Hey there, ready to dive into the world of high-dividend yield stocks? Buckle up as we explore what makes these stocks so attractive and how they can amp up your investment game.

Get ready to uncover the ins and outs of high-dividend yield stocks, from their definition to the top players in the game.

Introduction to High-Dividend Yield Stocks

High-dividend yield stocks are stocks of companies that pay out a high percentage of earnings to shareholders in the form of dividends. These stocks are popular among investors seeking a steady income stream from their investments.

Investing in high-dividend yield stocks can provide investors with a source of passive income, especially during times of economic uncertainty. By choosing companies with a history of consistent dividend payments, investors can build a portfolio that generates regular cash flow.

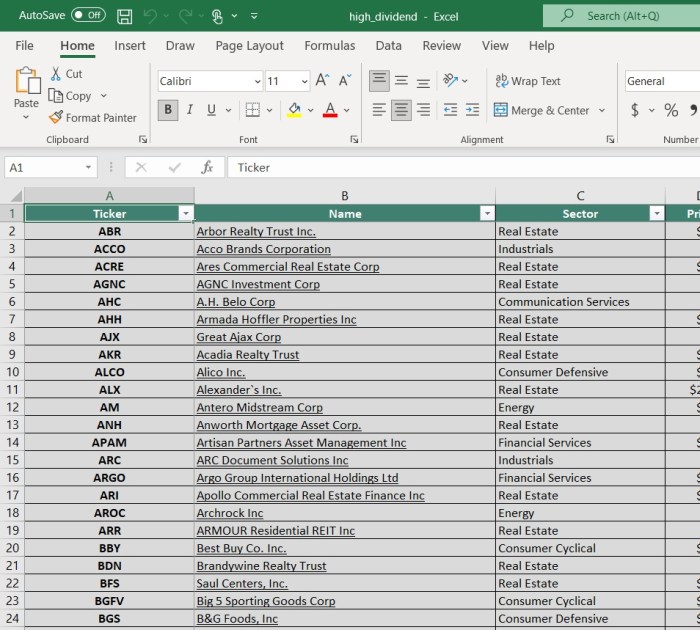

Examples of Well-Known High-Dividend Yield Stocks

- AT&T (T): AT&T is a telecommunications giant known for its generous dividend payouts. The company has a long history of rewarding shareholders with steady dividends.

- Exxon Mobil Corporation (XOM): Exxon Mobil, one of the largest oil companies in the world, is another well-known high-dividend yield stock. Despite fluctuations in oil prices, Exxon Mobil has maintained its dividend payments.

- Johnson & Johnson (JNJ): Johnson & Johnson is a healthcare company that has consistently increased its dividends over the years. With a strong balance sheet and diversified business segments, J&J remains a popular choice for dividend investors.

Factors Influencing High-Dividend Yields

When it comes to high-dividend yield stocks, there are several key factors that can influence the dividend yields. Understanding these factors is crucial for investors looking to maximize their returns.

Market conditions play a significant role in determining dividend yields. During times of economic uncertainty or market volatility, companies may choose to reduce or suspend dividend payouts in order to preserve cash. On the other hand, when the economy is strong and company profits are high, dividend yields tend to increase as companies share their success with shareholders.

Comparison of Dividend Payout Ratios

One important metric to consider when evaluating high-dividend yield stocks is the dividend payout ratio. This ratio indicates the percentage of a company’s earnings that are paid out to shareholders as dividends. A higher dividend payout ratio may suggest that a company is distributing a larger portion of its profits as dividends, which can be attractive to income-seeking investors.

However, a very high dividend payout ratio could also signal that a company is not reinvesting enough in its business for future growth. This may not be sustainable in the long run, potentially putting the dividend at risk.

Risks Associated with High-Dividend Yield Stocks

When it comes to high-dividend yield stocks, there are certain risks that investors should be aware of before diving in. These risks can impact the overall performance of the stocks and potentially lead to losses if not carefully considered.

Impact of Economic Conditions

Economic conditions play a significant role in the performance of high-dividend yield stocks. During times of economic downturn or recession, companies may struggle to maintain their dividend payouts. This can result in a decrease in stock value and overall returns for investors. It’s important to keep an eye on the broader economic landscape when investing in these types of stocks.

Companies Facing Challenges

Some companies have faced challenges due to their high-dividend payouts. One example is General Electric (GE), which historically had a high dividend yield but was forced to cut its dividend in 2017 due to financial difficulties. This move led to a significant drop in the company’s stock price and investor confidence. It’s essential to research and monitor the financial health of companies offering high dividends to avoid potential pitfalls.

Strategies for Selecting High-Dividend Yield Stocks

When it comes to choosing high-dividend yield stocks, you want to look for ones that not only offer a high yield but also have the potential for growth. Here are some tips to help you identify these stocks and make smart investment decisions.

Identifying High-Dividend Yield Stocks with Strong Growth Potential

- Look for companies with a history of increasing dividends over time. This shows financial stability and growth potential.

- Consider industries that are known for consistent cash flow and profitability, such as utilities or consumer staples.

- Check the company’s earnings growth and revenue trends to ensure they have the ability to sustain high dividend payments.

The Importance of Diversification in High-Dividend Yield Stocks

- Diversification is key to reducing risk in your investment portfolio. Spread your investments across different sectors and industries to minimize the impact of market volatility.

- By diversifying your holdings, you can protect yourself from the underperformance of any single stock and ensure a more stable return on your investment.

The Role of Dividend Sustainability in Stock Selection

- Focus on companies with a strong balance sheet and cash flow that can support their dividend payments over the long term.

- Check the payout ratio to ensure that the company is not paying out more in dividends than it can afford.

- Look for companies with a history of consistent dividend payments, as this indicates a commitment to rewarding shareholders and financial stability.