Yo, peeps! Home loan refinancing is like the ultimate glow-up for your mortgage game. It’s all about leveling up and making those dollars work smarter, not harder. Let’s dive into this world of financial flexing and see how you can boss up your home loan situation.

Now, let’s break it down and get into the nitty-gritty of what home loan refinancing is all about.

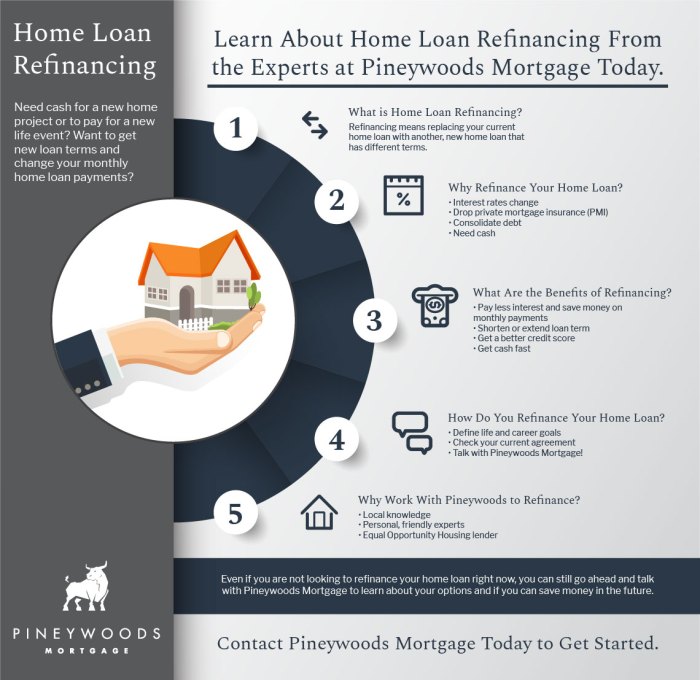

What is Home Loan Refinancing?

When you talk about home loan refinancing, you’re basically looking to replace your current mortgage with a new one. It’s like giving your old loan a makeover, but with better terms that could help you save some cash or get other benefits.

When Refinancing is Lit

- Lower Interest Rates: If interest rates have dropped since you got your original loan, refinancing can help you secure a lower rate, reducing your monthly payments and saving you money over time.

- Shorter Loan Term: By refinancing to a shorter term, like switching from a 30-year loan to a 15-year loan, you can pay off your mortgage faster and save on interest in the long run.

- Access Equity: If your home has gained value since you bought it, refinancing can allow you to tap into that equity for things like home improvements, debt consolidation, or other expenses.

The Downside, Bruh

- Closing Costs: Refinancing comes with fees and closing costs, just like when you first got your mortgage. Make sure the potential savings outweigh these expenses.

- Extended Loan Term: While lowering your monthly payments can be tempting, extending your loan term through refinancing means you’ll pay more interest over time, even if your rate is lower.

- Resetting the Clock: If you’ve been paying off your current mortgage for a while, refinancing starts the clock over again, so you’ll take longer to fully own your home.

Types of Home Loan Refinancing Options

When it comes to refinancing your home loan, there are several options to choose from based on your financial goals and needs. Let’s explore the different types of home loan refinancing options available to homeowners.

Fixed-Rate Refinancing

- Fixed-rate refinancing involves replacing your current mortgage with a new loan that has a fixed interest rate for the entire term of the loan.

- It provides stability and predictability as your monthly payments remain the same throughout the loan term.

- Great for homeowners who prefer consistent payments and want to avoid the risk of interest rate fluctuations.

Adjustable-Rate Refinancing

- Adjustable-rate refinancing, also known as variable-rate refinancing, offers an initial lower interest rate that can adjust periodically based on market conditions.

- Initial lower rates can result in lower monthly payments at the beginning, but they can increase over time, potentially leading to higher payments.

- Suitable for homeowners who plan to sell or refinance before the rate adjustments occur.

Cash-Out Refinancing

- Cash-out refinancing allows homeowners to refinance their mortgage for an amount higher than the current loan balance and receive the difference in cash.

- Commonly used to access equity for home improvements, debt consolidation, or other financial needs.

- Important to consider the impact on your loan balance and monthly payments before opting for cash-out refinancing.

Rate-and-Term Refinancing

- Rate-and-term refinancing involves refinancing your existing mortgage to change the interest rate, loan term, or both without taking out additional cash.

- Used to secure a lower interest rate, shorten the loan term, or switch from an adjustable-rate to a fixed-rate mortgage.

