Yo, check it out! We’re diving into the world of global investment trends, giving you the lowdown on what’s hot and happening in the financial world. From stocks to cryptocurrencies, we’re breaking it all down with some serious flair.

Now, let’s get into the nitty-gritty details of different investment types and how they’re making waves across the globe.

Global Investment Trends Overview

Investing globally is all the rage right now, with people looking to diversify their portfolios and capitalize on opportunities across different markets. The current landscape is dynamic and ever-changing, influenced by various factors that shape investment trends worldwide.

Key Factors Driving Global Investment Trends

- Rapid Technological Advancements: Innovations in technology are driving investment in sectors like artificial intelligence, renewable energy, and e-commerce.

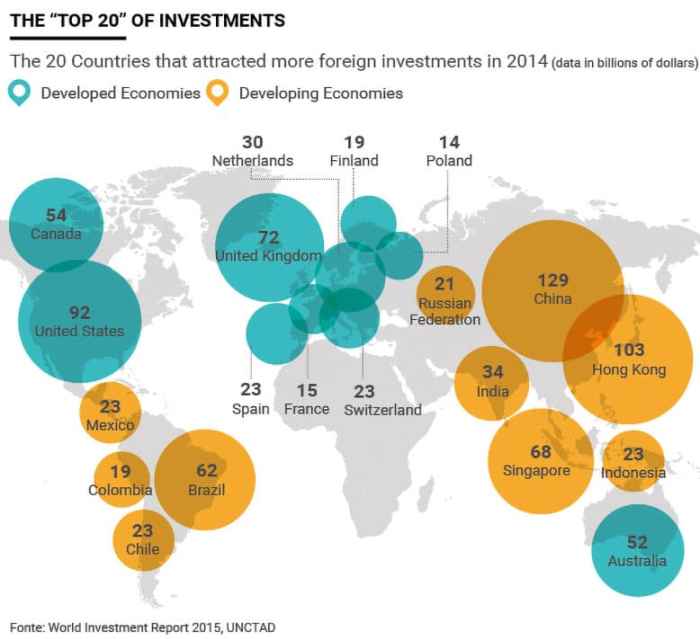

- Emerging Markets Growth: Investors are eyeing emerging economies like China, India, and Brazil for high growth potential and attractive returns.

- Low Interest Rates: With interest rates remaining low in many developed countries, investors are seeking higher returns in riskier assets like stocks and real estate.

- Globalization: Increased interconnectedness of economies has led to cross-border investments and opportunities for international diversification.

Impact of Geopolitical Events on Global Investment Trends

Geopolitical events such as trade wars, political instability, and global health crises can have a significant impact on investment trends worldwide.

Investors often react to geopolitical uncertainties by shifting their assets to safe-haven investments like gold or government bonds.

Trade tensions between major economies can disrupt supply chains and affect the performance of multinational companies, influencing investment decisions.

It’s essential for investors to stay informed about geopolitical developments and their potential impact on the global investment landscape to make informed decisions.

Types of Global Investments

Investing globally offers a wide range of options for investors looking to grow their wealth. From traditional investments like stocks and bonds to newer opportunities like cryptocurrencies, the world of global investing is diverse and dynamic.

Stocks

Stocks represent ownership in a company and can be bought and sold on stock exchanges. Investors can choose from a variety of stocks ranging from large multinational corporations to smaller companies.

Bonds

Bonds are debt securities issued by governments or corporations to raise capital. Investors who buy bonds are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Real Estate

Real estate investments involve purchasing properties such as residential homes, commercial buildings, or land with the expectation of generating rental income or capital appreciation over time. Real estate can provide diversification to an investment portfolio.

Commodities

Commodities include raw materials such as gold, oil, and agricultural products that are traded on commodity exchanges. Investing in commodities can serve as a hedge against inflation and economic uncertainties.

Cryptocurrencies

Cryptocurrencies are digital assets that use cryptography for security and operate independently of central authorities like governments or banks. Popular cryptocurrencies like Bitcoin and Ethereum have gained traction as alternative investment options in recent years.

Global Investment Trends Across Asset Classes

Global investment trends can vary across different asset classes based on factors like economic conditions, geopolitical events, and technological advancements. While traditional investments like stocks and bonds remain popular, emerging opportunities in sectors like cryptocurrencies are reshaping the investment landscape.

Regional Investment Variances

When it comes to global investment trends, different regions around the world have their own unique characteristics and factors that influence investment decisions. Let’s take a closer look at how investment trends vary between regions such as Asia, Europe, North America, and emerging markets.

Asia

Asia is known for its rapidly growing economies, making it an attractive destination for investors looking for high growth potential. Factors such as technological advancements, a young and tech-savvy population, and government initiatives to promote innovation play a significant role in shaping investment decisions in this region. Additionally, the regulatory environment in Asia can vary greatly from country to country, influencing how investors approach opportunities in different markets.

Europe

In Europe, investment trends are influenced by factors such as political stability, economic growth, and the regulatory framework of the European Union. Countries within the EU benefit from a unified market and currency, making it easier for investors to diversify their portfolios across different countries. However, Brexit and other political developments have introduced a level of uncertainty that investors need to consider when making investment decisions in Europe.

North America

North America, particularly the United States, is a major hub for global investments due to its stable economy, strong regulatory environment, and access to capital markets. Factors such as technological innovation, industry trends, and government policies play a crucial role in shaping investment decisions in this region. Additionally, the US-China trade tensions and other geopolitical factors can impact how investors perceive opportunities in North America.

Emerging Markets

Emerging markets offer high growth potential and unique investment opportunities, but they also come with higher risks due to factors such as political instability, currency fluctuations, and regulatory challenges. Investors looking to capitalize on the growth of emerging markets need to carefully assess these risks and consider how regulatory environments in these regions can impact their investment strategies.

Sustainable Investing

Sustainable investing refers to the practice of making investment decisions based on not only financial returns but also environmental, social, and governance (ESG) criteria. This approach aims to generate long-term positive impact on society and the environment while also achieving financial goals.

Examples of Sustainable Investment Strategies

- Impact Investing: Investing in companies, organizations, and funds with the intention to generate measurable social and environmental impact alongside financial returns.

- ESG Integration: Incorporating environmental, social, and governance factors into traditional financial analysis to identify risks and opportunities that may not be captured by financial metrics alone.

- Community Investing: Directing capital to underserved communities or projects that benefit low-income individuals, providing access to affordable housing, healthcare, or education.

Impact of ESG Factors on Global Investment Trends

ESG factors are increasingly becoming key considerations for investors as they recognize the importance of sustainable practices in ensuring long-term financial performance and mitigating risks.

- Enhanced Risk Management: Companies with strong ESG practices are better equipped to manage risks related to climate change, regulatory issues, and social unrest, leading to more sustainable financial performance.

- Improved Corporate Reputation: Embracing sustainable practices can enhance a company’s reputation among consumers, investors, and other stakeholders, ultimately attracting more capital and fostering long-term growth.

- Regulatory Compliance: Increasingly stringent environmental and social regulations worldwide are driving companies to adopt sustainable practices to comply with laws and regulations, reducing legal and reputational risks.