Yo, diving into the world of home equity loans vs lines of credit, let’s break it down in a way that’s totally lit. Get ready to learn all about these financial options and how they can impact your wallet!

So, you’re probably wondering what the deal is with home equity loans and lines of credit, right? Well, buckle up because we’re about to lay down some knowledge that’ll have you seeing dollar signs.

Understanding Home Equity Loans and Lines of Credit

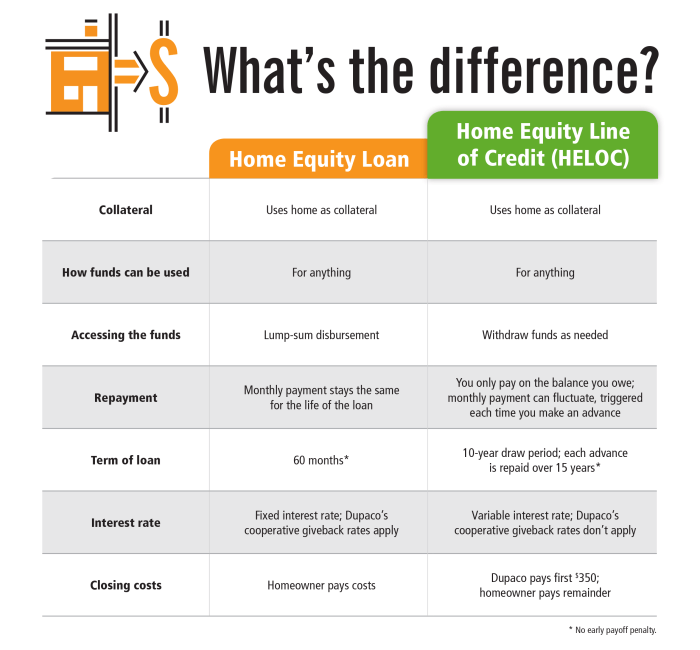

When it comes to home equity loans and lines of credit, it’s important to know the differences and how they work to make the best financial decision for your situation. Let’s break it down!

Home Equity Loans

Home equity loans are loans that allow you to borrow a lump sum of money using the equity in your home as collateral. This type of loan typically has a fixed interest rate and a set repayment term. It’s like getting a second mortgage on your home.

Home Equity Lines of Credit (HELOCs)

On the other hand, a home equity line of credit (HELOC) works more like a credit card. It provides you with a line of credit based on the equity in your home, which you can borrow from as needed. You only pay interest on the amount you use, and the interest rate is usually variable.

Differences and Benefits

- Home equity loans offer a lump sum payment upfront, while HELOCs provide a flexible line of credit.

- Interest rates on home equity loans are typically fixed, providing predictability, whereas HELOC rates can fluctuate.

- Home equity loans have a set repayment term, while HELOCs allow for ongoing borrowing and repayment.

- Both options can be used for home improvements, debt consolidation, or other major expenses.

Eligibility Criteria and Application Process

When it comes to getting a home equity loan or line of credit, there are specific requirements you need to meet and steps you need to take to apply.

To qualify for a home equity loan, lenders typically look at factors such as your credit score, income, existing debts, and the amount of equity you have in your home. You’ll need a good credit score (usually 620 or higher), a low debt-to-income ratio, and at least 15-20% equity in your home.

Application Process for Home Equity Line of Credit

To apply for a home equity line of credit (HELOC), you’ll need to submit an application to the lender. You may be required to provide documentation such as proof of income, tax returns, bank statements, and information about your existing mortgage. The lender will also assess the value of your home to determine how much equity you can borrow against.

- Submit application with required documents

- Undergo credit and financial assessment

- Lender evaluates the value of your home

- Approval and setting credit limit

Qualification Criteria Comparison

When comparing home equity loans and lines of credit, it’s important to note that the eligibility criteria can vary between the two. While both may require a good credit score and sufficient equity in your home, the approval process and terms of the loan can differ.

Home equity loans provide a lump sum amount upfront, while HELOCs offer a revolving line of credit that you can borrow from as needed.

- Home Equity Loans: Fixed monthly payments, typically higher interest rates

- HELOCs: Variable interest rates, flexible borrowing options

- Both may have closing costs and fees associated with the loan

Interest Rates and Repayment Terms

When it comes to home equity loans and lines of credit, the interest rates and repayment terms play a crucial role in determining which option is more suitable for your financial needs.

Interest Rates

Interest rates for home equity loans are typically fixed, meaning you will have a consistent monthly payment amount throughout the loan term. On the other hand, lines of credit usually have variable interest rates, which means your monthly payments can fluctuate based on market conditions.

- Home Equity Loan: Fixed interest rates

- Line of Credit: Variable interest rates

Repayment Terms

Repayment terms for home equity loans are structured with a predetermined repayment schedule, where you make monthly payments over a set period of time. Lines of credit, however, offer more flexibility in repayment terms, allowing you to borrow and repay funds as needed within a specified draw period.

- Home Equity Loan: Fixed repayment schedule

- Line of Credit: Flexible repayment options

Beneficial Scenarios

In scenarios where you prefer stability in your monthly payments and want to lock in a specific interest rate, a home equity loan with a fixed interest rate would be more beneficial. On the other hand, if you anticipate needing access to funds over an extended period and are comfortable with potential interest rate fluctuations, a line of credit with variable rates might be a better choice.

Remember, it’s important to carefully consider your financial goals and circumstances before deciding between a home equity loan and a line of credit. Evaluate the interest rates and repayment terms to determine which option aligns best with your needs.

Uses of Funds and Flexibility

When it comes to home equity loans and lines of credit, the uses of funds and flexibility can greatly impact your decision on which option to choose. Let’s dive into the common uses of funds and the flexibility of accessing those funds between these two types of borrowing.

Common Uses of Funds

- Home Improvement Projects: Whether you’re looking to renovate your kitchen, upgrade your bathroom, or add a new deck, both home equity loans and lines of credit can be used to fund these projects.

- Debt Consolidation: If you have high-interest debt, such as credit card debt, using a home equity loan or line of credit to consolidate and pay off that debt can help lower your overall interest payments.

- Education Expenses: From college tuition to continuing education courses, tapping into your home’s equity can help cover the costs of furthering your education.

Flexibility of Accessing Funds

Home Equity Loan: With a home equity loan, you receive a lump sum upfront and make fixed monthly payments over a set term. This provides predictability in repayment but limits flexibility in accessing additional funds.

Home Equity Line of Credit (HELOC): A HELOC allows you to access funds as needed, up to a predetermined credit limit. You only pay interest on the amount you use, offering more flexibility in managing your expenses.

Influence of Intended Use on Choice

- For one-time expenses with a specific cost, such as a home renovation project, a home equity loan may be more suitable due to the fixed lump sum amount.

- If you anticipate ongoing expenses or want the flexibility to access funds as needed, a HELOC might be a better option, especially for unpredictable costs like medical bills or emergency repairs.

- Consider your financial goals and spending habits to determine which option aligns best with your needs and preferences.