- Helps homeowners save on interest costs, pay off the loan faster, or align their mortgage with their financial goals.

Factors to Consider Before Refinancing

Before jumping into refinancing your home loan, there are several key factors to consider that can impact your decision and overall financial situation. Let’s break down these factors to help you make an informed choice.

Credit Score and Debt-to-Income Ratio

Your credit score and debt-to-income ratio play a crucial role in determining your eligibility for refinancing and the interest rates you may qualify for. Lenders typically prefer borrowers with a good credit score (usually 620 or higher) and a low debt-to-income ratio (typically below 43%). A higher credit score and lower debt-to-income ratio can help you secure better refinancing options with lower interest rates.

Current Interest Rates

The current interest rates in the market also greatly influence the decision to refinance a home loan. When interest rates are low, it may be a good time to refinance and lock in a lower rate, potentially saving you money in the long run. On the other hand, if interest rates are high, refinancing may not be as beneficial and could end up costing you more in the long term. It’s important to monitor interest rate trends and evaluate whether refinancing makes financial sense based on the current rates.

The Refinancing Process

When it comes to refinancing your home loan, there are several important steps to follow to ensure a smooth process. From preparing your application to dealing with appraisals and closing costs, each step plays a crucial role in getting your loan refinanced successfully.

Step-by-Step Refinancing Process

- 1. Evaluate Your Current Loan: Take a look at your current loan terms, interest rate, and monthly payments to determine if refinancing makes sense for you.

- 2. Check Your Credit Score: A good credit score is essential for getting favorable refinancing terms, so make sure yours is in good shape.

- 3. Research Lenders: Compare offers from different lenders to find the best refinancing options for your situation.

- 4. Submit Your Application: Gather all necessary documents and submit your application to the chosen lender.

- 5. Wait for Approval: Once your application is submitted, wait for the lender to review and approve your refinancing request.

- 6. Close the Loan: If approved, you’ll need to sign the new loan documents and close the loan officially.

Tips for Preparing for Refinancing

- 1. Organize Your Financial Documents: Make sure you have all necessary financial documents ready for the application process.

- 2. Improve Your Credit Score: Work on improving your credit score before applying for refinancing to secure better terms.

- 3. Shop Around: Don’t settle for the first offer you receive; compare multiple lenders to find the best deal.

Role of Appraisals, Inspections, and Closing Costs

- Appraisals: An appraisal will determine the current value of your home, which is crucial for determining the refinancing amount.

- Inspections: Inspections may be required to ensure the property meets certain standards or to identify any potential issues.

- Closing Costs: Closing costs include fees for processing your loan, title insurance, and other expenses associated with closing the refinanced loan.

Benefits of Home Loan Refinancing

Refinancing a home loan can offer several potential benefits that can help homeowners save money, access cash, or pay off their mortgage faster.

Lower Monthly Payments

- By refinancing at a lower interest rate, homeowners can reduce their monthly mortgage payments, freeing up more cash for other expenses or savings.

- Switching from a longer-term loan to a shorter one could also lower monthly payments by reducing the total interest paid over the life of the loan.

Shorten the Loan Term

- Refinancing to a shorter loan term can help homeowners pay off their mortgage faster, saving money on interest payments in the long run.

- Although monthly payments may increase, the overall interest savings and early debt payoff can be a significant benefit.

Access Equity for Home Improvements or Debt Consolidation

- Refinancing can provide homeowners with the opportunity to tap into their home’s equity, allowing them to fund home renovations, repairs, or consolidate high-interest debt.

- Using equity from refinancing for investments in the home can increase property value and enhance living conditions.

Risks and Considerations

When considering home loan refinancing, it’s crucial to be aware of the potential risks involved. From prepayment penalties to refinancing costs, there are important factors to consider before making a decision.

Prepayment Penalties and Refinancing Costs

- Prepayment Penalties: Some lenders impose prepayment penalties if you pay off your loan early. These penalties can offset the savings you might gain from refinancing, so it’s essential to understand the terms of your current loan.

- Refinancing Costs: Refinancing comes with closing costs, which can include application fees, appraisal fees, and other expenses. These costs can add up and impact the overall benefit of refinancing.

Determining Savings vs. Costs

- Calculate Potential Savings: Before refinancing, calculate how much you could potentially save each month with a new loan. Compare this with the total costs of refinancing to determine if the savings outweigh the expenses.

- Break-Even Point: Determine the break-even point, which is the time it takes for your monthly savings to surpass the costs of refinancing. If you plan to stay in the home beyond this point, refinancing may be beneficial.