Yo, ready to talk about dividend growth investing? It’s all about making that money by investing in companies that keep increasing their dividends. Get ready for some juicy deets!

Let’s break down what it means and why it’s a hot topic in the investment world.

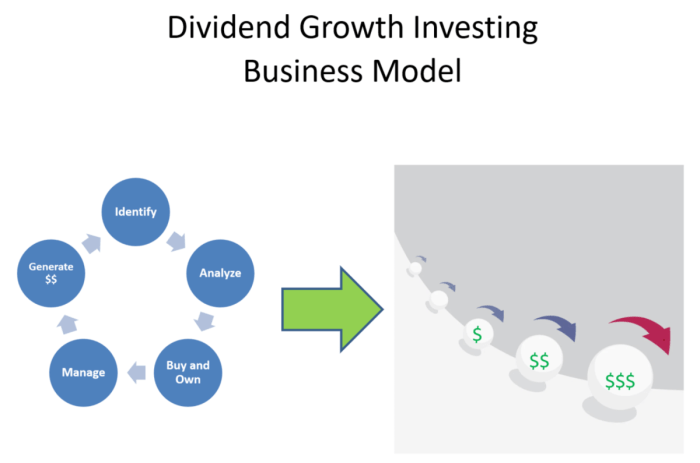

Introduction to Dividend Growth Investing

Alright, so dividend growth investing is basically when you put your money into companies that are always upping the amount they pay out to their investors over time. It’s like watching your allowance get bigger and bigger every month – pretty cool, right?

These companies are like the real MVPs of the stock market because they show that they’re not messing around when it comes to taking care of their shareholders. They’re all about that steady growth and making sure you get a nice chunk of change in your pocket.

Popular Companies for Dividend Growth Investors

- Apple: Yup, the tech giant isn’t just about iPhones and MacBooks – they also know how to keep those dividends climbing.

- Johnson & Johnson: This healthcare powerhouse is all about keeping investors happy with their consistent dividend increases.

- Coca-Cola: Who doesn’t love a good Coke? Well, dividend growth investors certainly do, especially when they see those payouts going up year after year.

Benefits of Dividend Growth Investing

When it comes to investing, dividend growth investing offers several advantages that can benefit investors in the long run.

Source of Passive Income

One of the key benefits of dividend growth investing is that it provides a consistent source of passive income. By investing in companies that have a history of increasing their dividends over time, investors can enjoy regular dividend payments without having to actively trade or sell their investments.

Comparative Long-Term Returns

Dividend growth stocks have historically shown strong long-term returns compared to other investment strategies. Not only do investors benefit from the dividend payments, but they also have the potential to benefit from capital appreciation as the company grows and increases its dividends over time.

Strategies for Dividend Growth Investing

When it comes to dividend growth investing, there are various strategies that investors can utilize to build a strong portfolio. Evaluating a company’s dividend history and financial health is crucial in making informed decisions. Additionally, selecting the right dividend growth stocks is essential for achieving long-term success.

Different Approaches for Dividend Growth Strategies

- Dividend Aristocrats: Investing in companies that have consistently increased their dividends for at least 25 years.

- Dividend Champions: Focusing on companies with a track record of increasing dividends annually for more than 5 years.

- High Dividend Yield: Choosing stocks with high dividend yields, which may indicate strong cash flow and potential for growth.

Importance of Evaluating a Company’s Dividend History and Financial Health

Before investing in dividend growth stocks, it is essential to assess a company’s dividend history and financial stability. A strong track record of consistent dividend payments and a healthy balance sheet can indicate a company’s ability to continue growing its dividends in the future.

Tips for Selecting Dividend Growth Stocks for a Well-Rounded Portfolio

- Look for companies with a history of increasing dividends year over year.

- Consider the payout ratio to ensure the company can sustain dividend payments.

- Diversify across different sectors to reduce risk and maximize returns.

- Monitor economic trends and company performance to make informed investment decisions.

Risks and Challenges in Dividend Growth Investing

When it comes to dividend growth investing, there are certain risks and challenges that investors need to be aware of to make informed decisions. Economic conditions and market volatility can have a significant impact on dividend-paying stocks, making it crucial to understand how to navigate these potential pitfalls.

Market Volatility and Economic Conditions

Market volatility and economic conditions play a significant role in the performance of dividend-paying stocks. During times of economic uncertainty or market downturns, companies may struggle to maintain their dividend payments. This can lead to a decrease in stock prices and overall returns for investors. It is essential to consider the broader economic landscape when investing in dividend stocks and be prepared for potential fluctuations in the market.

Interest Rate Risks

Changes in interest rates can also pose a risk to dividend growth investors. When interest rates rise, dividend-paying stocks may become less attractive compared to other investment options. This could lead to a decrease in demand for dividend stocks and a subsequent decline in stock prices. Investors should keep a close eye on interest rate movements and adjust their investment strategies accordingly.

Company-specific Risks

Investing in individual dividend-paying stocks comes with company-specific risks. Factors such as poor management decisions, industry disruptions, or financial instability can impact a company’s ability to maintain or grow its dividend payments. Conducting thorough research and diversifying your portfolio can help mitigate these risks and protect your investments.

Strategies to Mitigate Risks

To navigate the risks and challenges of dividend growth investing, investors can employ certain strategies. Diversification is key to spreading risk across different companies and sectors. Regularly reviewing your investments and staying informed about market trends can also help identify potential risks early on. Additionally, setting realistic expectations and maintaining a long-term perspective can help investors weather market fluctuations and achieve their financial goals.

Tools and Resources for Dividend Growth Investors

When it comes to dividend growth investing, having access to the right tools and resources can make a huge difference in your success. These platforms and websites provide essential data and analysis to help investors make informed decisions and maximize their returns.

Dividend Tracking Websites

- Dividend.com: This website offers a comprehensive database of dividend-paying stocks, along with detailed information on dividend history, yield, and growth rates.

- Seeking Alpha: A popular platform that provides in-depth analysis and research on dividend stocks, including expert opinions and trending topics in the market.

- Morningstar: Known for its extensive financial data, Morningstar offers tools to assess a company’s dividend health and sustainability.

Stock Screeners

- Yahoo Finance: Their stock screener allows investors to filter stocks based on dividend yield, payout ratio, and dividend growth history.

- Finviz: A powerful tool for screening dividend stocks based on various criteria such as market cap, sector, and dividend frequency.

Educational Resources

- Investopedia: A go-to resource for beginners and experienced investors alike, offering articles, tutorials, and videos on dividend investing strategies.

- Dividend Growth Investor: A blog dedicated to dividend growth investing, providing insights, case studies, and real-life examples to help investors enhance their knowledge.