Yo, handling defaulted loans is no joke. It’s like diving into a financial rollercoaster with twists and turns that keep you on the edge of your seat. Get ready to explore the ins and outs of dealing with defaulted loans in a way that’s as cool as it is informative.

So, buckle up and let’s dive into the world of defaulted loans – it’s gonna be a wild ride!

Understanding Defaulted Loans

When it comes to defaulted loans, we’re talking about borrowers who haven’t been keeping up with their payments, leaving financial institutions high and dry. Let’s dive into why this happens and what it means for those who default.

Impact of Defaulted Loans

Defaulted loans can hit financial institutions hard, causing them to lose out on expected payments and interest. This can lead to financial instability and even impact their ability to lend to other borrowers in the future.

Reasons for Loan Defaults

- Loss of income: When borrowers face unexpected job loss or reduced income, it can make it difficult to keep up with loan payments.

- High debt levels: Borrowers who are overwhelmed with debt from multiple sources may struggle to prioritize loan payments.

- Financial emergencies: Unforeseen medical expenses or home repairs can derail a borrower’s ability to make loan payments.

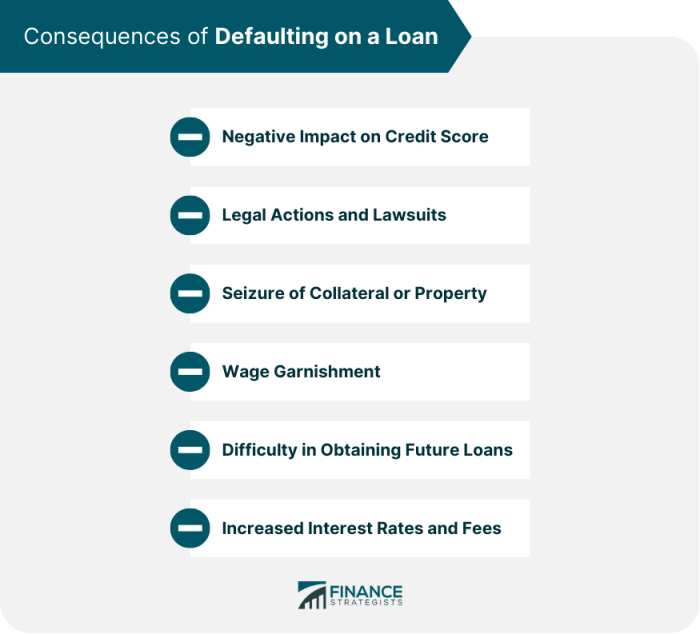

Consequences for Borrowers

- Damage to credit score: Defaulting on a loan can significantly lower a borrower’s credit score, making it harder to qualify for future loans or credit cards.

- Legal action: Financial institutions may take legal action to recover the unpaid debt, leading to potential court judgments or wage garnishment.

- Loss of collateral: In cases where a loan is secured by collateral, such as a car or home, defaulting can result in the loss of the asset used as security.

Handling Defaulted Loans

When it comes to handling defaulted loans, lenders have a few strategies up their sleeves to recover the money owed to them. It’s important for lenders to take action promptly to minimize losses and protect their financial interests.

Recovery Strategies

- One common approach is to work with the borrower to restructure the loan. This could involve adjusting the repayment schedule, interest rates, or even the total amount owed to make it more manageable for the borrower.

- If restructuring is not an option or proves unsuccessful, lenders may resort to legal action to recover the defaulted loan amount. This could include filing a lawsuit, obtaining a court judgment, or even pursuing wage garnishment or asset seizure.

Debt Collection Process

Debt collection for defaulted loans typically involves a series of steps to recover the outstanding amount. This may include sending collection letters, making phone calls, and working with collection agencies to negotiate repayment terms. In some cases, lenders may also choose to sell the debt to a third-party debt collector for a percentage of the total amount owed.

Preventing Loan Defaults

To avoid loan defaults, it is crucial for lenders to take proactive measures to assess credit risk and mitigate potential default risks.

Importance of Credit Risk Assessment

Credit risk assessment plays a vital role in reducing loan defaults by helping lenders evaluate the creditworthiness of borrowers. By analyzing factors such as credit score, income stability, and debt-to-income ratio, lenders can determine the likelihood of a borrower defaulting on a loan.

- Utilize credit reports and scores to evaluate borrower’s creditworthiness.

- Consider the borrower’s income stability and debt-to-income ratio to assess repayment capacity.

- Implement risk-based pricing strategies to adjust interest rates based on credit risk.

Proactive Measures for Mitigating Default Risks

Taking proactive steps can help lenders reduce the chances of loan defaults and minimize potential losses.

- Offer financial education and counseling to borrowers to improve financial literacy and budgeting skills.

- Establish clear communication channels with borrowers to address any financial difficulties or changes in circumstances.

- Implement early intervention strategies to identify and assist borrowers at risk of default before it escalates.

Impact of Defaulted Loans

Defaulted loans can have a significant impact on the overall economy, affecting various sectors and financial institutions. Let’s dive into how these defaulted loans can shape the financial landscape.

Impact on the Credit Market and Interest Rates

When loans are defaulted on, lenders face losses which can lead to a decrease in available credit. This reduction in credit availability can lead to higher interest rates for consumers and businesses seeking loans. It creates a ripple effect in the credit market, making it more challenging for individuals and businesses to access funds.

Management of Portfolios by Financial Institutions

Financial institutions often have strategies in place to manage their portfolios when faced with defaulted loans. They may sell off these loans to debt collection agencies at a discounted rate, in an effort to recover some of the lost funds. Alternatively, they may work with borrowers on repayment plans or restructuring of the loan to mitigate losses. These decisions impact the overall risk management of the institution and its financial health.