Buckle up, peeps! We’re diving into the wild world of high-volatility stock trading, where the risks are high and the rewards can be even higher. Get ready for a rollercoaster ride of market madness and money moves that will keep you on the edge of your seat!

Let’s break down everything you need to know about high-volatility stock trading, from what it is to why some investors can’t resist the adrenaline rush of trading these risky stocks.

Understanding High-Volatility Stock Trading

When it comes to high-volatility stock trading, we’re talking about stocks that have wild price swings in a short period of time. This means the stock’s price can go up or down significantly, offering the potential for big gains or losses.

Why Investors are Drawn to High-Volatility Stocks

Investors are often drawn to high-volatility stocks because of the potential for quick and substantial profits. These stocks can offer opportunities for traders to capitalize on rapid price movements and make a significant return on their investment in a short period of time.

- High-volatility stocks can provide adrenaline-pumping excitement for thrill-seeking investors looking for a high-risk, high-reward scenario.

- Some investors see high-volatility stocks as a chance to outperform the market and achieve above-average returns compared to more stable investments.

- Day traders and swing traders are particularly attracted to high-volatility stocks due to the potential for quick profits through short-term trading strategies.

Risks Associated with Trading High-Volatility Stocks

Trading high-volatility stocks comes with its fair share of risks that investors should be aware of before jumping in. These risks include:

- Increased potential for significant losses: The same volatility that can lead to large gains can also result in substantial losses if the stock price moves against the investor.

- Higher levels of uncertainty: High-volatility stocks are often more unpredictable, making it challenging to accurately predict price movements and make informed trading decisions.

- Emotional rollercoaster: The extreme price fluctuations of high-volatility stocks can lead to emotional decision-making, causing investors to make impulsive choices that may not align with their long-term investment goals.

Factors Influencing High-Volatility Stock Trading

When it comes to high-volatility stock trading, several factors play a significant role in influencing the fluctuations in stock prices. These factors can range from external market conditions to company-specific news, all of which can contribute to the unpredictability of stock movements.

External Factors Contributing to High Volatility

External factors such as economic indicators, geopolitical events, and global market trends can greatly impact the volatility of stocks. For example, a sudden change in interest rates by the Federal Reserve could lead to a sharp increase or decrease in stock prices, causing high volatility in the market.

Market Conditions Impact on Stock Volatility

Market conditions, including supply and demand dynamics, investor sentiment, and overall market sentiment, can heavily influence the volatility of stocks. In times of uncertainty or panic, investors may rush to sell their stocks, leading to a spike in volatility. Conversely, positive market conditions can also drive volatility as investors become more optimistic about the future.

Company-Specific News and Stock Volatility

Company-specific news, such as earnings reports, product launches, mergers, or scandals, can have a significant impact on the volatility of a stock. Positive news can cause a surge in stock prices, while negative news can lead to a sharp decline. Investors closely monitor such news to gauge the future performance of a company, which in turn affects the volatility of its stock.

Strategies for High-Volatility Stock Trading

When it comes to trading in high-volatility markets, having a solid strategy is key to navigating the ups and downs of the market. Here, we will discuss some common trading strategies used in high-volatility markets, the importance of risk management, and the comparison between short-term trading strategies and long-term investment approaches for volatile stocks.

Common Trading Strategies

- Day Trading: This strategy involves buying and selling stocks within the same trading day to capitalize on short-term price movements.

- Swing Trading: Traders using this strategy aim to capture gains in a stock within a few days to a few weeks by analyzing short-term price patterns.

- Momentum Trading: This strategy involves buying stocks that are showing upward momentum in the hopes that the trend will continue.

Risk Management in High-Volatility Trading

- Setting Stop-Loss Orders: This helps limit potential losses by automatically selling a stock when it reaches a certain price.

- Diversification: Spreading investments across different stocks can help reduce risk in case one stock experiences a significant drop.

- Position Sizing: Properly sizing your positions based on risk tolerance can help manage potential losses.

Short-Term Trading vs. Long-Term Investment

- Short-Term Trading: Involves buying and selling stocks in a short period to take advantage of price fluctuations. It requires active monitoring of the market.

- Long-Term Investment: Focuses on holding stocks for an extended period, typically years, with the belief that the stock will increase in value over time despite short-term fluctuations.

Tools and Resources for High-Volatility Stock Trading

When it comes to trading high-volatility stocks, having the right tools and resources at your disposal can make a significant difference in your success. These tools can help you monitor market trends, analyze stock movements, and make informed decisions in a fast-paced environment.

Essential Tools and Platforms for Monitoring High-Volatility Stocks

- Stock Screener: A tool that allows you to filter stocks based on specific criteria such as price, volume, and volatility.

- Real-Time Quote Platforms: Platforms that provide up-to-the-minute stock prices and market data.

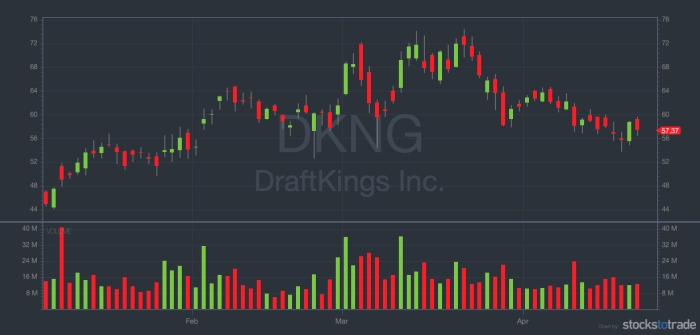

- Volatility Indicators: Tools like Bollinger Bands, Average True Range (ATR), and Volatility Index (VIX) can help you gauge the volatility of a stock.

How Technical Analysis Can be Utilized in High-Volatility Trading

Technical analysis involves studying historical price data and volume to predict future price movements. In high-volatility trading, technical analysis can help you identify key support and resistance levels, trends, and patterns that may indicate potential trading opportunities. Tools like moving averages, Relative Strength Index (RSI), and MACD can be particularly useful in high-volatility environments.

The Role of Fundamental Analysis in Making Trading Decisions for Volatile Stocks

Fundamental analysis focuses on evaluating a company’s financial health, management team, industry trends, and competitive position. While fundamental analysis may not be the primary focus in high-volatility trading, it can still play a crucial role in assessing the long-term potential of a stock. Factors like earnings reports, news events, and macroeconomic indicators can impact the volatility of a stock and should be considered alongside technical analysis in making trading decisions.