000. If you value saving money on interest in the long run and are motivated by seeing big wins early on, the debt avalanche method might be the way to go. On the other hand, if you prefer quick wins to stay motivated and are more concerned about simplifying your debt repayment process, the debt snowball method could be a better fit.

Comparison Table: Debt Avalanche vs. Debt Snowball

| Debt Repayment Method | Pros | Cons |

|---|---|---|

| Debt Avalanche | • Saves more money on interest in the long run • Tackles high-interest debt first |

• May take longer to see progress • Requires strict discipline to stick with the plan |

| Debt Snowball | • Provides quick wins for motivation • Simplifies debt repayment process |

• May cost more in interest over time • Does not prioritize high-interest debt |

Factors to Consider

- Interest Rates: Compare the interest rates on your debts and consider how much you could save by paying off high-interest debt first.

- Motivation: Think about what keeps you motivated. Are you more encouraged by quick wins or long-term savings?

- Financial Goals: Consider your overall financial goals and how each method aligns with your objectives.

- Personal Discipline: Assess your ability to stick to a strict repayment plan and adjust based on your self-discipline.