Alright, peeps, today we’re diving into the world of credit report errors – and how to handle them like a pro. Get ready to learn the ins and outs of disputing those pesky mistakes that can mess with your financial game.

Let’s break it down step by step, so you can take charge of your credit report and keep it error-free.

Understanding Credit Report Errors

When it comes to credit report errors, it’s important to know what you’re dealing with. These errors can have a big impact on your financial life, so understanding them is crucial. Let’s break it down.

Common Types of Credit Report Errors

- Incorrect personal information like name, address, or social security number

- Accounts that don’t belong to you

- Incorrect account details such as payment history or credit limits

- Duplicate accounts

Potential Impact of Credit Report Errors

Having errors on your credit report can mess up your credit score and make it harder to get approved for loans or credit cards. It can also lead to higher interest rates or even denial of credit altogether.

Examples of Errors on a Credit Report

- A credit card account that you never opened showing up on your report

- An old debt that has been paid off but still shows as outstanding

- Incorrect payment history that makes it look like you missed payments when you didn’t

Identifying Credit Report Errors

Identifying errors on your credit report is crucial to maintaining a healthy financial profile. Here’s how you can get started:

Obtaining a Free Copy of Your Credit Report

To obtain a free copy of your credit report, you can request it from each of the three major credit bureaus – Equifax, Experian, and TransUnion. By law, you are entitled to one free credit report from each bureau every 12 months. You can request your reports online at annualcreditreport.com or by contacting the credit bureaus directly.

Reviewing and Identifying Errors on Your Credit Report

When reviewing your credit report, check for inaccuracies such as incorrect personal information, accounts you don’t recognize, or late payments that you know you made on time. Look for any accounts that may have been opened fraudulently in your name. If you spot any errors, make a note of them to dispute later.

Recognizing Discrepancies in Credit Reports

Some common discrepancies to watch out for include incorrect account balances, duplicate accounts, and outdated information that should have been removed. Pay attention to your credit utilization ratio, which is the amount of credit you’re using compared to your total credit limit. A high ratio can negatively impact your credit score.

Steps to Dispute Credit Report Errors

To dispute credit report errors like a boss, you gotta follow these steps and make sure you got all your receipts, if ya catch my drift. It’s all about keeping it real and standing up for your financial rep, ya know?

Process of Disputing Errors with Credit Bureaus

- First off, get a copy of your credit report from all three major bureaus – Experian, Equifax, and TransUnion.

- Identify the errors you wanna dispute and gather any supporting documents or evidence to back up your claim.

- Reach out to the credit bureau in writing or online and explain the errors you found with all the deets.

- The bureau will investigate your dispute within 30 days and inform you of their findings.

Importance of Documenting All Communications

Documenting all your communications related to disputes is key, fam! Keep records of all your letters, emails, and phone calls with dates and times. This can help you track the progress of your dispute and prove your case if needed.

Tips on Writing an Effective Dispute Letter

- Keep it short and sweet, but make sure to include all the relevant info about the errors and why you’re disputing them.

- Be clear and specific about which items on your credit report are incorrect and provide any supporting evidence you have.

- Send your dispute letter via certified mail to ensure it’s received and keep a copy for your records.

- Stay polite and professional in your letter, even if you’re feeling frustrated. Being chill and respectful can go a long way in getting your dispute resolved.

Following Up on Disputes

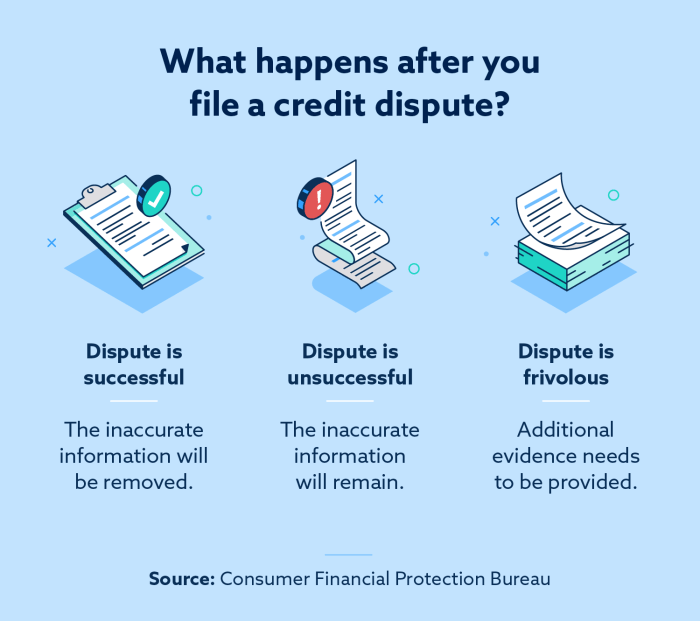

After you’ve submitted a dispute to the credit bureau, it’s important to stay on top of the situation to ensure your credit report is accurate. Here’s what you need to know to follow up on your disputes:

Credit Bureau Response

If the credit bureau does not respond to your dispute within the required timeframe (usually 30 days), you have the right to take further action. You can reach out to them directly to inquire about the status of your dispute. If necessary, you can also file a complaint with the Consumer Financial Protection Bureau (CFPB) to escalate the issue.

Timeline for Resolution

The timeline for resolving credit report errors can vary depending on the complexity of the dispute. In general, credit bureaus are required to investigate your claim within 30 days of receiving it. Once the investigation is complete, they must provide you with the results in writing. If the error is verified, the credit bureau must correct it promptly.

Monitoring Your Credit Report

Even after disputing an error on your credit report, it’s crucial to continue monitoring your credit report regularly. Set up alerts or reminders to check your credit report periodically for any new errors or discrepancies. You can also consider enrolling in a credit monitoring service to receive real-time updates on changes to your credit report.