Yo, you ever wonder how to make your money work for you? Well, investment diversification is the name of the game! Get ready to dive into the world of spreading your dough in different baskets for maximum gains.

Let’s break it down and see why mixing up your investments is like having a squad of backup plans for your cash flow.

Importance of Investment Diversification

Investment diversification is like having a squad of different investments in your crew to spread out the risk and keep your money game strong. It’s all about not putting all your cash in one place and staying on top of your financial game.

Benefits of Diversifying Investments

When you diversify your investments, you’re basically playing it smart and not putting all your eggs in one basket. It’s like having different players on your team, so if one slacks off, the others can pick up the slack and keep you winning in the long run.

How Diversification Reduces Risk in a Portfolio

By diversifying your investments, you’re not putting all your cash on the line with just one investment. It’s like keeping your options open and not letting one bad move wipe out all your hard-earned dough. So, spread out your investments and watch your portfolio stay strong through thick and thin.

Types of Investment Diversification

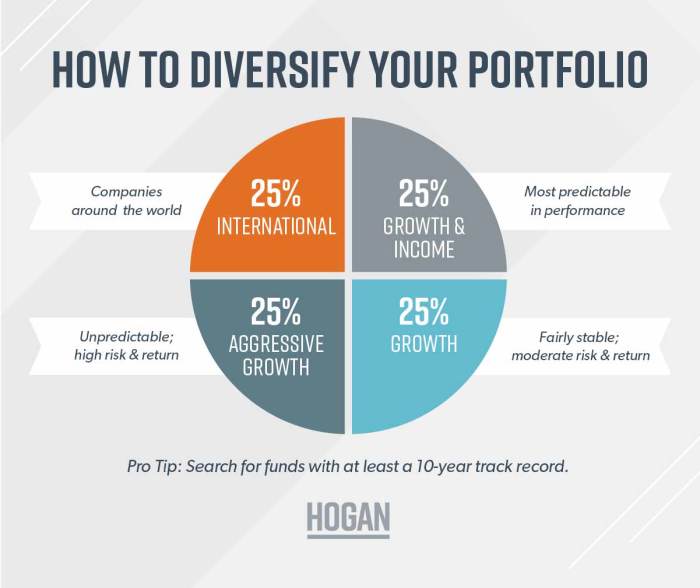

When it comes to diversifying your investment portfolio, there are several strategies you can employ to spread out risk and potentially increase returns. Diversification can be achieved through a variety of asset classes, geographical regions, and sectors within the market.

Asset Diversification

- Diversifying across different asset classes such as stocks, bonds, real estate, and commodities can help reduce the overall risk in your portfolio. Each asset class reacts differently to market conditions, so having a mix can provide stability.

- Investing in a combination of high-risk, high-return assets like stocks and lower-risk, more stable assets like bonds can help balance out your portfolio and potentially increase returns over time.

Geographical Diversification

- Geographical diversification involves investing in assets from different countries or regions around the world. This can help protect your portfolio from country-specific risks such as political instability, economic downturns, or currency fluctuations.

- By spreading your investments across various regions, you can take advantage of growth opportunities in different markets and reduce the impact of any negative events in a single country on your overall portfolio.

Sector Diversification

- Sector diversification entails investing in companies across different industries or sectors of the economy. This can help mitigate risks associated with a particular sector experiencing a downturn while other sectors are performing well.

- By diversifying across sectors, you can benefit from the growth potential of various industries and reduce the impact of industry-specific events on your investments.

Strategies for Effective Diversification

When it comes to diversifying your investments, it’s crucial to have a solid strategy in place to maximize returns and minimize risks. Let’s explore some key strategies for effective diversification.

Asset Allocation Strategies

Asset allocation is a key component of diversification, and there are several strategies you can use to spread your investments across different asset classes:

- Equity and Bonds: Allocating a certain percentage of your portfolio to stocks and bonds can help balance risk and return.

- Real Estate: Including real estate investments in your portfolio can provide diversification and potential income streams.

- Commodities: Investing in commodities like gold or oil can help hedge against inflation and market volatility.

Correlation in Diversification

Correlation refers to how closely the returns of different investments move in relation to each other. When diversifying your portfolio, it’s important to choose assets with low correlation to reduce overall risk:

Choosing assets with negative or low correlation can help offset losses in one investment with gains in another.

Periodic Review and Rebalancing

Once you have diversified your portfolio, it’s essential to regularly review and rebalance your investments to maintain your desired asset allocation:

- Reviewing your portfolio quarterly or annually can help ensure it aligns with your financial goals and risk tolerance.

- Rebalancing involves adjusting your asset allocation by selling overperforming assets and buying more of underperforming ones.

Risks and Challenges of Investment Diversification

Investing can be risky business, and even diversification, which is meant to spread out risk, comes with its own set of challenges. Let’s dive into some of the potential risks and difficulties that investors may face when attempting to diversify their portfolios.

Over-Diversification Drawbacks

While diversification is generally a good strategy, there is such a thing as over-diversification. This occurs when an investor spreads their investments too thin, resulting in decreased potential returns. By investing in too many assets, the overall performance of the portfolio may suffer as gains in some areas are offset by losses in others. It can also lead to increased complexity and difficulty in monitoring and managing the investments effectively.

Maintaining a Diversified Portfolio

One of the challenges of maintaining a diversified portfolio is the need for ongoing monitoring and rebalancing. As asset values fluctuate, the original diversification strategy may become skewed, requiring adjustments to realign the portfolio with the investor’s goals and risk tolerance. This active management can be time-consuming and may incur additional costs, such as transaction fees.

Impact of Market Conditions

Market conditions play a significant role in the effectiveness of diversification. During periods of market volatility or economic downturns, correlations between asset classes may increase, leading to a situation known as “correlation risk.” In such scenarios, previously uncorrelated assets may move in tandem, reducing the benefits of diversification. Additionally, certain events or trends can negatively impact specific sectors or asset classes, affecting the overall performance of a diversified portfolio.