Yo, check it – we’re diving into the world of debt reduction strategies. Get ready for some lit tips and tricks to help you break free from the chains of debt and secure that bag!

Alright, let’s get real about understanding what debt reduction strategies are all about and why they’re clutch for your financial game.

Understanding Debt Reduction Strategies

Debt reduction strategies are methods or approaches used to pay off debt efficiently and effectively. These strategies are important because they help individuals or organizations manage their debt, reduce financial stress, and work towards achieving financial freedom.

Benefits of Implementing Debt Reduction Strategies

- Lower Interest Payments: By focusing on paying off high-interest debt first, individuals can save money on interest payments over time.

- Increased Savings: As debt decreases, individuals can allocate more funds towards savings and investments.

- Improved Credit Score: Paying off debt on time and reducing overall debt levels can positively impact credit scores.

- Financial Freedom: Debt reduction strategies can help individuals break free from the cycle of debt and achieve financial independence.

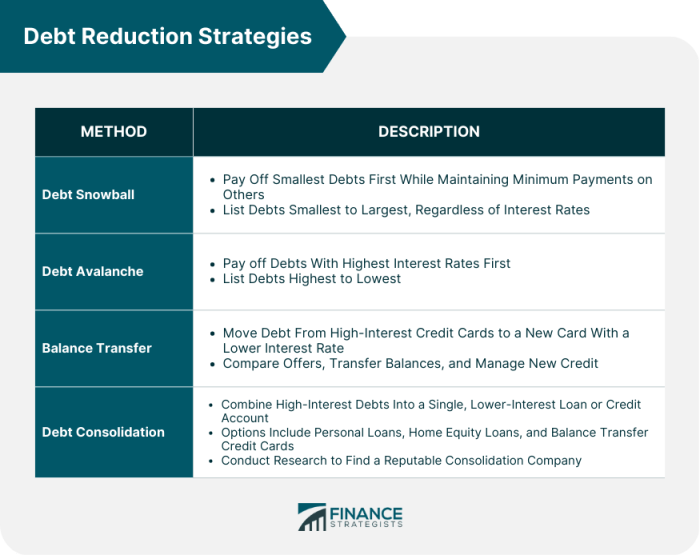

Examples of Common Debt Reduction Strategies

- Snowball Method: This strategy involves paying off the smallest debt first, then using the freed-up funds to tackle larger debts.

- Avalanche Method: With this approach, individuals focus on paying off debts with the highest interest rates first to minimize overall interest costs.

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify payments and reduce overall interest expenses.

- Budgeting and Cutting Expenses: By creating a budget and cutting unnecessary expenses, individuals can free up more money to put towards debt repayment.

Creating a Budget

Budgeting plays a crucial role in reducing debt as it helps individuals track their income and expenses, identify areas where they can cut back, and allocate funds towards paying off debts strategically.

How to Create a Budget to Effectively Reduce Debt

Creating a budget for debt reduction involves the following steps:

- List all sources of income: Include your salary, side hustle earnings, or any other money coming in regularly.

- Track your expenses: Record all your expenses, from bills to daily purchases, to understand where your money is going.

- Identify areas to cut back: Analyze your expenses to pinpoint areas where you can reduce spending, such as dining out or subscription services.

- Allocate funds for debt repayment: Set aside a specific amount each month to pay off debts, prioritizing high-interest debts first.

- Monitor and adjust: Regularly review your budget to see if you are sticking to it and make adjustments as needed to stay on track.

Tips on Sticking to a Budget for Debt Reduction

- Avoid unnecessary expenses: Cut back on non-essential purchases to free up more money for debt repayment.

- Use cash or debit cards: Leave credit cards at home to avoid impulse spending and stay within your budget.

- Set realistic goals: Break down your debt repayment goals into manageable chunks to stay motivated and track progress.

- Reward yourself: Celebrate small victories along the way to debt reduction to maintain motivation and stay focused on your financial goals.

- Seek support: Share your budgeting and debt reduction goals with friends or family for accountability and encouragement.

Snowball vs. Avalanche Method

When it comes to tackling debt, two popular strategies are the snowball and avalanche methods. Let’s take a closer look at how they differ and which one might work best for you.

