Hey there, ready to dive into the world of income tax on investments? Get ready to learn the ins and outs of how your investments are taxed and what you can do to minimize those taxes. It’s time to level up your financial knowledge game!

In this guide, we’ll break down everything you need to know about income tax on investments, from how it’s calculated to strategies you can use to keep more of your hard-earned cash. Let’s get started!

What is Income Tax on Investments?

Income tax on investments refers to the taxes that individuals must pay on the income they earn from various types of investments, such as stocks, bonds, mutual funds, and real estate. This tax is based on the profits earned from these investments and is an important consideration for investors to understand.

Calculation of Income Tax on Investments

Income tax on investments is calculated based on the type of investment and the holding period. For example, short-term capital gains from investments held for less than a year are taxed at a higher rate than long-term capital gains from investments held for more than a year. Additionally, dividends and interest earned from investments are also subject to income tax.

Common Investments Subject to Income Tax

- Stocks: Profits from buying and selling stocks are subject to capital gains tax.

- Bonds: Interest earned from bonds is taxed as ordinary income.

- Mutual Funds: Capital gains distributions from mutual funds are taxable.

- Real Estate: Rental income and capital gains from real estate investments are subject to income tax.

Importance of Understanding Income Tax Implications on Investments

Income tax implications on investments can significantly impact the overall return on investment. By understanding how income tax is calculated on various types of investments, investors can make informed decisions to minimize their tax liabilities and maximize their profits. It is essential for investors to consider the tax consequences of their investment choices to effectively plan their financial strategies.

Types of Investments Subject to Income Tax

When it comes to investments, it’s not just about making money – you also have to consider the tax implications. Here are some types of investments that are typically subject to income tax and how they are treated:

Stocks

Stocks are one of the most common types of investments subject to income tax. When you sell stocks for a profit, you will be taxed on the capital gains. The tax rate on capital gains depends on how long you held the stocks before selling them – short-term capital gains are taxed at a higher rate than long-term capital gains.

Bonds

Bonds are another investment that is subject to income tax. The interest income you earn from bonds is taxable at your ordinary income tax rate. However, if you own tax-exempt bonds, you may be able to avoid federal income tax on the interest.

Mutual Funds

When it comes to mutual funds, you may have to pay taxes on the dividends and capital gains distributed by the fund. The tax treatment of mutual funds can be complex, as it depends on the types of investments held by the fund and how they are managed.

Real Estate

Investing in real estate can also have tax implications. Rental income from real estate properties is subject to income tax, as well as any capital gains from selling properties. However, there are also tax benefits available to real estate investors, such as depreciation deductions and 1031 exchanges.

Comparison

Each type of investment has its own tax treatment and considerations. Stocks and mutual funds are subject to capital gains tax, while bonds are taxed on interest income. Real estate investments have their own set of tax rules, including deductions and exemptions. It’s important to understand how income tax is applied to different investment vehicles to make informed decisions about your investments.

Tax Rates and Thresholds

When it comes to income tax on investments, understanding the tax rates and thresholds is crucial. Let’s dive into how tax rates are determined and how they impact the taxation of investment income.

Tax Rates on Investment Income

Tax rates on investment income are determined based on the type of investment and the duration it is held. Generally, investment income is subject to different tax rates than regular income. The tax rates can vary depending on whether the investment is considered short-term or long-term.

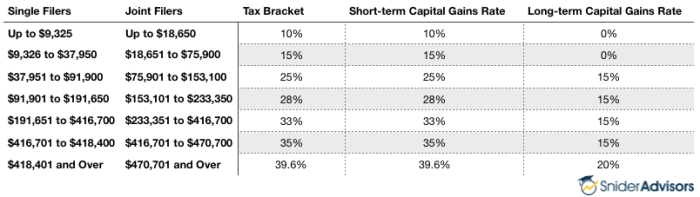

- Short-term Investments: Short-term investments, typically held for one year or less, are subject to higher tax rates compared to long-term investments. The tax rates for short-term investments are based on the individual’s ordinary income tax bracket.

- Long-term Investments: Long-term investments, held for more than one year, are eligible for lower tax rates. The tax rates for long-term investments are typically lower than those for short-term investments, incentivizing investors to hold onto their investments for a longer period.

Tax Thresholds and Impact

Tax thresholds play a significant role in determining the taxation of investment income. These thresholds define the income level at which different tax rates apply.

For example, in the United States, long-term capital gains tax rates are 0%, 15%, or 20% depending on the individual’s income level. Individuals with lower incomes may qualify for the 0% tax rate on long-term investments.

Understanding tax thresholds is essential for investors to optimize their tax strategies and minimize tax liabilities on their investment income.

Strategies to Minimize Tax on Investments

One of the key aspects of managing your investments effectively is minimizing the tax impact on your returns. By employing tax-efficient investment strategies, you can reduce your tax liability and keep more of your hard-earned money. Let’s explore some strategies to help you achieve this goal.

Tax-Deferred and Tax-Exempt Investments

Tax-deferred and tax-exempt investments are crucial tools in minimizing your tax burden. Tax-deferred investments allow you to postpone paying taxes on your investment gains until a later date, usually retirement when you may be in a lower tax bracket. Examples of tax-deferred investments include 401(k) plans, traditional IRAs, and annuities. On the other hand, tax-exempt investments, such as municipal bonds, provide income that is not subject to federal income tax, offering a way to earn tax-free income.

Tax Planning Techniques

- Utilize tax-efficient accounts: Maximize contributions to tax-advantaged accounts like Roth IRAs, Health Savings Accounts (HSAs), and 529 college savings plans to grow your investments tax-free or tax-deferred.

- Harvest tax losses: Capital loss harvesting involves selling investments that have decreased in value to offset capital gains from profitable investments, reducing your overall tax liability.

- Consider holding assets long-term: Holding investments for over a year can qualify you for lower long-term capital gains tax rates, which are generally more favorable than short-term capital gains rates.

- Strategically rebalance your portfolio: Regularly review and rebalance your investment portfolio to ensure it aligns with your financial goals while minimizing taxable events.