The snowball method involves paying off your debts from smallest to largest, regardless of interest rates. You make minimum payments on all debts except the smallest one, which you tackle aggressively until it’s paid off. Once that debt is cleared, you move on to the next smallest debt, and so on. This method can provide a psychological boost as you see debts being eliminated one by one.

On the other hand, the avalanche method focuses on paying off debts with the highest interest rates first. You make minimum payments on all debts but put any extra money towards the debt with the highest interest rate. This method saves you money in the long run by reducing the amount of interest you pay over time.

Benefits of Snowball Method

- Provides a sense of accomplishment by clearing smaller debts quickly.

- Boosts motivation to continue tackling larger debts.

- Offers a psychological advantage by seeing progress sooner.

Benefits of Avalanche Method

- Saves money in the long run by reducing overall interest payments.

- Prioritizes debts with higher interest rates, leading to faster debt reduction.

- Helps you become debt-free more efficiently by focusing on high-cost debts first.

Scenarios for Snowball Method

- If you have multiple small debts and want to see quick wins.

- If you need a psychological boost to stay motivated during debt repayment.

- If you prefer a structured approach that simplifies the debt payoff process.

Scenarios for Avalanche Method

- If you have debts with high-interest rates that are costing you a lot in interest payments.

- If you are focused on reducing the total amount of interest paid over time.

- If you want to pay off debts strategically based on interest costs rather than balance size.

Negotiating with Creditors

When it comes to reducing your debt, negotiating with creditors can play a crucial role in finding a solution that works for both parties. By effectively communicating with your creditors, you may be able to secure better repayment terms and lower interest rates, ultimately helping you pay off your debt faster.

Tips for Effective Negotiation

- Be proactive: Reach out to your creditors before you fall behind on payments. They may be more willing to work with you if you communicate early.

- Know your finances: Have a clear understanding of your financial situation and be prepared to explain your challenges and limitations to your creditors.

- Propose a plan: Come to the negotiation table with a realistic repayment plan that you can commit to. This shows your creditors that you are serious about resolving your debt.

- Stay calm and polite: Keep a professional and respectful tone during negotiations. Being aggressive or hostile can hinder the process.

- Consider seeking help: If you find negotiations too challenging, consider working with a reputable credit counseling agency or financial advisor to assist you.

Impact of Successful Negotiations

Negotiating successfully with your creditors can have a significant impact on your debt reduction journey. By securing lower interest rates, reduced fees, or extended repayment terms, you can make your debt more manageable and accelerate your path to financial freedom. Additionally, successful negotiations can help you avoid bankruptcy or other extreme measures, preserving your credit score and financial stability in the long run.

Debt Consolidation

Debt consolidation is a strategy where you combine multiple debts into a single loan or payment, typically with a lower interest rate. This can make it easier to manage your debt and potentially reduce the overall amount you owe.

Pros and Cons of Debt Consolidation

- Pro: Simplifies your finances by combining multiple payments into one.

- Pro: May lower your interest rate, saving you money in the long run.

- Pro: Can help improve your credit score if you make timely payments.

- Con: May come with fees or costs associated with the consolidation process.

- Con: If you use consolidation as a band-aid solution without changing spending habits, you could end up in more debt.

When Debt Consolidation may be a Viable Option

Debt consolidation may be a good option if you have multiple high-interest debts, such as credit card debt, and are struggling to keep up with payments. It can also be beneficial if you can qualify for a lower interest rate than what you are currently paying on your debts. However, it’s important to carefully consider the terms of the consolidation loan and ensure you have a plan in place to avoid accumulating more debt in the future.

Increasing Income Sources

In order to accelerate debt reduction, it’s essential to find ways to increase your income. Having additional sources of income can make a significant impact on your ability to pay off debts faster and more efficiently.

Side Hustles and Part-Time Jobs

- One popular way to increase income is by taking on a side hustle. This could involve freelancing, tutoring, pet sitting, or driving for a ride-sharing service.

- Another option is to look for a part-time job in addition to your full-time job. This could include working retail, bartending, or delivering food.

- Consider monetizing a skill or hobby you have, such as photography, graphic design, or crafting. You could sell your products or services online to bring in extra cash.